Q4: risks and opportunities

17 October 2024 _ News

1.Last quarter: between profits and macro data

The last quarter of 2024 has begun. A quarter that will be marked by several events: US elections, earnings season, central bank rate cuts, various macro data and geopolitical tensions.

How to manage this uncertainty and what is already discounted in market prices?

2.Hot topics

Let us start by analysing some of the hot topics of the quarter.

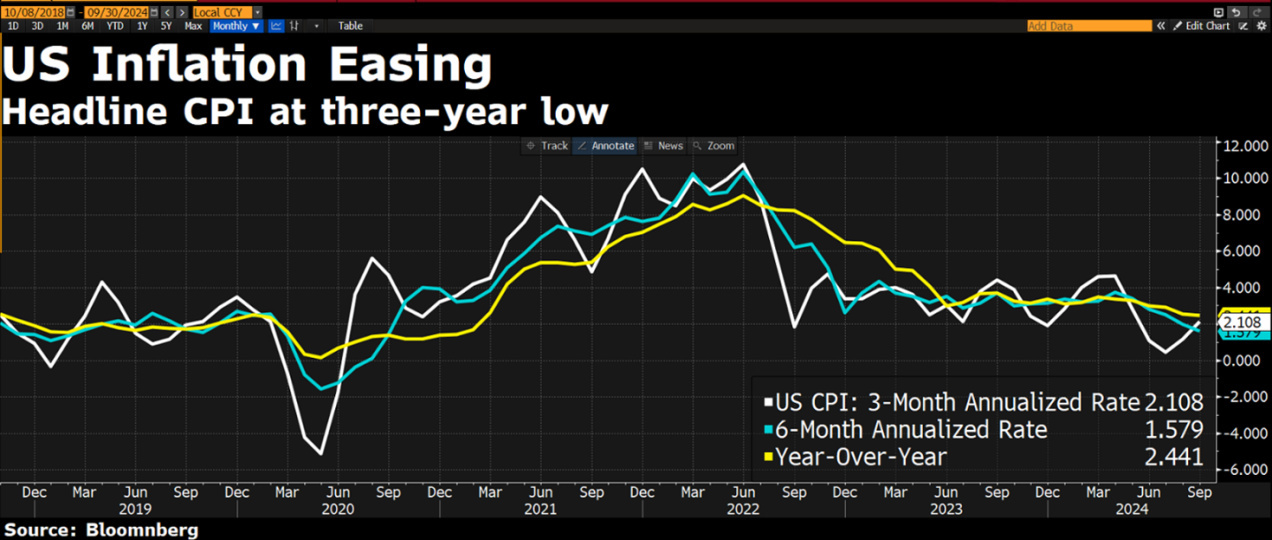

First, the macro data, where the global disinflation process is continuing in line with expectations.

As far as US inflation is concerned, the figure confirmed the process of price reductions, but this process is slower than expected. The figure is still weighed down by shelter, i.e. housing, which, as we have been telling you for several months, is hardly representative of the real cost of renting for citizens, since it is a survey and not the cost of rent actually paid. If we exclude this figure, inflation falls to 2%.

As for European inflation, last month's figure was +1.8%, in line with the ECB's target. This week we will have the updated figure for last month, where we do not expect any surprises.

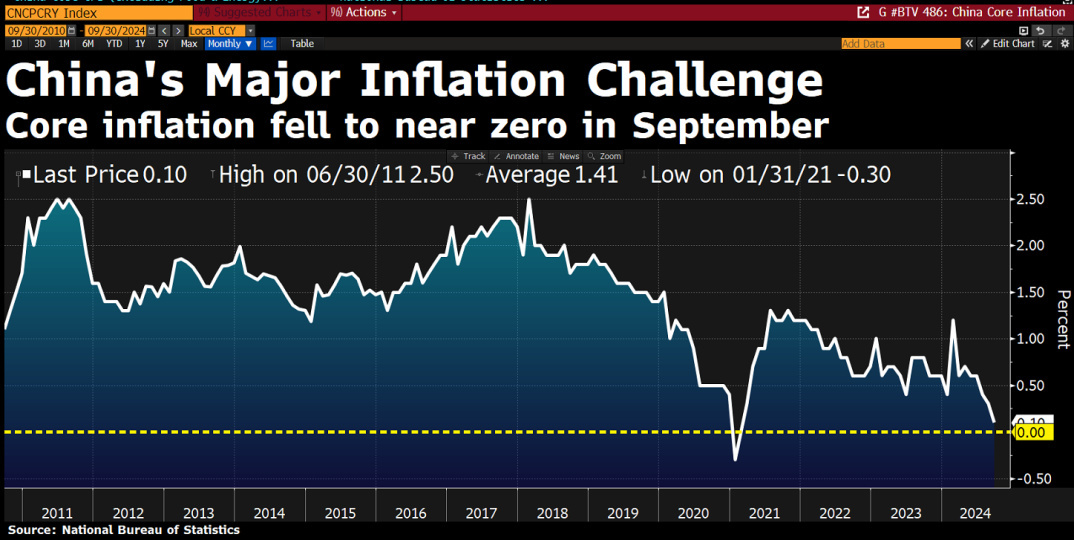

Finally, China's inflation performance shows us that ultimately the main determinant of inflation is the performance of the economy, so a recession remains the main driver of price declines:

In addition to inflation, it is useful to look at how economies are responding to rising interest rates.

First and foremost, the most resilient economy so far has been the US economy, however, we are starting to see the slowdown in the labour market as evidenced by the unexpected rise in initial jobless claims to 258,000, the highest level since 5 August 2023. On Thursday we have US retail sales data, where it will be useful to see how the US consumer is reacting to high interest rates.

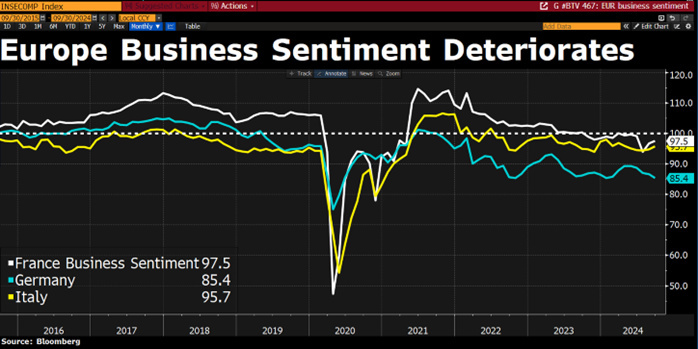

Turning to European economic growth, the latest data is not very encouraging. Germany, for example, has revised its GDP forecast for this year to a contraction of 0.2%, the latest sign that Europe's largest economy is struggling to shake off a prolonged period of sluggishness. The economy may already be in a technical recession, with a further contraction possible in the third quarter after output fell 0.1% in the April-June period.

As far as Chinese growth is concerned, GDP is expected to remain at around 5%, a much higher rate than in Europe and America.

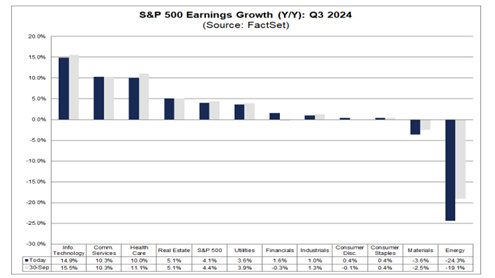

Turning now to the US earnings season. Analysts are expecting growth of +4.1%, down from +4.4% at the end of September. Among the sectors expected to grow the most are tech-communications and healthcare. Sectors expected to decline include energy and materials.

On Friday, JPMorgan surprisingly reported a rise in net interest income for the third quarter and raised its guidance. Revenues also beat analyst estimates, with investment banking fees up 31%, beating estimates for a 16% rise.

Bank of America, Goldman and Citigroup are due to report on Tuesday.

Returning to the concept of risk perception from last week, it is useful to highlight the performance of banks since the banking crisis a year ago, when investors' perception of risk in banks was at its highest. Indeed, from May 2023 to October 2024, US banks have performed around +62% compared to the market, which has performed +56%. So when the perception of risk goes up because prices go down, that's where the opportunities are.

3.How much has the market already discounted?

Given these considerations, how much has the market already discounted?

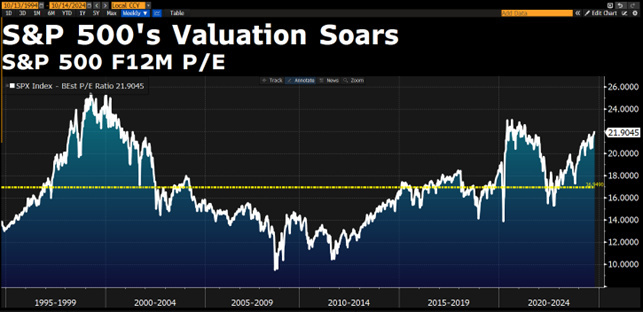

Let's start with the US, where the perception of risk is very low, as evidenced by valuations that are at all-time highs, with the S&P500 price-to-earnings ratio now at 22, at the 2021 peak.

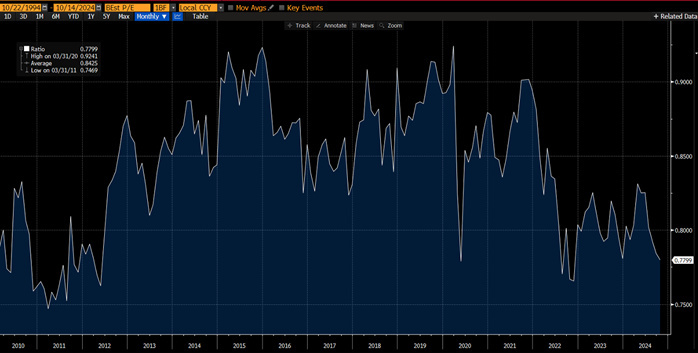

Let's move on to Europe, where the economic slowdown has driven valuations down to their lowest levels relative to the US equivalent index:

Finally, China continues to show deeply discounted valuations, especially given that earnings have already discounted a recession with a decline of around 17%.

Conclusions

In conclusion, some markets and companies have very high expectations, while other markets are heavily discounted. We continue to watch these discounts with great interest, knowing that it will take time but that the market pendulum always tends to swing back into balance.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.