S&P500 on the rise: The return of animal spirits

10 December 2024 _ News

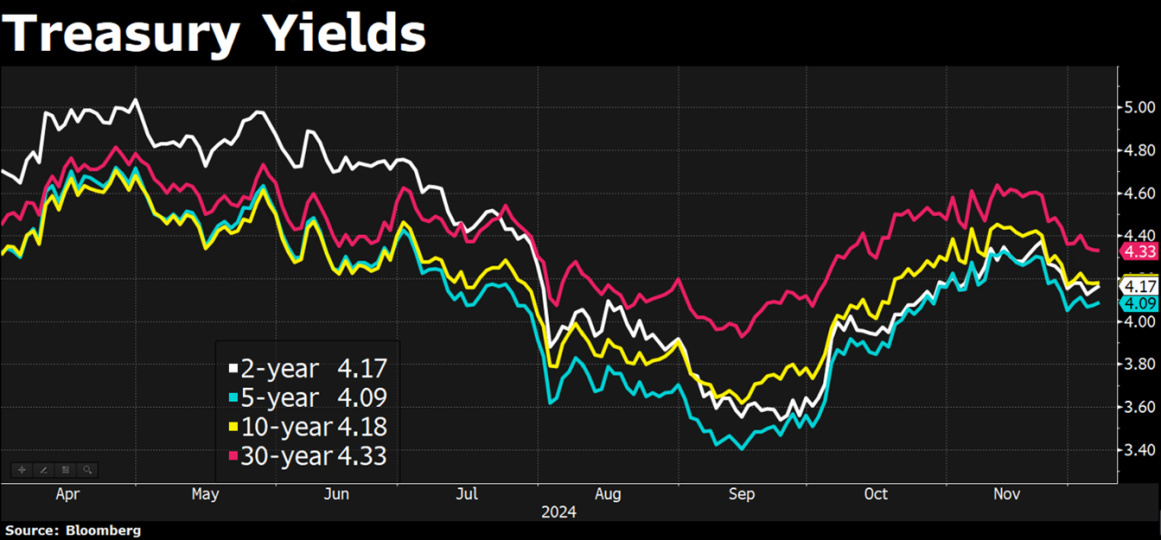

Global equity markets start December exactly as we left them in November, with equities hitting new all-time highs and interest rates generally falling, both in the US, where the Treasury is below 4.15%, and in Europe, where the Bund is at 2.10%.

At the macro level, data from the US tended to be in line with or below expectations, with ISM services coming in at 52.1 against expectations of 55.7 and the labour market registering a higher than estimated number of jobless claims and a higher unemployment rate of 4.2%, but also better than expected non-farm payrolls.

These data contributed to a deterioration in the economic surprise indices both in the US and, in particular, in Europe, where they fell sharply and even moved back into negative territory, highlighting a backdrop of weaker-than-expected macroeconomic data.

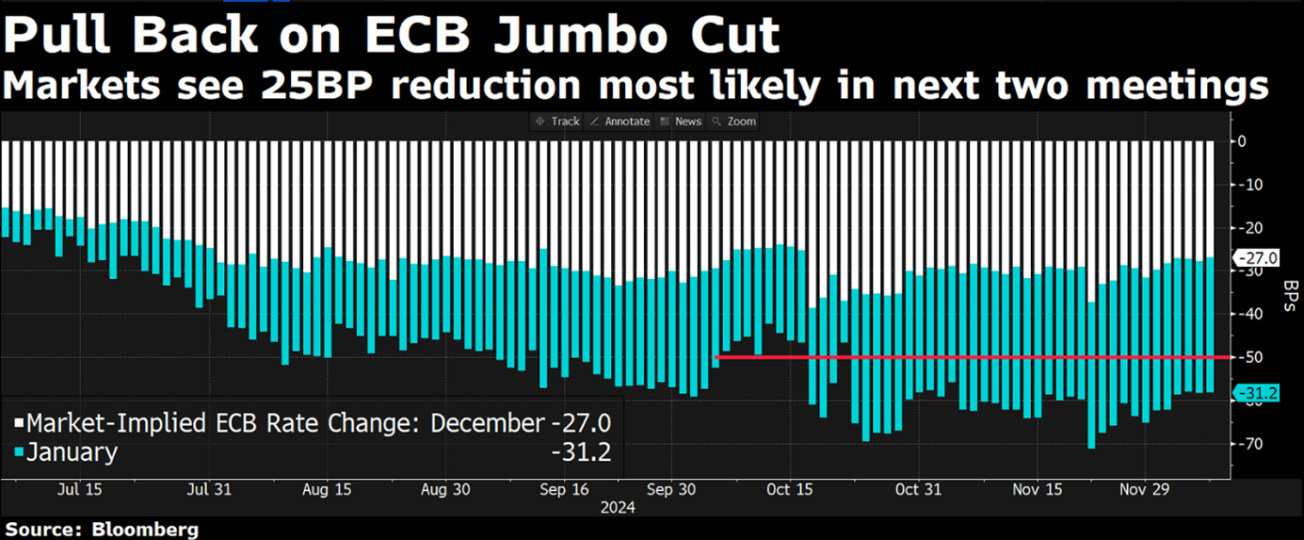

Market expectations for the next central bank rate cuts therefore appear reasonable, with the Fed expected to cut by 25 basis points in December, with an 85% probability implied in market futures, and the ECB to cut by 25 cents twice at its next meetings in December and January.

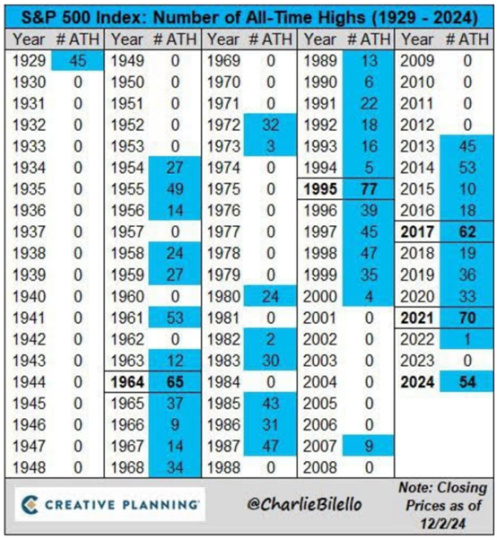

However, it is not the bond market that is attracting investors' attention, but the equity market, and in particular the US S&P500, where we are seeing more than 50 new all-time highs for the year and where talk of animal spirits is returning.

The term 'animal spirits' refers to the human beliefs, emotions, instincts and impulses that influence economic and financial decisions, both individually and collectively. The term was popularised by the British economist John Keynes in 1936. Keynes introduced the term to explain that financial markets and the real economy are not solely based on rational decisions and precise calculations, but are also influenced by psychological and irrational factors - the animal spirits - that can explain speculative bubbles or sudden collapses where decisions are not based on fundamentals but on herd behaviour or emotional reactions.

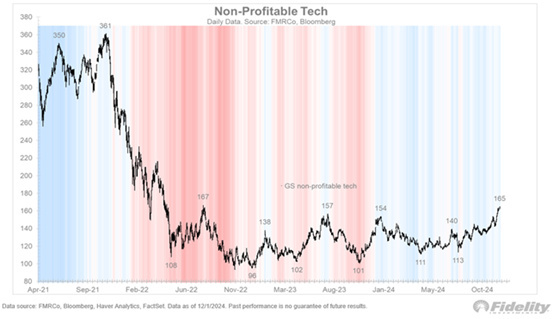

Well, even the animal spirits have moved to the more speculative side of the market, pushing unprofitable growth stocks further above 2022 levels.

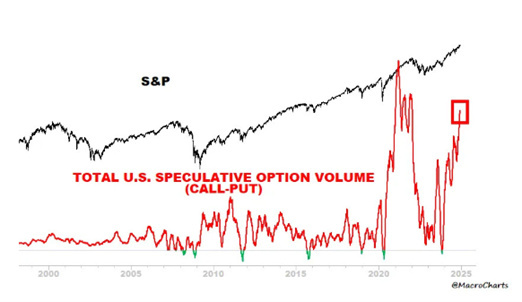

If we are allowed to push even bitcoin (always a good thermometer of euphoria in the financial markets) past the psychological threshold of 100,000 and also the speculative exposure of the options market to the extreme levels seen in 2021.

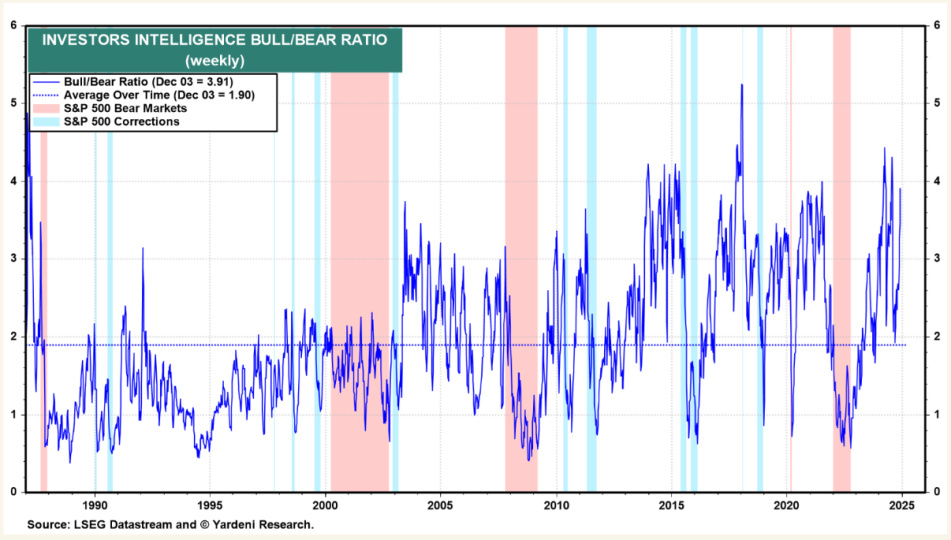

The return of animal spirits is also evident in other indicators such as the Investors Intelligence bull/bear ratio, which rose to an all-time high, with the percentage of bulls (i.e. positive investors in the markets) rising to 63%, near all-time highs, and the percentage of consumers expecting stocks to rise in the next 12 months, which reached a record high of 56.4%, surpassing the highs seen during the internet bubble.

Adding to the rally in equities, we also have a discourse on flows, with Treasury data showing that foreign investors have stepped up their purchases of US equities in recent months, again reaching an all-time high. This is not a good sign as historically foreign investors tend to chase rallies to highs, leading to the next correction.

It is also striking that credit spreads, and not just US credit spreads, are in many cases at their lowest levels for 25 years.

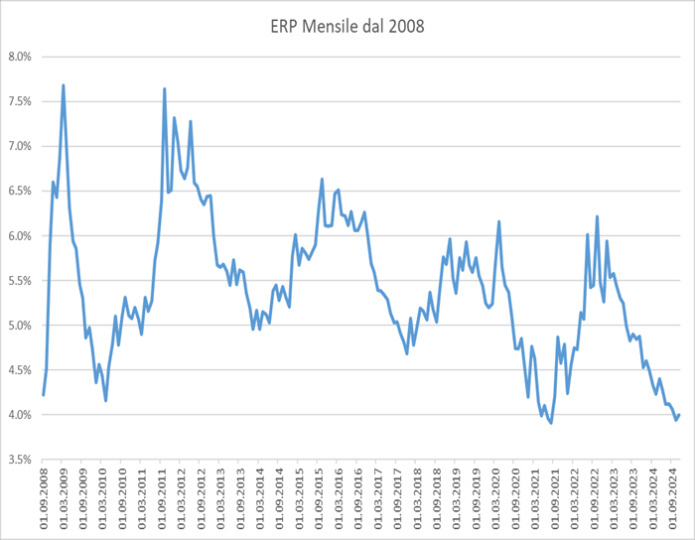

In conclusion: Even more significant and impressive is the chart of the equity risk premium in the US stock market, which is now at the same level as in 2021 and at its lowest level since 2008, with a lower level only reached in the years before the dot-com bubble of 1999. It took more than three years for the stock markets to collapse since then-Fed Chairman Alan Greenspan used the term "irrational exuberance" to describe the overvaluation of the markets in December 1996.

As always, valuations matter, but we know that markets can stay expensive for a long time, but when optimism and expectations get too high, it leads to increased risk in the markets. Indeed, history has shown that markets are always vulnerable to disappointment, especially when expectations are at the extreme of the upside.

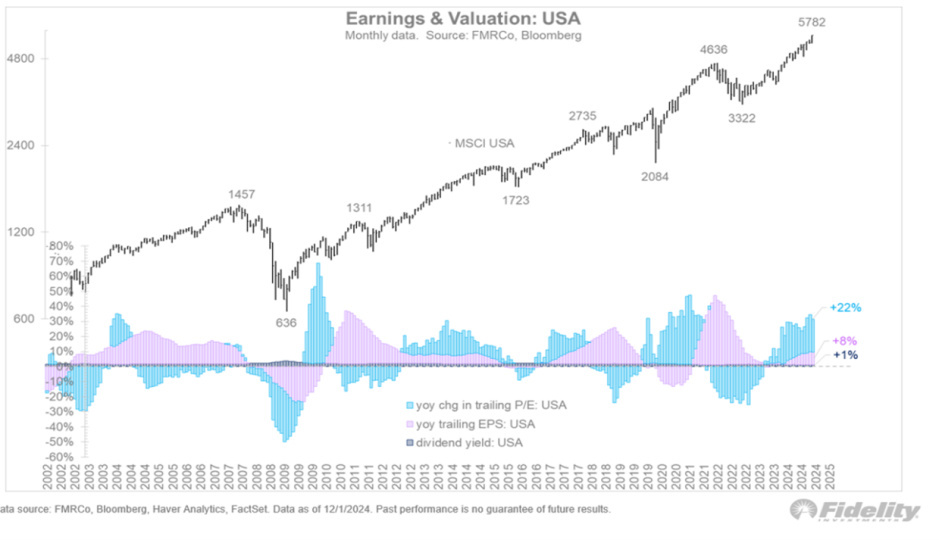

But how expensive is this market really, and has it gone too far?

One way of looking at market returns and assessing whether they are too optimistic is to break them down into their three components: dividends, earnings growth and changes in valuation multiples. Below we see that over the past 12 months dividends have contributed 1% of the return, earnings 8% and changes in P/E multiples 22%. Good earnings growth has been greatly enhanced by a significant widening of the multiple.

We have our doubts about the market's ability to repeat double-digit earnings growth and multiple expansion in 2025, but it is also true that the valuation overhang is concentrated in a few sectors (and in some tech stocks in particular) and that the earnings growth cycle, as we have long said, is healthy and probably only halfway through. Over-optimism could lead to a correction early in the year, but we continue to see opportunities in equities over the medium term, especially in several stocks that are trading at discounted valuations and have yet to recover from an earnings recession that has already occurred, making selectivity crucial for 2025.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.