US economy 'the envy of the world'... But for how long?

31 October 2024 _ News

The rally in global equities paused to end the week slightly lower, with corporate earnings dominating the newsflow. On the bond front, the US market continued to resist the Fed's accommodative monetary policy, keeping Treasury yields around 4.25%. European ten-year bonds followed suit, with the Bund reaching 2.25%, adding to the volatility in the global bond market.

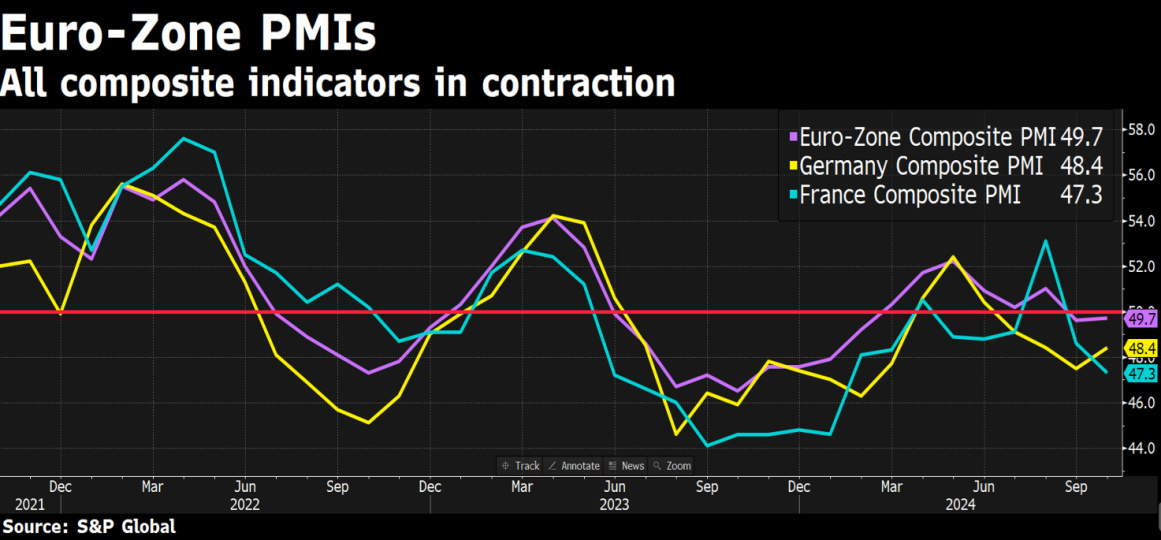

Among the key macroeconomic data, European PMIs were in line with or slightly below expectations.

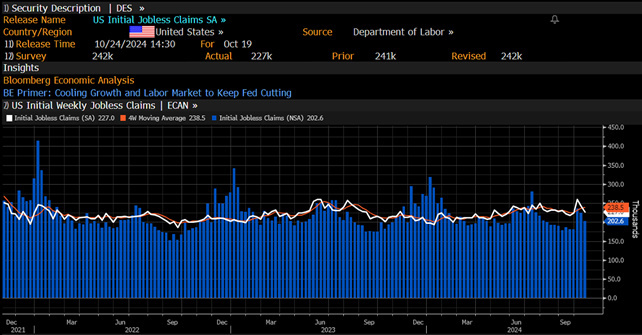

In the US, jobless claims came in slightly better than expected at 227,000 compared to 242,000 expected.

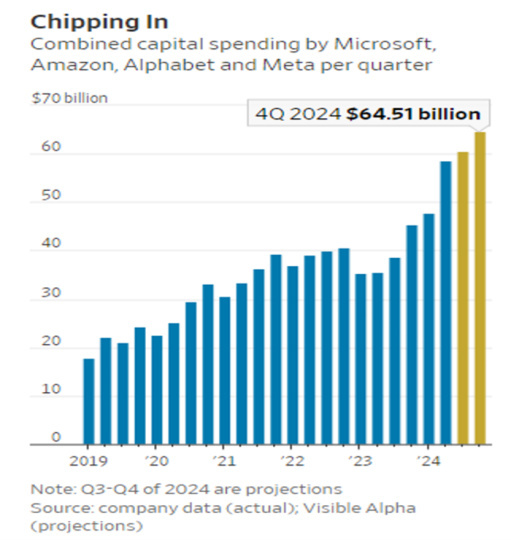

Investors are turning their attention to the earnings season, which is now in full swing, with a particular focus on next week when several of the Magnificent Seven companies are due to report. Their performance will be crucial as almost all of the earnings growth expected this quarter is tied to these stocks. Areas of concern range from high capital expenditure (CAPEX) to the visibility of returns from artificial intelligence, as well as company-specific issues: Amazon, for example, with its heavy spending on an ambitious satellite programme that could squeeze margins; Microsoft, with its changing approach to reporting; Google, with a legal dispute with the US government; and Meta, exposed to a possible slowdown in advertising spending by Chinese e-commerce (Temu). All these issues will be closely watched this week.

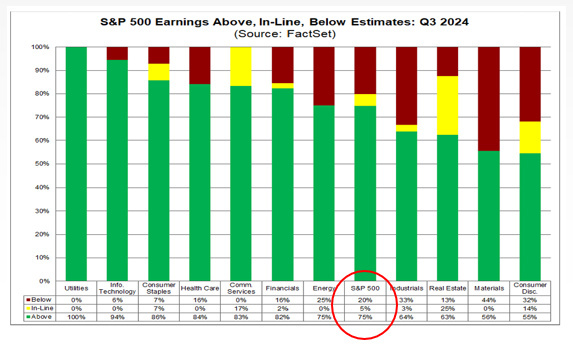

To date, around 40% of companies have reported results, beating estimates in 75% of cases, with an average surprise of around 5%.

An interesting aspect of this reporting season is the lack of clearly defined industry trends, with often contrasting performances between companies in the same sector. An important example this week comes from the automotive sector: GM and especially Tesla beat estimates, while in Europe Mercedes and Valeo disappointed. Tesla's reaction was remarkable, closing up 20%, boosted not only by better-than-expected results but also by CEO Elon Musk's extremely optimistic comments during the conference call. Musk devoted much of the conference to a monologue promising to make Tesla the most valuable company in the world, with deliveries expected to grow between 20% and 30% next year. This enthusiasm has boosted investor confidence, with Tesla returning to positive territory since the start of the year after being the only one of the 'Magnificent Seven' still in the red.

A note on the recent rise in 10-year rates: the yield on 10-year US Treasuries has risen as much as 63 basis points to 4.25% since the Fed's September meeting. The bond market seems to be sending a clear signal of disapproval of Powell's accommodative monetary policy, fearing that it could lead to an overheating of the economy and a consequent rise in inflation, with the planned 50bp cut likely to exacerbate this risk.

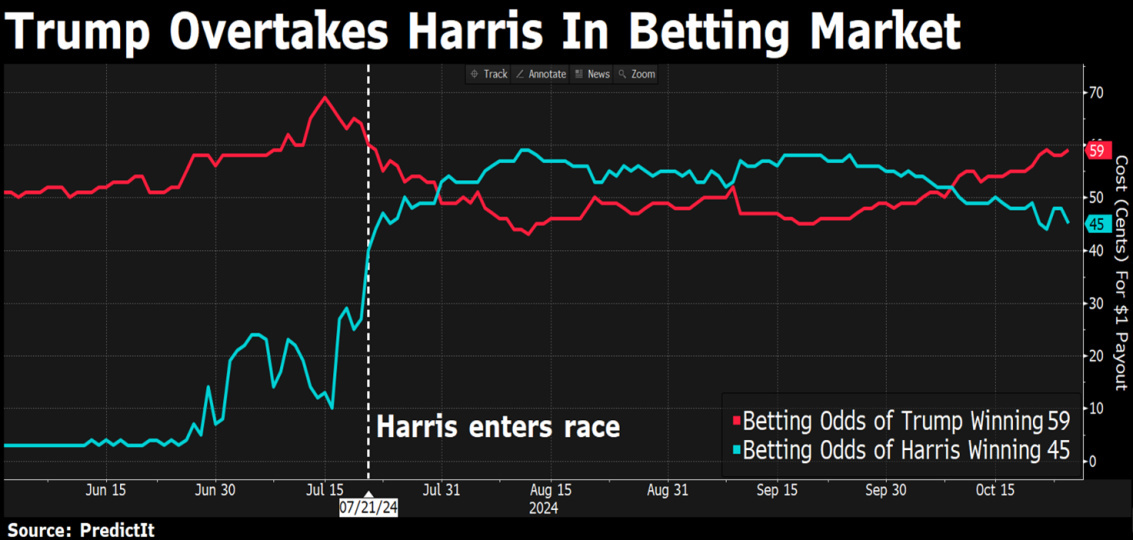

The rate hike could also be interpreted by the bond market as a vote of no confidence in Washington: regardless of the outcome of the upcoming elections, investors expect fiscal policy to further widen the already large federal deficit, adding to inflationary pressures. Importantly, the next administration will have to pay interest on the growing federal debt, which is estimated at more than trillion.

However, it seems that the bond market is more concerned about a possible overheating of the economy than about the budget deficit itself.

If we look at the US balance sheet, we see a steadily growing national debt, but on the asset side we find mainly bonds issued by the companies that make up the S&P500. These companies, which are global leaders and are in the portfolios of investors around the world, represent a kind of guarantee. The widely held view is that as long as these American companies continue to dominate the market, government debt, however high, is not an immediate threat. Japan is a case in point.

The immediate result has been a marked rise in the interest rate futures curve, which has shifted upwards from the level before the Fed's first cut. Twelve-month expectations have risen from an average of 2.80% to the current 3.60%.

All of this is a manifestation of a brilliantly healthy US economy, as evidenced by the cover of the latest issue of The Economist, which features an article entitled "THE WORLD'S INVESTMENT": The US economy is bigger and better than ever'.

In an analysis of The Economist's cover stories since 1998, two Citibank analysts noted an interesting phenomenon: emotional or hyperbolic portrayals of asset classes and market themes, especially when presented in a visually striking manner, tend to predict a reversal in the next 12 months. In more than 70 per cent of the cases studied, the most "sensationalist" coverage proved to be at odds with actual market performance, suggesting a contrarian approach when investor sentiment is particularly positive, with many of the sentiment indicators moving strongly into the extreme category.

We don't know if, and we don't know when, but putting the pieces of the puzzle together, and being wary of the crowd narrative, it seems more rational to have a cautious equity portfolio today, and it is probably time to pick up government bonds again, which could help portfolios in a correction and renewed volatility.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.