US in Goldilocks mode as Europe slashes interest rates: What to expect?

24 October 2024 _ News

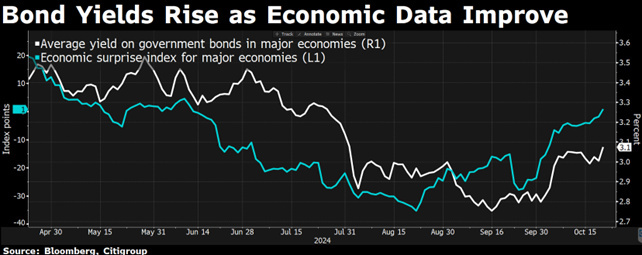

Equity markets continued to be exceptionally strong, reaching their 47th new high of the year, with financials, utilities and real estate the best sectors of the week. On the bond front, however, we have seen ten-year rates rise, with the US ten-year yield posting one of the largest post-interest rate cut rallies ever, reaching 4.20%, while the German bund reached 2.30%.

At the macro level, the ECB's decision on interest rates and European inflation were highlighted, while in the US, retail sales and unemployment benefits were released for September.

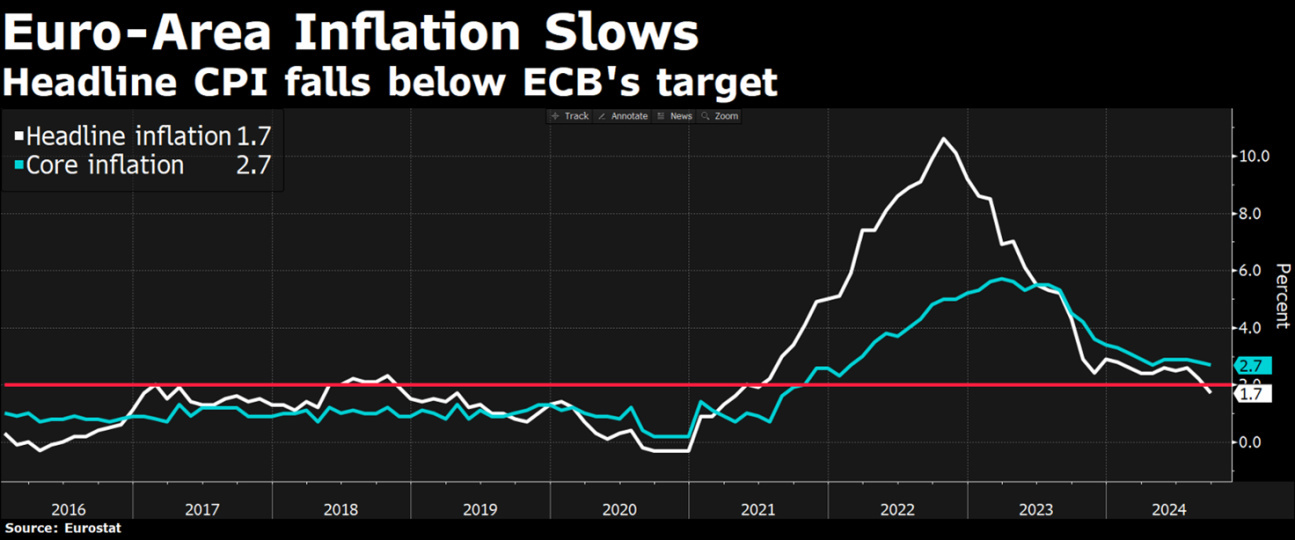

European inflation for September came in at 1.7%, below expectations of 1.8% and lower than the previous month, with the monthly figure still negative at -0.1%, in line with expectations.

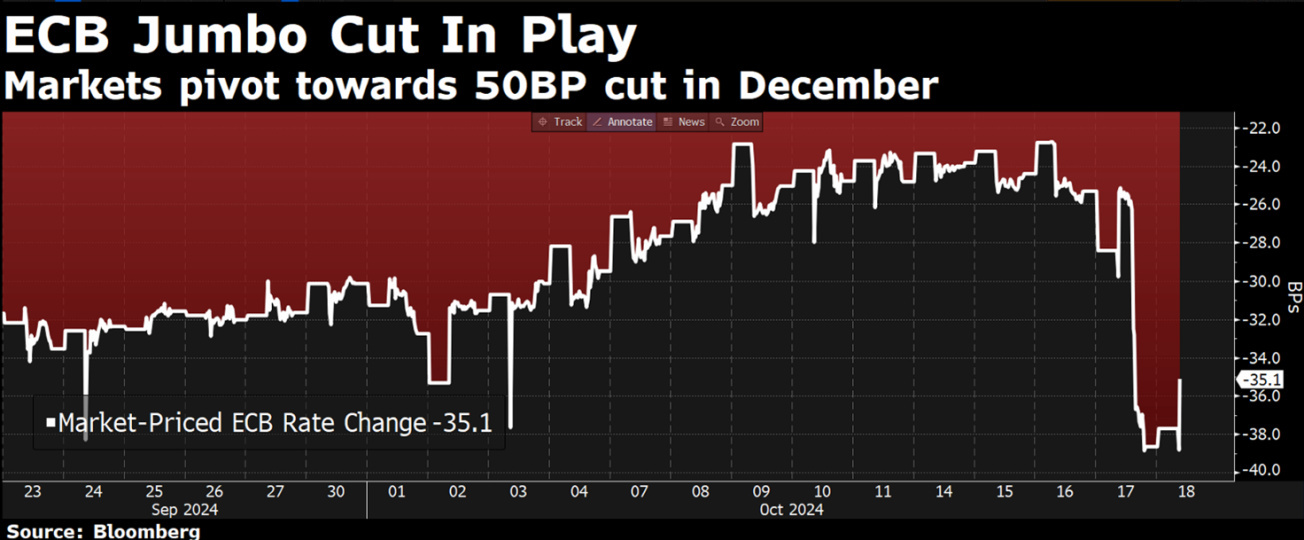

Also highly anticipated was the ECB's decision on interest rates, where it announced its third cut this year, reducing the benchmark rate by 25 basis points to 3.25%. During the press conference, the word "downside" predominated, referring to both growth and inflation. The statement as a whole took into account both the sharp slowdown in the of the German economy as well as the latest inflation data, and reinforced the view that the deposit rate would reach 2% by mid-2025.

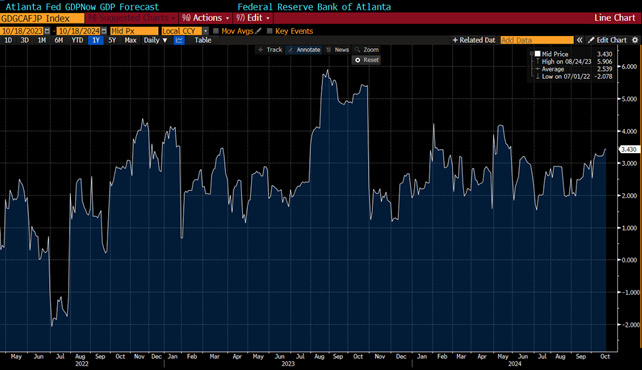

Meanwhile, macro data in the US continues to support the narrative of a Goldilocks scenario, with the economy still strong but at just the right point to avoid fuelling further inflationary pressures. The Atlanta Fed's GDP Now tracking model (a sort of real-time measure of GDP) raised the US GDP growth rate for the third quarter from 3.2% to 3.4%, following a strong September retail sales report that came in above expectations, rising 0.4% for the month versus the 0.3% expected. Unemployment claims also fell to 241K versus expectations of 259K, despite labour strikes and hurricanes.

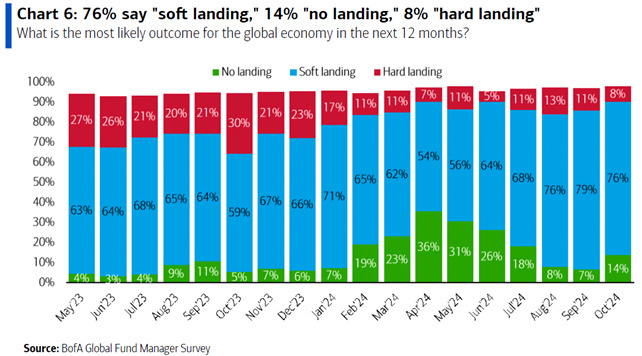

These macro data underline a clear divergence in economic phases between Europe and America, which is already well embedded in investors' expectations. In fact, according to Bank of America's September Fund Manager Survey, which the investment bank conducts each month among some 200 of its clients representing some 500 billion in assets under management, only 8% of respondents expect a global recession in the next 12 months, the lowest level in two years.

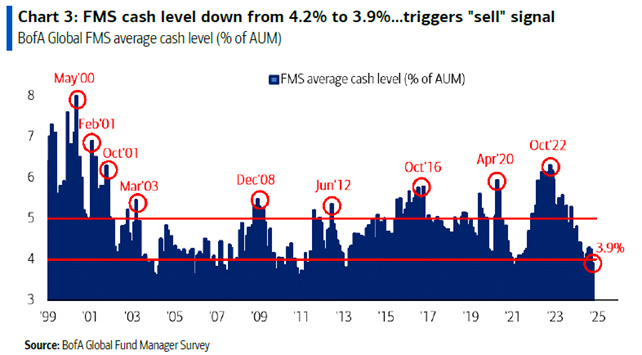

Investor liquidity is also at its lowest level since 2021, at 3.9% below 4%, a level that has historically been interpreted in the opposite direction as a sign of an impending correction.

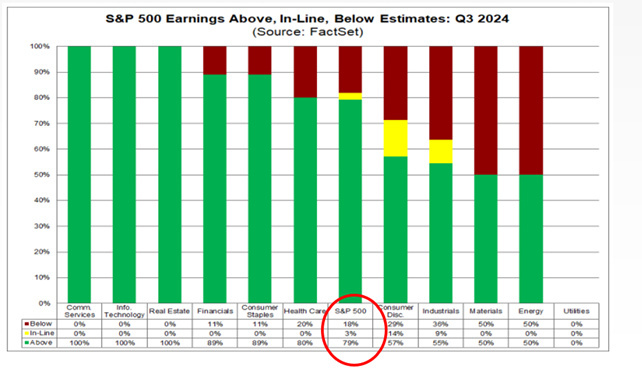

Meanwhile, the US third-quarter reporting season has begun. So far, just over 15% of the total number of companies have reported their quarterly results, of which 79% have been better than expected.

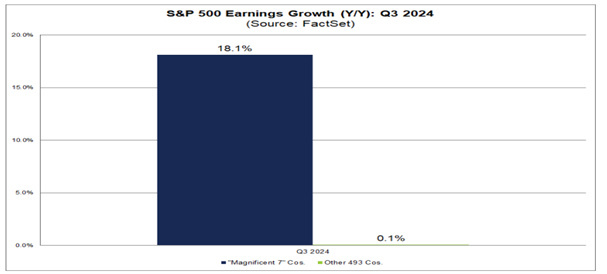

For the magnificent seven, earnings growth is expected to be 18% in the third quarter, and excluding them, earnings growth for the remaining 493 companies is close to zero.

Once again, as is almost always the case, there was a general reduction in analyst estimates in the weeks leading up to the quarter, which lowered expectations and made it easier for companies to beat estimates. This is a technical dynamic, but it is always important to be aware of it, because it is expectations that really count and play a key role in short-term price dynamics and stock reactions to the release of results.

Among the companies that reported, we can certainly mention a good set of results from the big banks, pushing the financial sector to new highs, with instead light and shade on the most fashionable sector at the moment, namely the semiconductor sector, where two giants, ASML and Taiwan Semiconductor, reported.

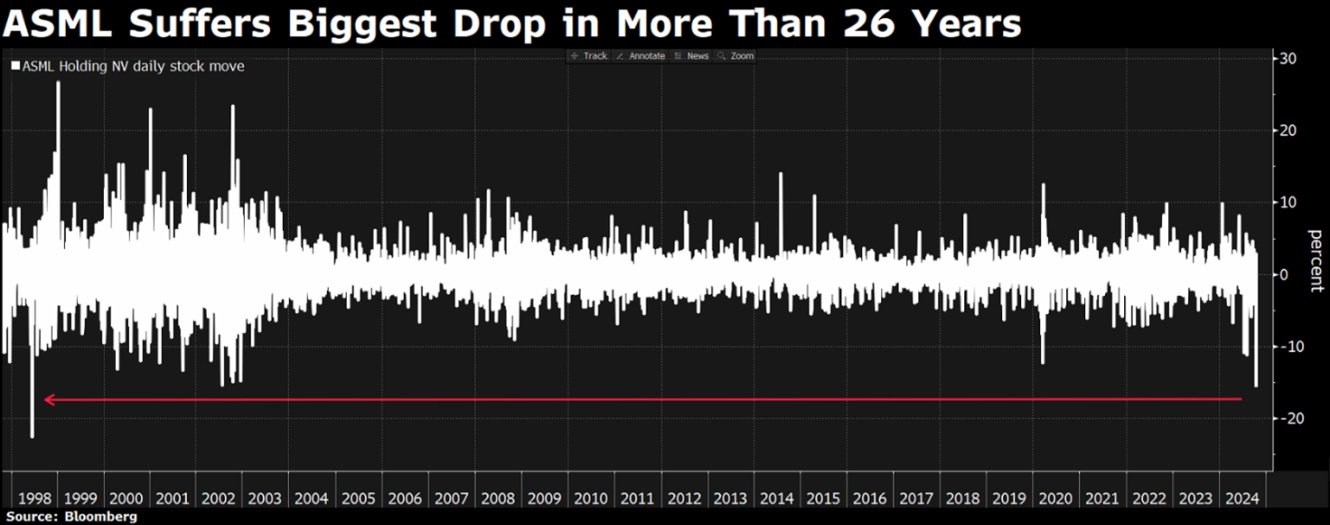

ASML, the leading manufacturer of advanced chip-making equipment, surprised the market with a profit warning after Q3 orders fell almost 50% short of expectations and guidance for 2025 was cut. According to the statement, the weakness in the numbers was due to a slower-than-expected recovery in some markets outside the AI world, with a cautious stance from major customers expected to continue into 2025, coupled with weakness in China. This was enough to send the stock down 15% on the day, taking it to -35% from its mid-July highs and to an average valuation of 28 times earnings, dragging the entire chip sector down with it.

Chipmakers rallied two days later when Taiwan Semiconductor's shares jumped 10% after it posted strong figures and raised its sales forecasts. This helped ease concerns about global chip demand and the sustainability of the AI hardware boom.

We have also seen contrasting results from the luxury sector so far, with LVMH disappointing consensus by reporting a 3% organic decline in Q3, but on the other hand we have had remarkable figures from Brunello Cuccinelli showing the resilience of the top end. The result is a very volatile luxury sector, with investors buying or selling based on the latest news, rather than its true long-term impact.

Great investors teach us that opportunities are the result of volatility minus emotion. Eliminating emotion and knowing how to use corrections to your advantage creates opportunities. Resisting human nature to react emotionally to short-term news is perhaps the greatest secret to successful investing. Related to this concept, we must never ignore the power of compounding, which plays a significant role in the long term. Getting out of the market or selling a sector or a quality stock just because of some short-term negative news, just because of a missed report for example, does not allow compounding to work and this is the biggest mistake investors make. Remember that Warren Buffet made more than 90% of his fortune after the age of 65, and that is precisely because of the power of compounding, which is not by chance called the eighth wonder of the world. Market sell-offs are inevitable, the history of the markets teaches us that there is a 10% correction every year, a 20% correction every 3 years and a 5% correction three times a year, this is nothing new and knowing the markets should help us to stay consistent with our strategy by taking advantage of the nature of the markets and the corrections themselves.

Market corrections hurt, but they are inevitable. Many investors intuitively interpret volatility as something negative, if the portfolio falls by 20-30% they see it as an indication that they have done something wrong and made a mistake, but very often this is not the case, they are just paying the price for long-term success. This change in perspective is crucial. The mistake many investors make is that they want to avoid paying this price of volatility, they want the return without the volatility, but that is not possible. Volatility should be seen as an option to enhance returns over the long term, and like any option, it comes at a price, but with great rewards.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.