Freefalling rates: too late for the Fed?

12 September 2024 _ News

Over the past month, global equity indices excluding China have been in positive territory with gains of around 2%, but this is happening in a new context where financial market volatility has definitely increased and investors are talking again about a possible recession.

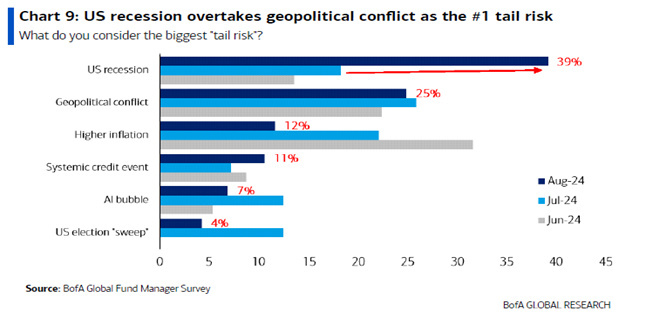

This is evidenced by the latest Bank of America Fund Manager Survey, a survey conducted by the investment bank of all its clients, which shows that for 40% of respondents (up from 20% in the previous month), recession has become the most important current risk in the markets.

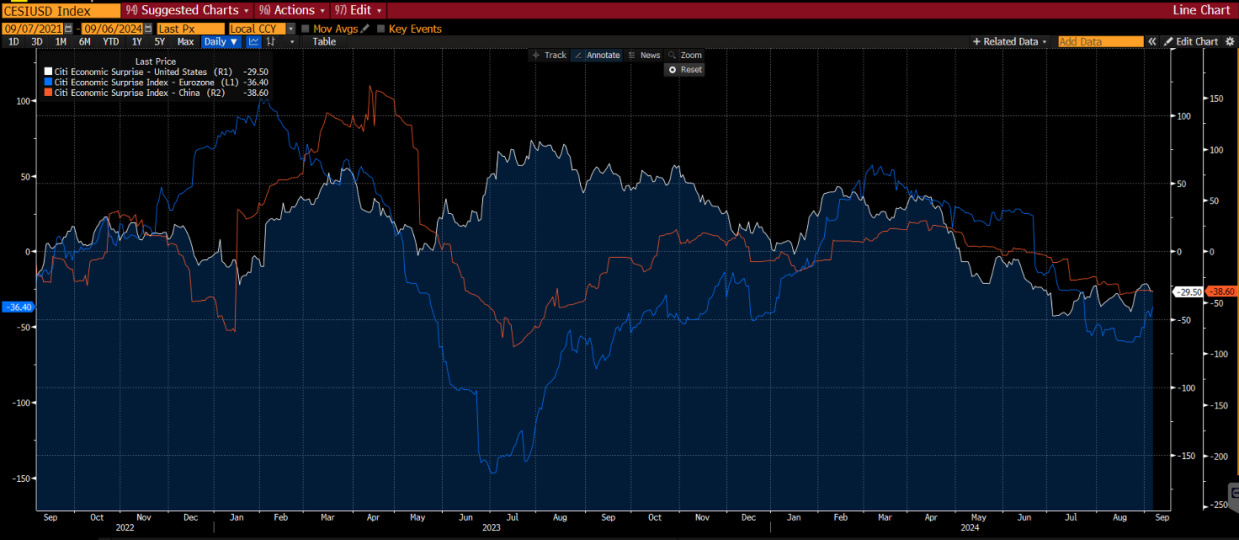

Indeed, we are in an environment of deteriorating and weaker-than-expected macro data, with indicators of economic surprises, as measured by the Citi Economic Surprise Index, falling in all geographical areas, from the Americas to Europe to China.

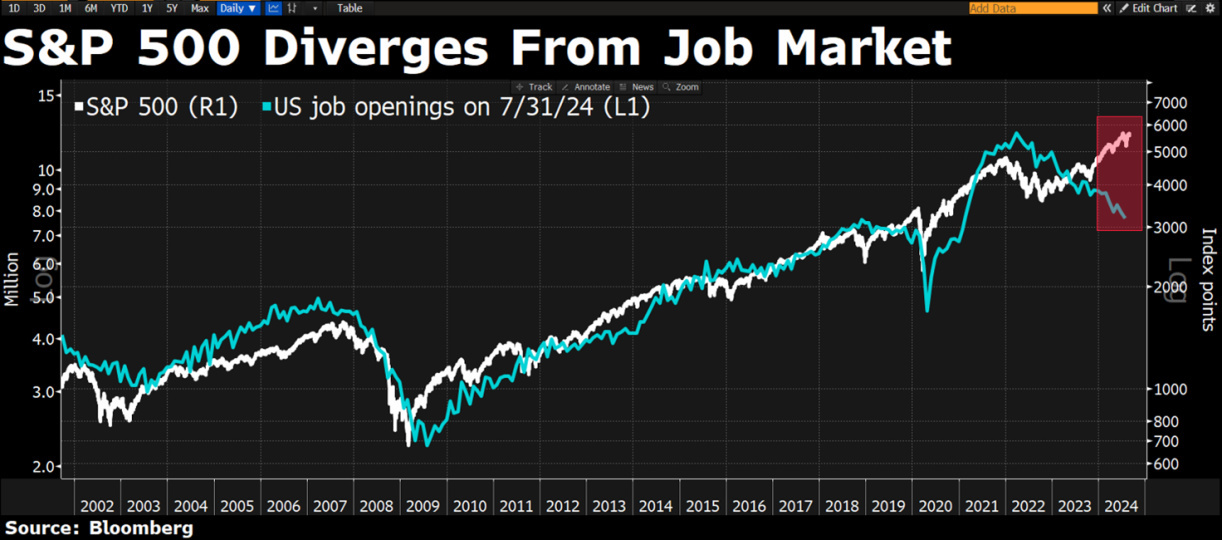

In the United States, the data that worried investors most concerned the labour market, which has deteriorated markedly since the beginning of August, with the latest non-farm payrolls figure on Friday coming in below expectations and the unemployment rate at 4.2%, accompanied by very worrying revisions to data from previous months and seemingly disconnected from stock market trends.

As a result, investors have begun to believe that the Fed is delaying rate cuts against a backdrop of falling inflation, now very close to the Fed's target, and a slowing economy. This perfect storm of falling inflation, slowing growth and a deteriorating labour market is behind the fall in government bond yields, with US Treasury yields falling to 3.7% from 4.7% at the end of April and German Bund yields falling to 2.15% from 2.7% in May.

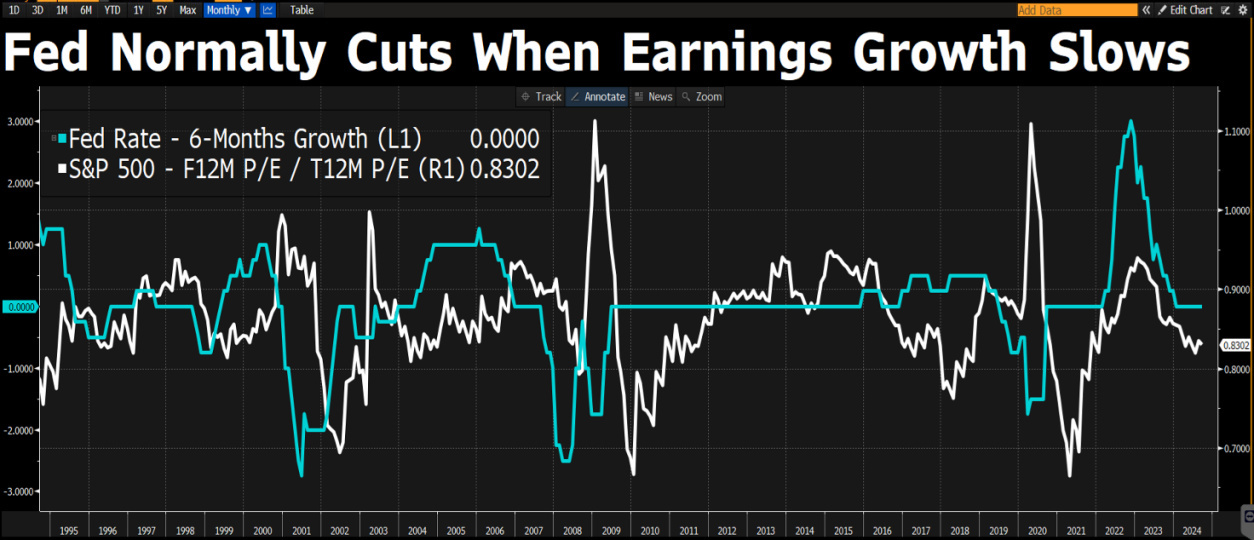

In a few days' time, the Fed will start cutting rates at its meeting on 18 September, with the market wondering whether the first cut will be 25 or 50 basis points, and expecting around six cuts by the end of the year. There is a real risk that the Fed is already behind schedule and will have to chase with rapid rate cuts an economy that seems to be heading for a recession rather than a soft landing, at least that is the scenario that historical analysis suggests.

We believe that the downward movement in interest rates, which is more pronounced at the short end but will also affect the long end of the curve, will continue in the coming months, making government bonds an excellent instrument within portfolios.

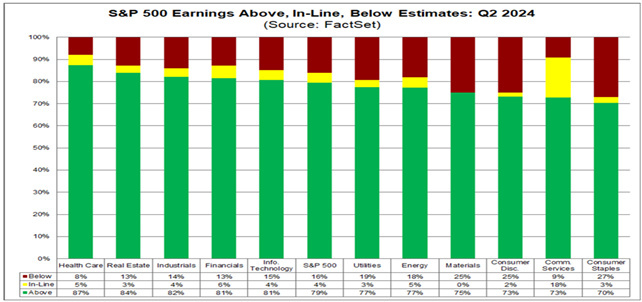

With regard to equities, we are seeing the start of a sector rotation towards defensive or more interest rate sensitive sectors. So far this quarter, the best sectors have been the much-hated real estate, utilities and consumer staples, while the worst sectors have been growth and technology, especially semiconductors and AI. The reporting season ended with around 85% of companies beating estimates, but many companies cut their growth forecasts for the coming quarters as consumers become less inclined to spend.

Market expectations for many stocks are still very generous and earnings growth very challenging. There are a number of elements to consider when thinking about expected earnings growth:

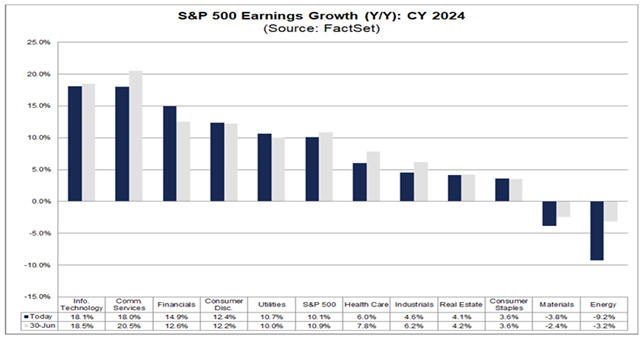

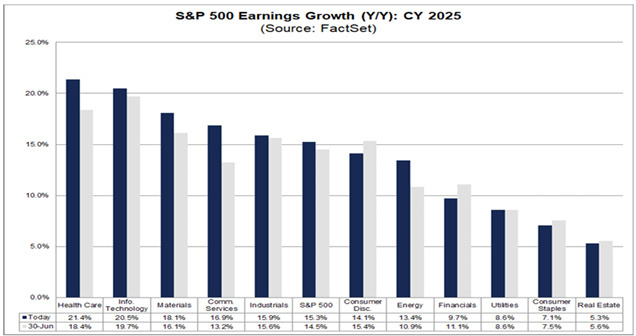

First, after the exceptional post-Covid growth spurt that led to unprecedented earnings growth in many sectors, the comparison base is now very challenging and it is becoming increasingly difficult for companies to surprise to the upside. Moreover, historical analysis suggests that years following major rate hike cycles (such as the one we have just experienced) are characterised by earnings growth below historical averages and a slowing economy, not the other way around. Ultimately, earnings growth is a nominal quantity and the return of inflation is not in its favour. The current consensus forecast for S&P 500 earnings growth is 10.1% in 2024 and 15.3% in 2025. Estimates for 2024 were at 11% until a few weeks ago and are now starting to fall, and we believe this trend will continue through the end of the year, particularly affecting sectors where expectations have been unrealistically high, such as technology.

Market experience tells us that periods of downgrades are never accompanied by a positive performance of the stocks that trigger them. It is therefore likely that we will see a general weakness in the indices, which will probably be characterised by greater volatility during the presidential elections, causing some valuation excesses and overly generous estimates to recede, perhaps setting the indices up for a recovery in the last part of the year.

The good news is that there are many stocks and sectors in the market that have already discounted this momentum and are therefore protected from large earnings revisions or valuation downgrades.

These are often companies in the more traditional sectors (such as utilities, consumer discretionary, real estate or some pharmaceuticals) that offer deeply discounted valuations combined with excellent prospects for returns on capital, which could defend portfolios in a potential index correction scenario and allow investors to add quality stocks to portfolios at reasonable prices.

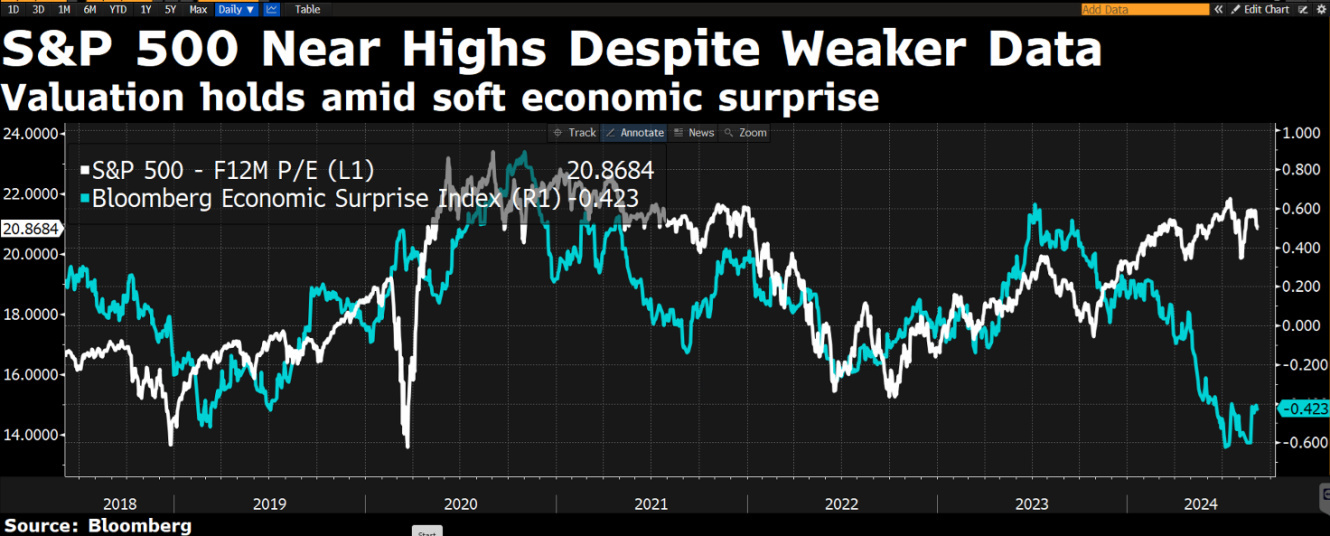

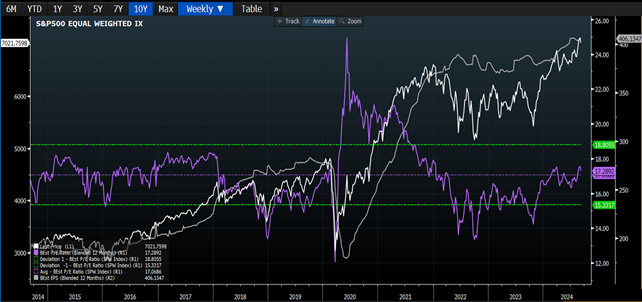

Valuations of the S&P500 have returned to historically high levels and now trade at 23 times earnings. To find indices with valuations closer to historical averages, we need to look at the S&P500 equivalents, or small caps, which have historically been one of the best performing sectors after a rate cut, as the earnings recession has already been discounted by the market.

The European markets, with the EuroStoxx 600 index trading at 14x earnings, remain close to or below average valuations, as do the Chinese markets, which are trading at 11x earnings, a discount of more than 50% to the US market. Here, newsflow remains negative and market earnings have been cut by 20% from their highs, giving the patient investor a very good chance of above-average expected returns over the next few years.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.