Recession or reset? What to do in an uncertain 2025.

22 April 2025 _ News

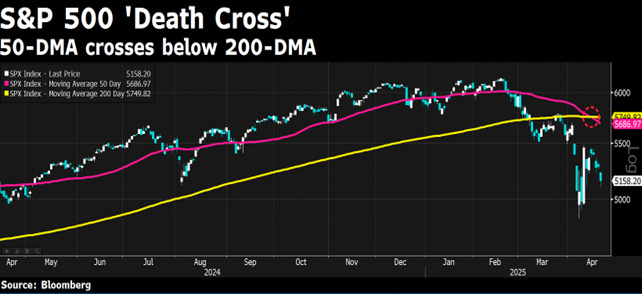

Global equity markets had another busy week, marked by a mix of political uncertainty, conflicting economic data and an increasingly dovish Federal Reserve. The dominant theme once again remains the tariff turmoil generated by the Trump administration, which continues to trigger volatility, weaken confidence and reshape the global macro environment.

Much attention has been paid to Fed Chairman Jerome Powell's speech at the Economic Club of Chicago, where he made it clear that monetary policy will remain on hold and that a "Fed put" - i.e. central bank intervention in the event of a market crash - is not a given. When asked directly about Fed intervention in the event of a market crash, Powel replied with a blunt "no", adding that the market was "working as it should".

Another cold shower for the markets came when Powel hinted at the threat of stagflation, admitting that tariffs will raise inflation more than expected, perhaps permanently, and that growth is slowing. That would be the scenario that every central bank fears. Because you can't fight inflation without destroying growth. And you can't stimulate the economy without fuelling inflation; that would be a dead end, the worst. But for now, this scenario is still a long way off, and the Fed is standing firm.

In response, President Trump verbally attacked Powel and once again incited the Fed to preemptively cut rates, going so far as to call Powel a loser and once again questioning his actions, blaming him for an economic slowdown. The result has been a general decline in risky assets, with the dollar and major equity indices falling.

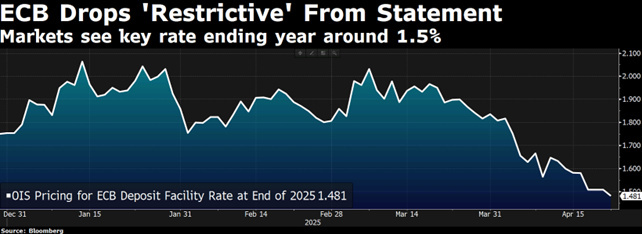

Meanwhile, the European Central Bank unanimously cut interest rates by 25 basis points for the seventh time since June, bringing the cost of money down to 2.25%. Ms Lagarde said that the impact of interest rates on inflation would only become clear over time and that uncertainty was therefore very high, with the European Central Bank continuing to follow its approach of deciding its next steps meeting by meeting.

Returning to the US, macroeconomic data continues to surprise on the upside. Retail sales rose 1.4% in March to an all-time high and industrial production is also showing signs of resilience, with manufacturing and mining expanding slightly. However, "soft" data - such as consumer and business confidence surveys - tell a different story: unemployment expectations are rising, perceived inflation is increasing and confidence in equity markets is falling.

The picture that emerges is one of an economy in the balance: still resilient in numbers, but we know that macro data are always lagging, so the market is looking ahead and seeing an economy very much under pressure.

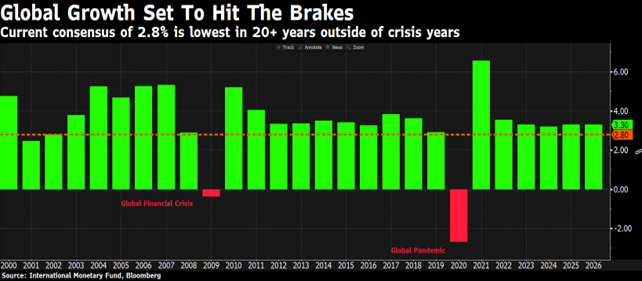

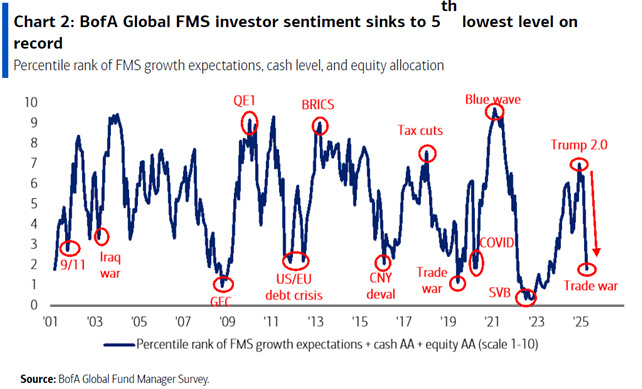

This general scepticism and negativity is reflected in the latest Fund Manager Survey, Bank of America's traditional monthly survey of fund managers, which is the fifth most pessimistic survey in the last 25 years (after 2001, 2009, 2019 and 2022), with 82% of fund managers expecting a slowdown in the global economy and 49% expecting a recession.

The rapid deterioration in sentiment is illustrated by the fact that the latter two indicators stood at 44 per cent and 11 per cent respectively last month, recession expectations rose to their fourth highest level in 20 years and 57 per cent of respondents expect inflation to rise.

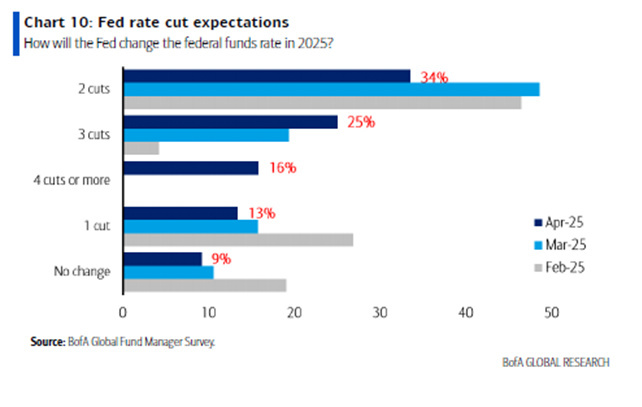

This, in turn, will lead to a decline in corporate earnings (28% of respondents) and a further depreciation of the dollar (61%). Expectations for Fed rate cuts rise accordingly, and for the first time we see those who are starting to discount 4 rate cuts in 2025.

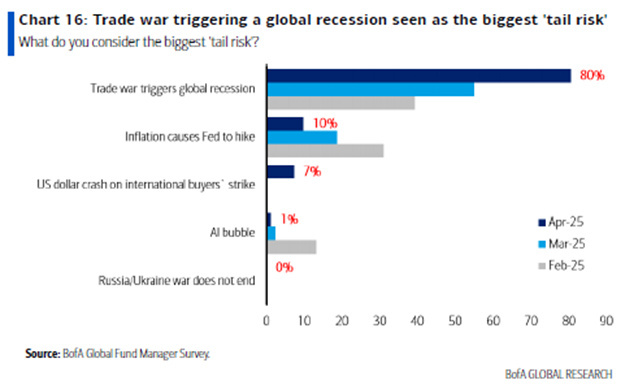

For 73 percent of managers, U.S. exceptionalism has peaked, and a trade war that triggers a global recession is considered the greatest tail risk according to 80 percent of investors, the highest concentration of tail risk in 15 years.

Meanwhile, the reporting season is underway and has started off without a disaster, with solid bank results and healthcare giants such as JNJ and Abbot beating expectations. However, the real test will come in the coming weeks with the quarterly results of the big names.

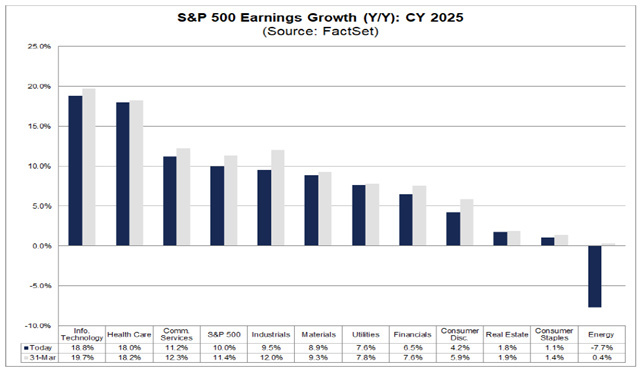

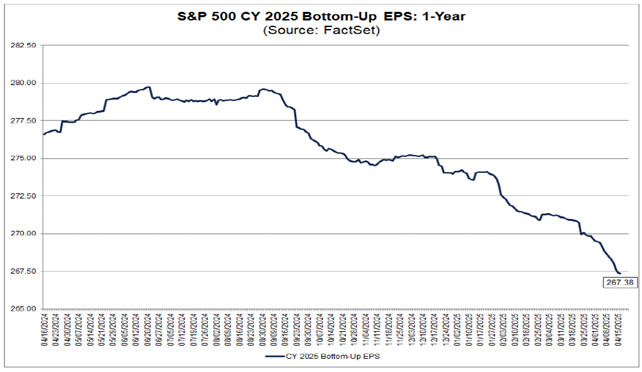

Consensus expectations are for year-end earnings growth of +10% for the S&P500, which we recall was already lower than the +15% expected at the start of the year and is now more in line with the historical average of between 8% and 10%.

It will now take a few months to see if this +10 percent will be realized or if these estimates will have to come down further, and it will all depend on the evolution of trade policies and geopolitical relations. Certainly investors' focus at this point will be more on the guidance provided by companies rather than the reported number, and we would not be surprised if many companies take advantage of the current instability between tariffs and the volatile environment to convey caution and uncertainty to the market. Perhaps it is just a tactical move to lower expectations in a time of general difficulty and then raise them later when they are more visible, a technique that companies have used before, but the context of uncertainty is still too high and therefore it is too early to tell how corporate earnings will evolve.

Markets will therefore have to navigate without their main compass, avvero corporate earnings, in the coming months, but for the informed and rational investor, the compass remains one of quality and selectivity, looking for market areas where expectations are already very low and there is less risk of them being further reduced.

Valuations are also returning to attractive levels in the US market, while they remain very supportive in both Europe and China, but it will take time for the market to renormalise and volatility will persist, an environment in which one of the most important virtues in investing, but also the most difficult for the investor, is required, namely a great deal of patience.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.