Rischi di Recessione USA: Investitori Ottimisti sull’Europa

24 March 2025 _ News

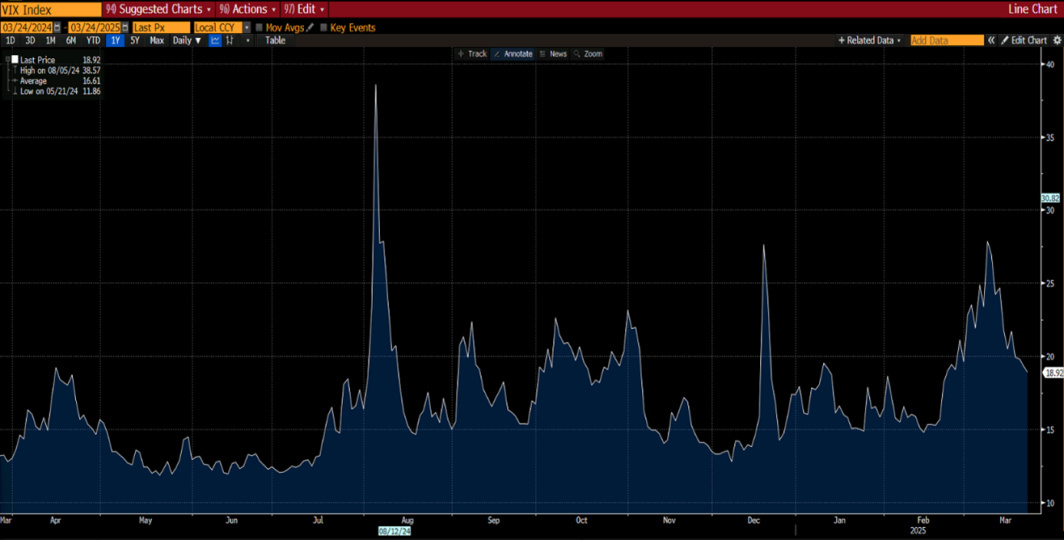

Markets took a breather during the week and against a backdrop of falling volatility, global equity indices closed marginally higher with virtually all equity sectors in positive territory. The bond world was also positive, with interest rates falling by around 5-10 cents in both America and Europe.

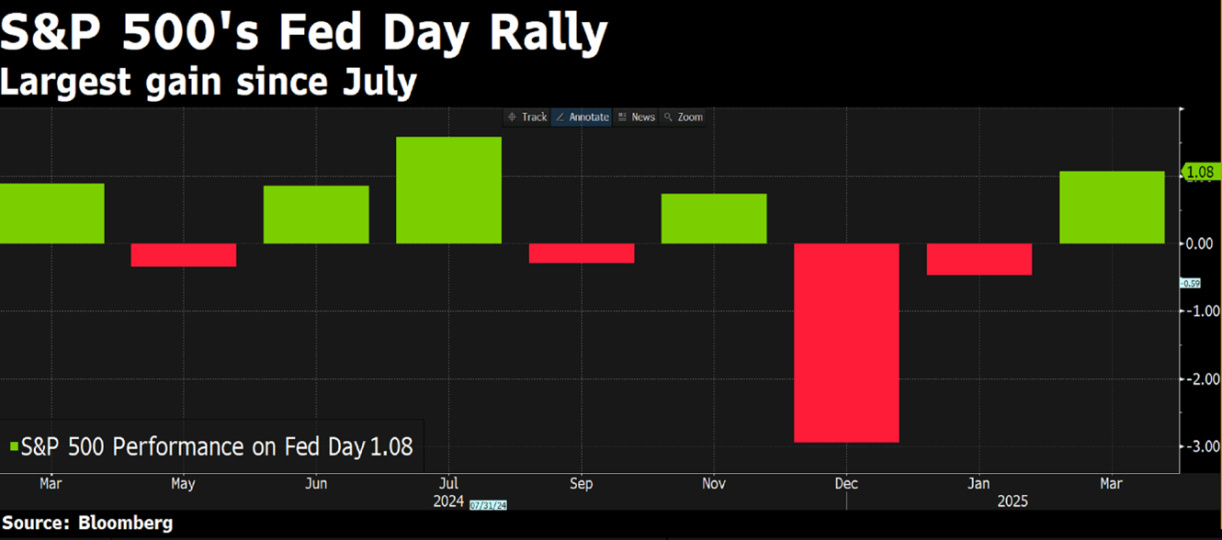

The undisputed star in the markets was not Trump, who instead reduced the number of his statements, particularly on tariffs, but Powell, with the FED expected to decide on interest rates. In his press conference, Powell uttered the word "uncertainty" no less than 16 times. And who can blame him? With the shadow of US tariffs looming and the reactions of trading partners yet to be written, the Fed is also navigating without a compass. So the FOMC's unanimous decision to keep rates steady between 4.25% and 4.50% for the second meeting in a row comes as no surprise. What really made the noise, however, were the new economic projections. Compared to its December estimates, the Fed lowered its GDP growth expectations for 2024 as well as for 2025 and 2026.

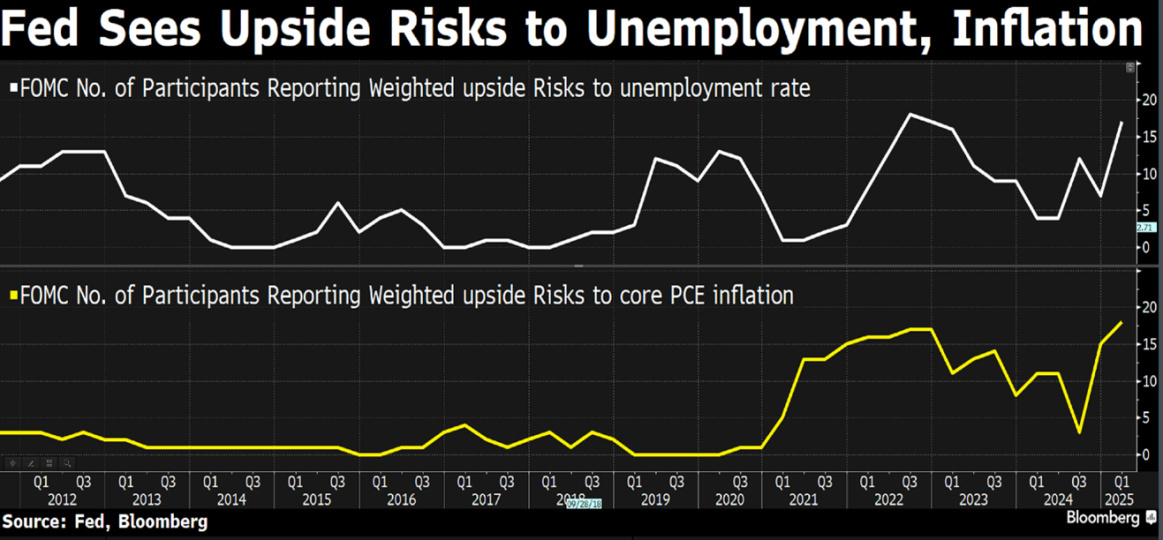

Not only is growth lower in the Fed's new projections, but the labour market looks more fragile, with the unemployment rate expected to rise to 4.4% by the end of the year, up from 4.3% just three months ago. A clear sign that the slowdown is starting to bite.

Complicating the picture are inflationary pressures, which could be affected in the coming months by the transitory effect of tariffs and the weak exchange rate, with the Fed closely monitoring the risk of medium-term inflation expectations slipping away from target, leading to talk of stagflation.

Powell reiterated that the central bank was in no rush to cut rates, but the market read between the lines an accommodative stance, with the Fed ready to intervene more decisively if needed. The median FOMC forecast remains for two 25bp cuts by the end of the year, in line with what market futures have already priced in.

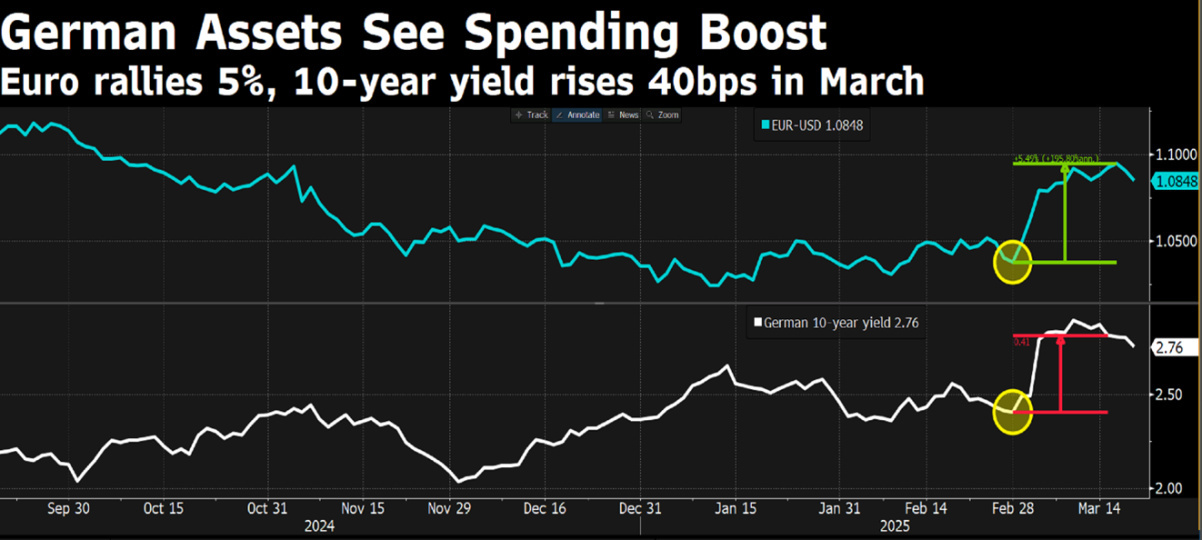

Meanwhile in Europe, February inflation came in slightly below expectations, but without triggering any major reactions in the markets. It is worth noting that during the hearing of the European Parliament's Economic and Monetary Affairs Committee, Lagarde for the first time gave explicit estimates of the impact of tariffs: according to the ECB's analysis, a 25% US tariff on European imports could reduce euro area growth by 0.3 percentage points in the first year, an impact that could rise to 0.5% in the event of European retaliation. The weight of the impact on economic growth would be concentrated in the first year after the tariff increase, but would then diminish over time, leaving a persistent negative effect on output levels, with the risk of a temporary acceleration in inflation of around half a percentage point, caused by the depreciation of the euro and the tariff response measures, which would be reversed as economic activity declines. In Europe, the narrative continues to focus on the announced gigantic stimulus and defence investment plan.

In this climate, suspended between slowdown and resilience, Wall Street bulls seem to be seeing glimmers of light after weeks of volatility, helped in part by a partial ceasefire in Ukraine, the result of a phone call between Trump and Zelensky, which improved overall sentiment. Bulls still believe (hope) that President Donald Trump will use tariffs as a bargaining tool to negotiate lower tariffs with America's major trading partners. Some of them are predicting that if this is not the case, Trump will back down in response to political pressure and a larger drop in equity markets. Bears, on the other hand, warn that the moment Trump backs down, the economy will enter a consumer-led recession and the stock market will fall well below current levels.

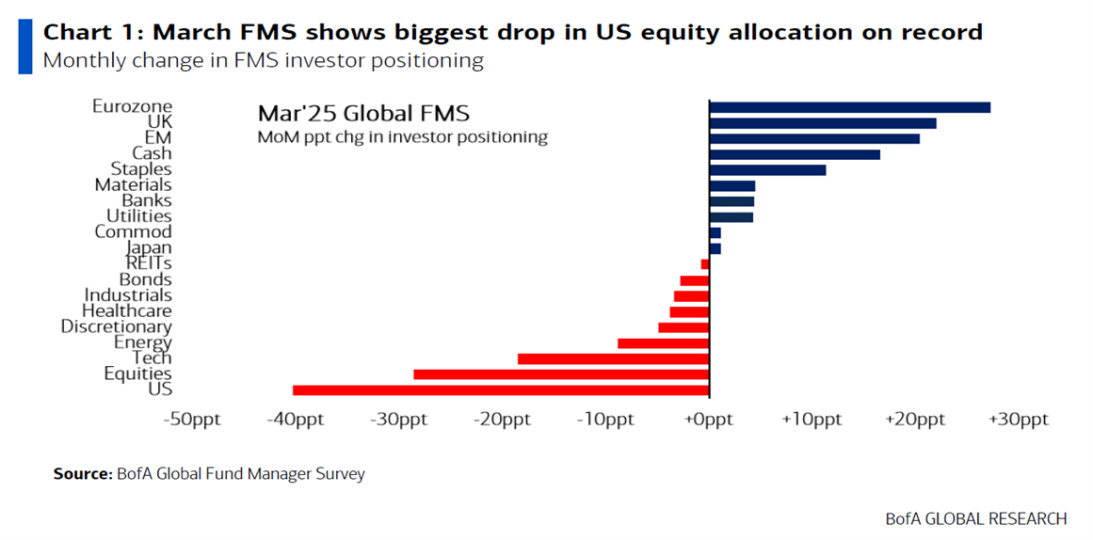

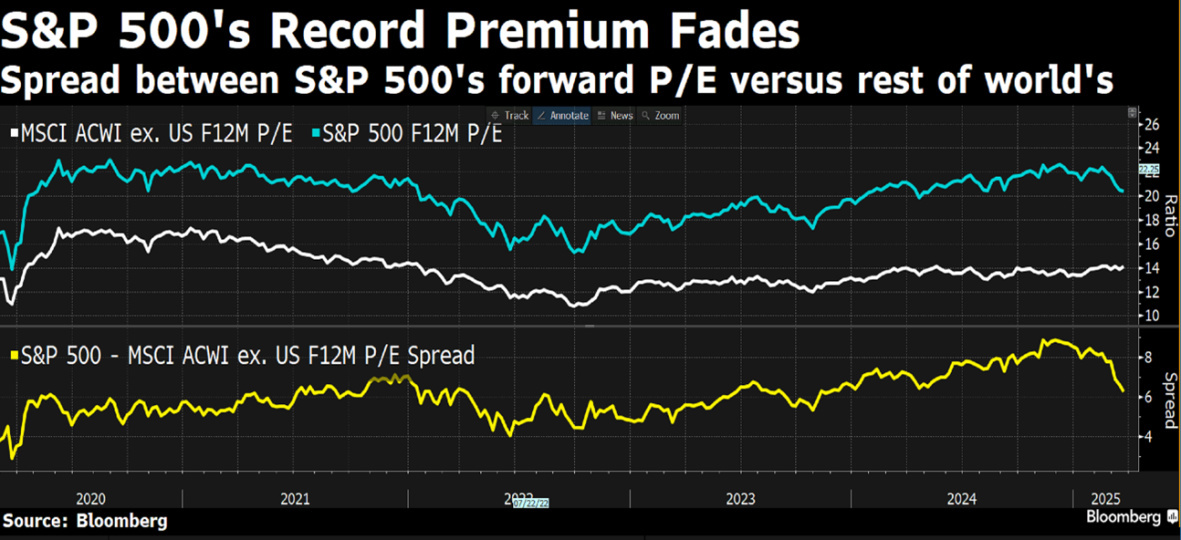

For now, the market narrative continues to suggest that economic growth outside the US is increasingly likely to improve, while downside risks to US growth are rising. It is no coincidence that Bank of America's fund manager survey in March showed the largest reduction in allocations to the US in favour of Europe, where managers now hold the highest allocation since July 2021.

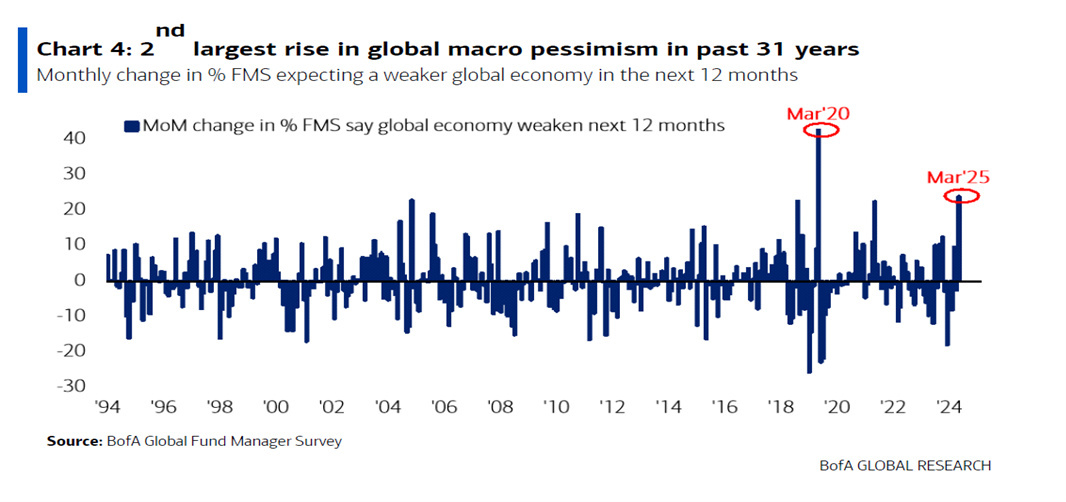

Conducted monthly by Bank of America, the survey of more than 200 managers with a total of around 0 billion under management is always very useful in understanding market sentiment and manager positioning. This month's key messages include an increasing deterioration in investor sentiment, with March showing the second largest monthly increase in macroeconomic pessimism on record, with 63 per cent of respondents expecting a weaker global economy over the next 12 months.

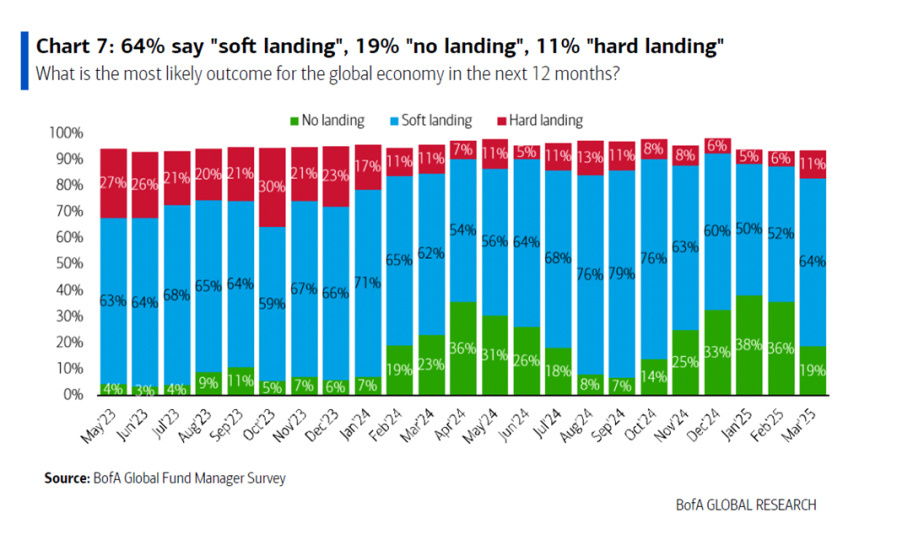

While the probability of a US recession has doubled to 11 percent from 6 percent last month, and risen to 20 percent from 5 percent last month, the managers expect three Fed rate cuts in 2025 instead of just two.

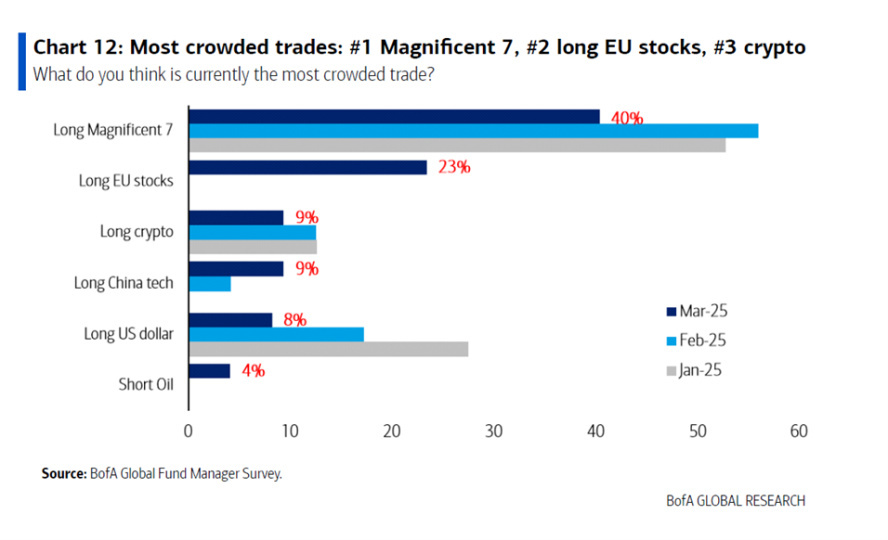

Fifty-five per cent of March FMS investors cite a recessionary trade war as the biggest tail risk to the markets, and finally a new consensus trade among managers is emerging, with 23 per cent of respondents being "long European equities", second only to the now standard "long the magnificent 7", which is still falling.

We need to remember that corrections occur when the stock market begins to discount a recession (economic and earnings) that does not occur, and is almost always due to a fall in multiples, while prospective earnings continue to rise (or at least do not fall). A bear market, on the other hand (we are talking about declines of more than 20%), typically occurs when there is a recession, causing both valuation multiples and earnings expectations to fall sharply, but for now we are only in the market correction phase and only time will tell. Many defensive stocks remain attractively valued and are already discounting significant downside, while some tech and growth stocks are starting to see multiples approach historical averages.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.