Markets between elections, macro data and quarterly reports: Who will hold the whip?

07 November 2024 _ News

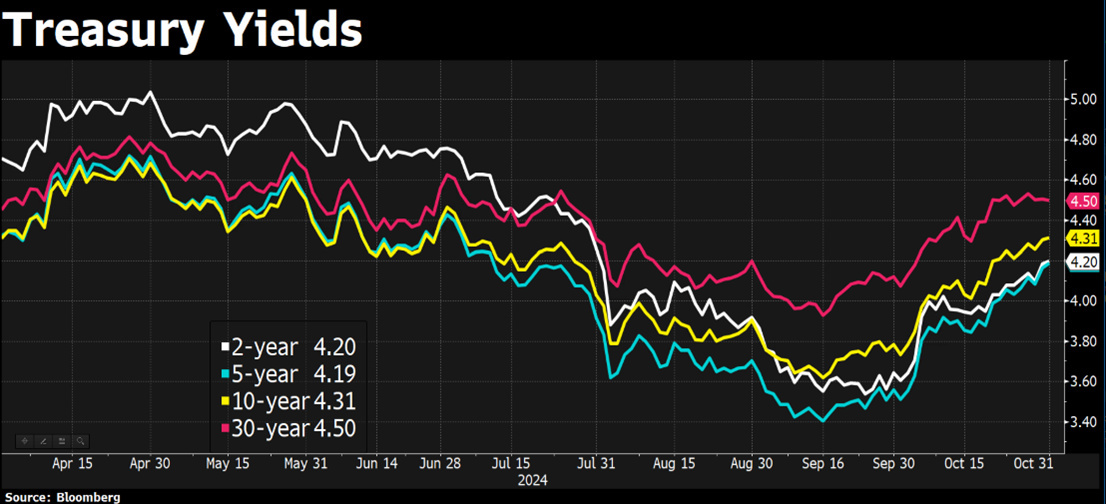

A period of apparent consolidation continues in the markets. However, volatility is on the rise in the markets ahead of the presidential elections, with the VIX back in the 20s and, above all, in the bond world, with the MOVE index on the rise and interest rates at their highest levels since the first FED cut in September, with the US 10-year at 4.3%.

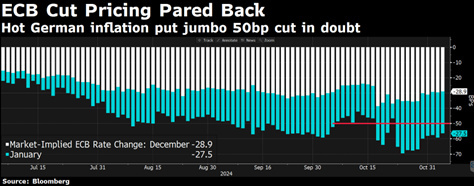

Also influencing bond market volatility was a week full of macroeconomic data, with German and French GDP coming in above expectations (although both were positively influenced by some one-off factors, such as the Olympic Games in the case of France or a downward revision of the previous month's figure in the case of Germany). In Europe, we also had some inflation data that came in above estimates, as the favourable base effect that had helped in previous months disappeared.

All of this data suggests to the market that the ECB may be easing up on the rate cut path, with the market reducing the odds of a 50bp cut at the next meeting.

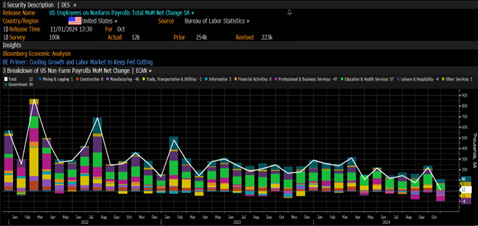

Several macro data were also released in the United States, including a PCE, i.e., the FED's main preferred inflation indicator, in line with expectations, and good data on the labor market, with lower-than-expected claims for unemployment benefits and the unemployment rate remaining at 4.1 percent. However, the much-anticipated nonfarm payrolls figure, which came out at 12,000, well below the expected 100,000, appears to be related to the distorting effect of the hurricanes, and this figure was also interpreted as a positive sign for the labor market.

The recent increase of as much as 75 basis points in 10-year rates began the day after the Fed cut rates by 50 basis points.

Some bond bears believe that the Fed will reignite inflation by cutting rates while the economy remains strong. Others fear that budget deficits are getting out of control and that this, in turn, could lead to inflation. Even two well-known investors, Tudor and Druckenmiller, have recently publicly come out against the US rate, fearing that a Donald Trump presidency and Republican control of Congress will increase deficits and lead to high inflation. Whenever such strong positions are reported in the media, it is perhaps time to be reminded of the contrarian approach that we also prefer, with a time horizon beyond the short-term volatility associated with presidential elections and the narratives of the moment. We believe that on the other side of a growing liability on the federal balance sheet is actually one of the most solid assets in the world: the great American companies, undisputed global leaders that can be found in portfolios around the world. As long as this axiom is true, we believe that debt will never be America's real problem.

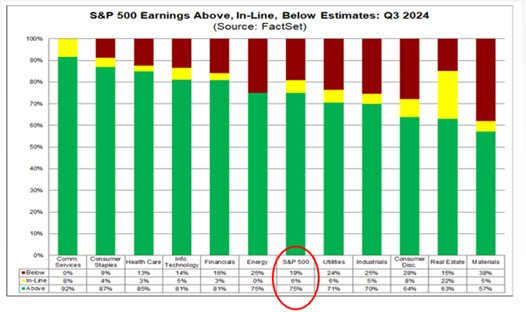

Not only macroeconomics, but more importantly, the reporting season, which at this point has seen almost all of the "magnificent seven" at the rendezvous with quarterly results. The earnings season continues to be positive overall, with companies reporting positive earnings surprises in 75% of cases.

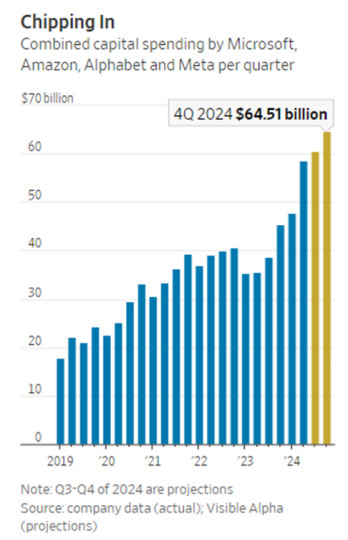

In the case of the Magnificent Seven, we can point to excellent growth figures from all of them, but what makes the difference are the directions and forecasts for the future. In the case of Alphabet and Amazon, these pleased the market, while in the case of Meta and Microsoft, they did not. The companies sent three main messages: demand for AI remains very strong, but companies are struggling to keep up with the necessary investment; this dynamic is increasingly raising investor concerns that margins may soon suffer. On the other hand, when valuations are high, as in the case of many tech companies, it is much easier to find an excuse to sell than to buy.

Big tech capital expenditure is set to exceed 0 billion this year and continue to rise through 2025. This shows how the world is changing and how huge investments are needed to keep up with the times.

New companies are emerging, but several aspects are still unclear, from what the business model will look like, i.e. how these companies will manage to charge for new services, how much demand there will be from customers, and whether these investments will not create an oversupply, as has already happened. All the way through to the key question: who will win the AI race?

These companies will have to invest heavily in order not to disappear, but the focus of investors is increasingly shifting to expected margins and who will be the winners and losers of this technological revolution.

These are all questions that cannot be answered today, but to which the market is already adding a very significant valuation premium that leaves no room for error for the companies and, with the exception of Alphabet and a few others, no margin of safety for investors.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.