The value compass: end-of-semester update

28 June 2023 _ News

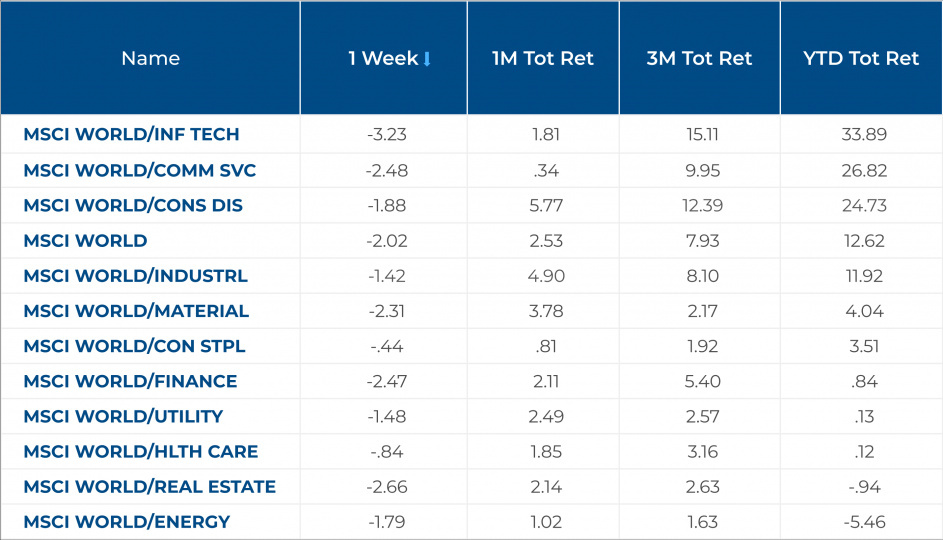

We have now come to the end of the first half of the year, with the global stock market performing +12.6% (06/26/2023) led by the three sectors that suffered the most at the end of 2022: Technology, Communication, and Discretionary, which registered +34%, +27%, and +25% respectively.

A good portion of the market, however, lagged behind, such as Real Estate, Health Care, Utilities, Financials, and Staples with near-zero performance.

The question that arises is: what to expect for year-end?

Both the ECB and the Fed have raised terminal interest rates in recent weeks, once again emphasizing that the path back to inflation is not over. The main reason for this rate hike can be found in the willingness of the Central Banks not to tell the market that the hikes are over, for fear of having to retrace their steps later if inflation in the coming months, supported by a very strong U.S. economy, does not fall at the expected rate, triggering negative effects on both the economy and the stock market.

Inflation in the coming months could be supported by a very strong labor market, as evidenced by unemployment rates in the United States and Europe being at historic lows, and as a result, Central Banks will try to keep rates at these levels until they see signs of weakening labor markets.

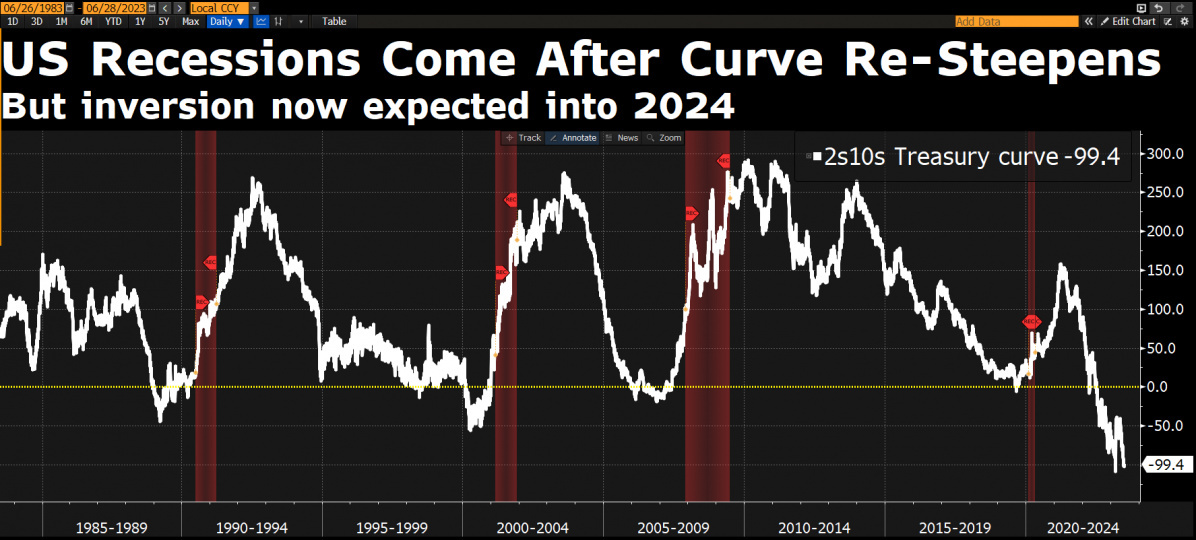

Given this context, from a macroeconomic standpoint we expect a slowdown, as evidenced by PMI data and the curve inversion that has touched nearly 100 basis points, levels seen only in the 1980s. The main factor to continue to monitor will be worsening access to credit, which should help Central Banks to lower inflation.

However, we do not believe that these factors can lead to a major recession in the markets, and a soft landing is still the most plausible scenario.

The investor, however, must not get lost in all this complexity, but must keep his or her compass pointed to value, which allows him or her to take advantage of the imbalances that are constantly forming in the market.

In this first half of the year, there have been disequilibria that have receded and others, however, that have arisen.

Regarding reentered imbalances, going to analyze sector performance, we see that the best sectors were Tech, communication, and discretionary with ytd performances of 34%, 27%, 25% respectively. These figures are the result of the valuation discount these sectors had at the end of 2022.

On the other hand, looking at the imbalances that were created in this first half of the year, we find sectors such as Consumer Non-Discretionary, Financials, Health Care, Utilities, and Real Estate showing flat or even negative performance.

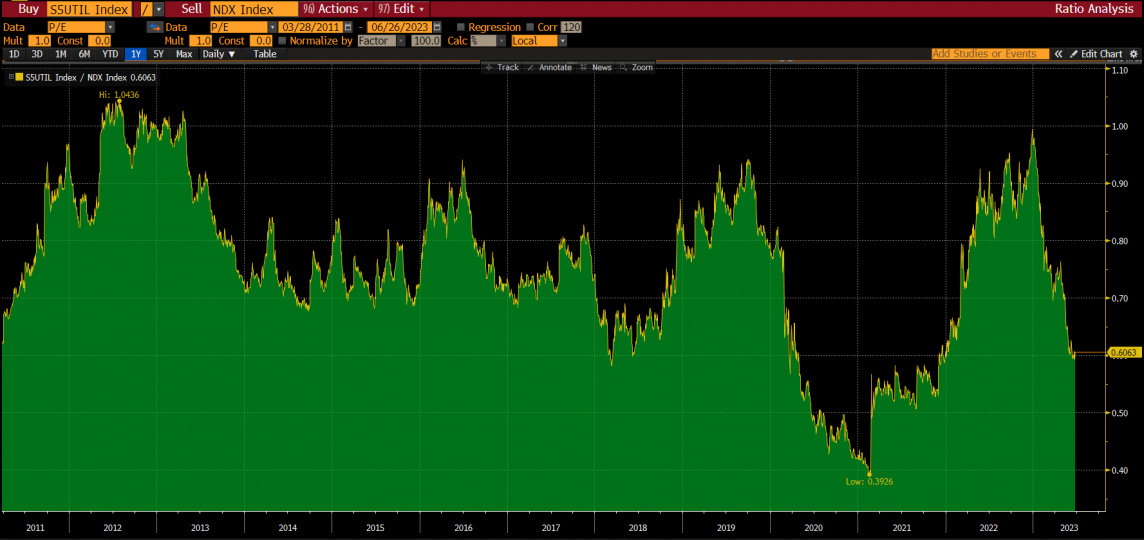

In particular, analyzing the U.S. utilities sector, we note a 40% valuation discount market with PE at 17x times and booming earnings. Utilities also show an underperformance relative to the market of more than 20% ytd, one of the highest levels ever recorded. But the PE of utilities at the end of 2022 was equal to the PE of the Nasdaq, and this was not a normal situation given that technology growths are much higher.

In conclusion, we will experience a very complex macroeconomic scenario in the coming months, characterized by high interest rates to manage inflation on the one hand, and economic slowdown on the other. This should not distract the investor from the search for value, value that is being created in some sectors such as Utilities, Health Care-Financial Real Estate, and Non-Discretionary Consumption.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.