The tasks ahead: What changes for markets

04 February 2025 _ News

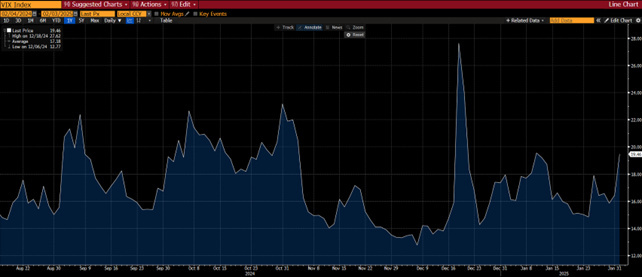

Central banks and the earnings season dominated market attention in the last week of January, but February begins with volatility and the return of tariff tensions.

In the background, the DeepSeek issue and, more generally, the growing competition in the field of artificial intelligence, which is likely to remain a market driver for a long time to come, remain central.

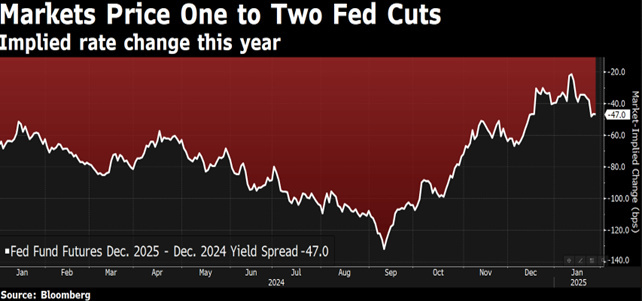

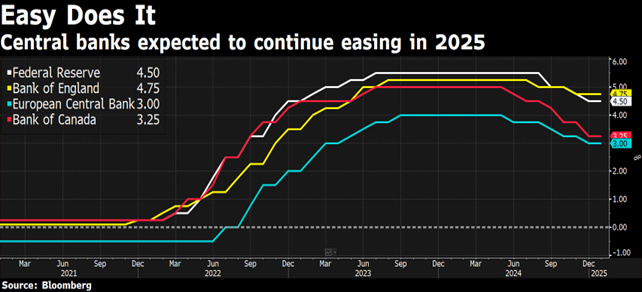

The Fed's latest meeting held no surprises and ended with a unanimous decision on interest rates. The Fed left rates unchanged between 4.25% and 4.50%, underlining once again its reliance on economic data. Chairman Powell's main message during his press conference was that the Fed was in no hurry to cut rates, but would do so gradually and in line with economic data, a message welcomed by the market, which interpreted it as an accommodative pause. By the end of 2025, the market still expects 2 more cuts.

An interesting point? Total silence on Donald Trump's criticism, with Powell reaffirming the central bank's independence.

While the Fed remains dovish, the ECB instead confirmed its more aggressive stance by announcing, again unanimously and in line with market expectations, a fifth rate cut of 25 basis points, bringing the benchmark rate to 2.75%. Asked where the rate cut would end, Lagarde said that at this stage it was too early to say where the rate cut would end as this would be a decision based on economic data and the pace, size and sequence of upcoming monetary policy decisions. The direction of European interest rates is therefore clear (downward), but the end point is uncertain. In this regard, Lagarde announced that a report will be published on 7th February which will indicate a neutral interest rate range. Traders have maintained their expectations of 3 further cuts of 25 basis points by the end of 2025, with the aim of bringing the deposit rate to 2%, which seems a plausible scenario at the moment, with the main risk being a possible inflationary spike as a result of Trump's tightening of tariffs.

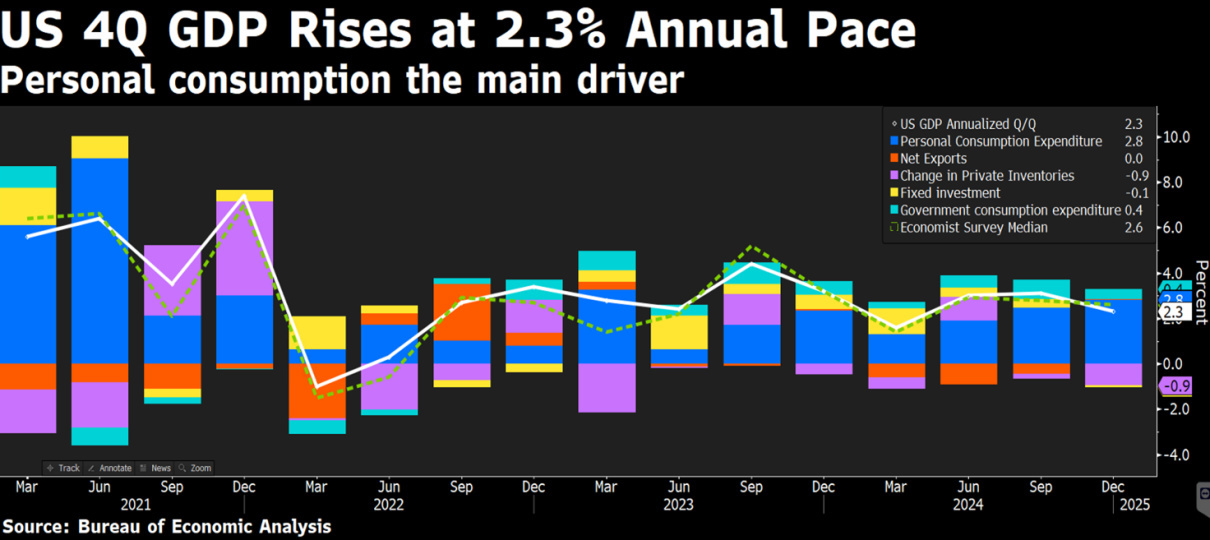

Macroeconomic data continued to suggest that the economy is still in good shape, with consumers continuing to spend, but not enough to worry investors too much. The Atlanta Fed's GDP Now tracking model revised its estimate for fourth quarter 2024 GDP growth from 3.2% to 2.3%, in line with the release of GDP, which came in slightly below estimates.

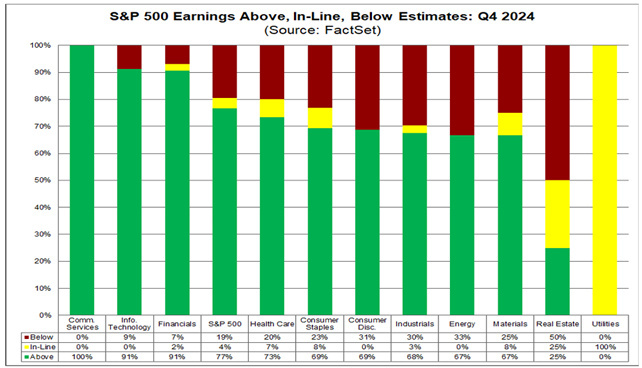

Earnings season is now in full swing, with about 40% of S&P 500 companies reporting so far and 77% beating estimates.

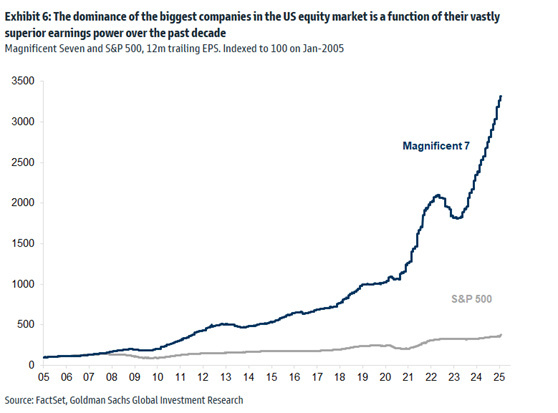

Amongst the various companies, the focus was on the results of the big tech companies, which on the whole reported somewhat mixed results, but not enough to change market sentiment significantly. META surprised to the upside, while Microsoft and Tesla disappointed and Apple was fairly in line. In general, an interesting aspect of the investor calls was the increasing focus on artificial intelligence and in particular the huge investments announced in this area.

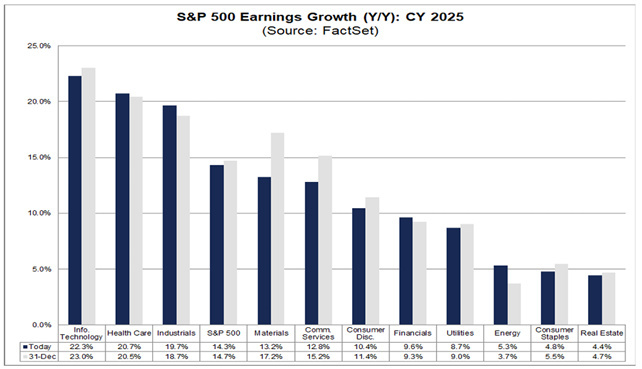

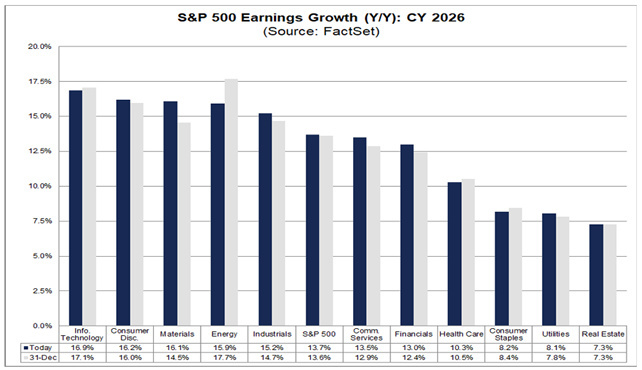

The good reporting should also support earnings growth estimates for the coming quarters. For the US market, earnings growth is forecast to be +14.5% in 2025 and +14% in 2026.

In both cases, we are talking about growth well above historical averages, underlining the expectations of earnings resilience that accompany the strengthening of the US economy, but which will have to be tested in the coming quarters.

Equity valuations remain high on average, but we know that this is not an issue that can tip the balance in the short term, where instead it seems that the long side of interest rates remains one of the main variables that can influence equity performance at this stage, alongside the unknowns of tariff policy.

With the 10-year yield in that critical 4.5-5% range, the stock market has to pay attention to the bond market. The risky asset (i.e. equities) should be yielding more than the risk-free asset (i.e. bonds), so when the yield of the latter approaches the former, the former has to revalue to remain competitive. The 5% level on the US 10-year is this alert threshold that the whole market is watching, but for the moment rates seem to be stabilising below this level, providing an ideal scenario for investors to consider bonds again as a viable alternative to equities in their portfolios.

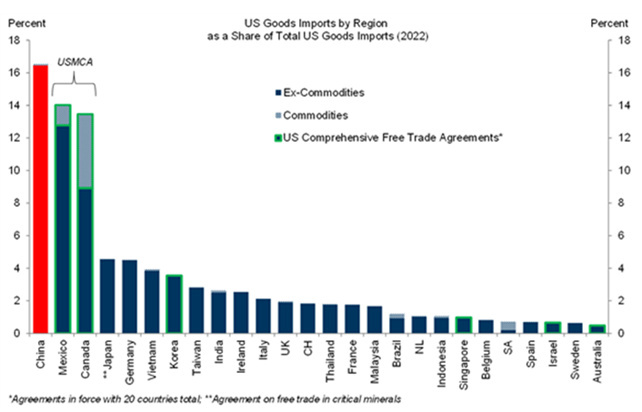

The other issue that we mentioned as being capable of causing volatility was tariffs, and indeed the month of February opened with financial markets immediately shaken by President Trump's announcements on Saturday, which anticipated the implementation of new tariffs earlier than expected. The measures include a 25% increase on imports from Mexico and Canada and an additional 10% on goods from China. In addition, Trump hinted to reporters that new tariffs on European products could come "very soon".

Canada, Mexico and China account for about half of all goods imported from the US. The impact of these decisions on stock indices is difficult to predict, as it will depend on the strategies companies adopt: passing on costs to consumers, passing them on to suppliers or absorbing them by reducing profit margins. According to early analysis by leading research houses, the new tariffs could reduce earnings estimates for the S&P 500 by around 2-3%. In addition to the risk of earnings cuts, political uncertainty could weigh on valuation multiples, while some investors fear that rising prices could prompt the Fed to keep interest rates on hold for longer, adding to market pressures.

This combination of factors suggests a possible near-term decline of around 5% for the S&P500, but if investors believe that tariffs are only a temporary bargaining chip ahead of a deal, the impact could be more muted. Interest rates and tariffs remain the two main factors to watch in the short term.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.