Redeeming markets: Optimism, inflation and valuations to watch

21 January 2025 _ News

It is a positive and risk-on week in financial markets, with both equities and bonds rising. The year 2025 started with a complex market dynamic, characterised by conflicting macroeconomic signals and volatility in both equities and bonds. A corrective start to the year, especially in the bond world, was contrasted by Wednesday, which was one of the best days since 2023 for balanced portfolios. This was thanks to government yields in both the US and Europe, which fell around 15 cents on the day from recent highs, while the equity market benefited from more benign macroeconomic data, particularly on inflation, and a solid start to the corporate earnings season.

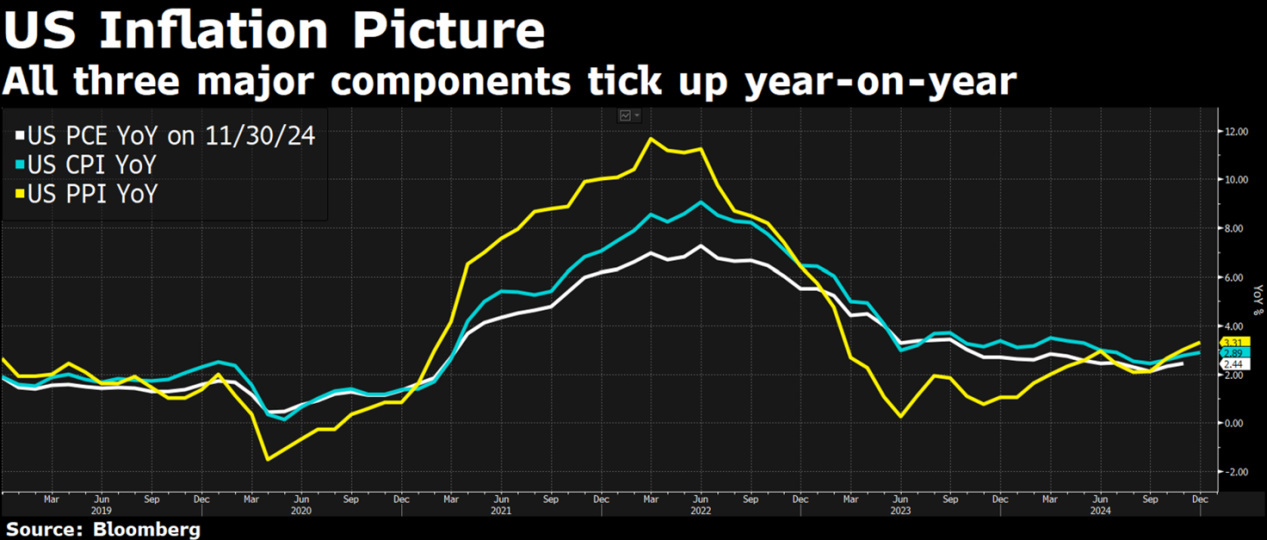

Indeed, inflation data in line with expectations was enough to provide relief and restore optimism to the markets. The most eagerly awaited figure, the US CPI for December, came in at 2.9%, in line with expectations.

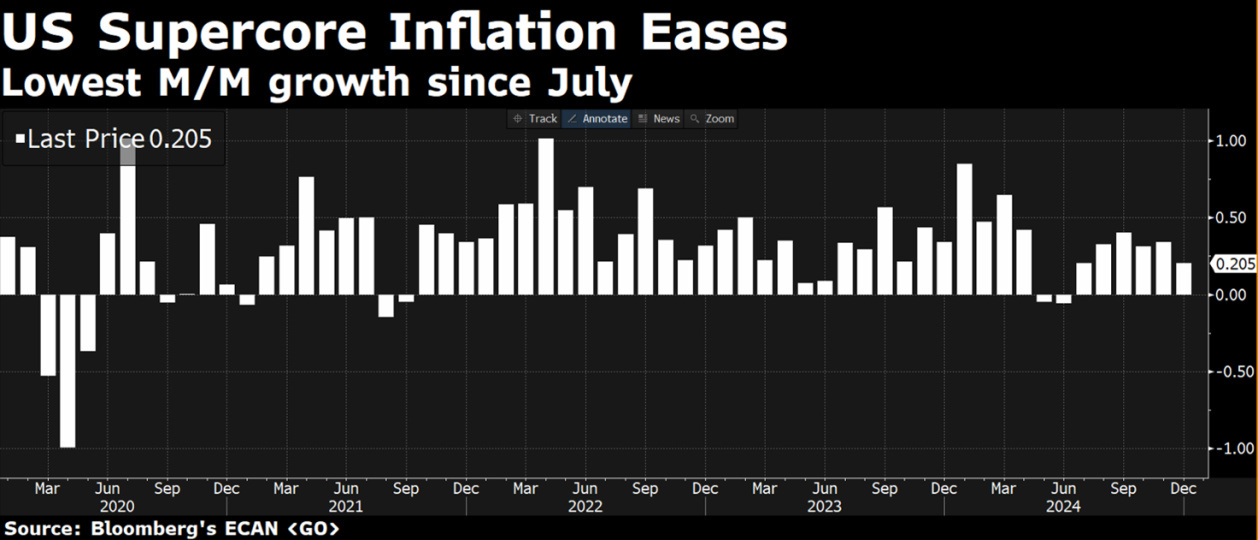

Core inflation, which strips out the more volatile components such as energy and food, also rose by 0.2% on a monthly basis, less than the 0.3% expected.

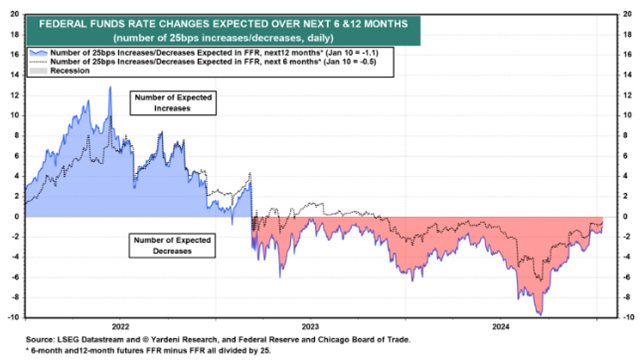

Also good was the data on rental inflation (which weighs heavily in the inflation index and has been very resilient in recent months), up 4.6% year-on-year, the smallest increase since January 2022, as well as production cost inflation, the so-called PPI, which was also below expectations. The UK also reported good inflation data. All this helped to push interest rates lower and the market to revise its year-end expectations, with the probability of a US rate cut in Q2 now estimated at 50% and almost two cuts by the end of the year.

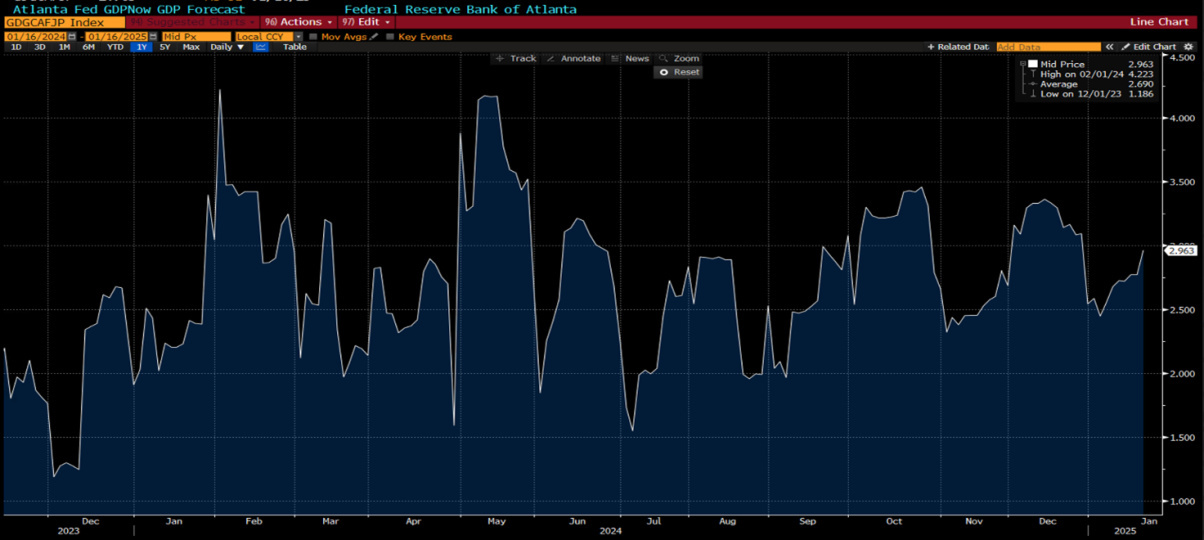

In addition, the Federal Reserve's Beige Book showed a moderate increase in economic activity between November and December, with consumption solid over the Christmas period and the labour market remaining resilient. Overall, US economic growth remains strong, with the Atlanta Fed now forecasting fourth quarter GDP growth of close to 3%.

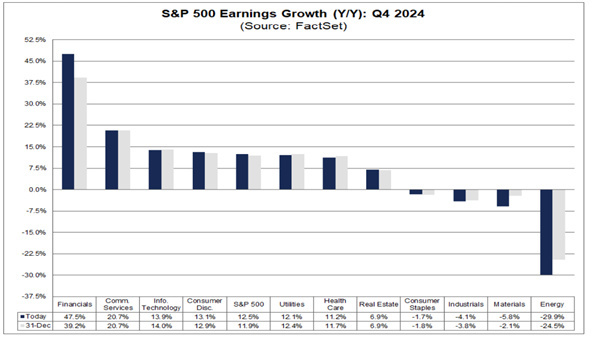

The health of the US economy continued to shine through in the earnings season that has just begun, and it did so in a robust way, with the major US banks reporting better-than-expected results. Citibank, JPMorgan and Goldman Sachs all beat estimates, showing growth in capital markets revenues and a still supportive credit environment.

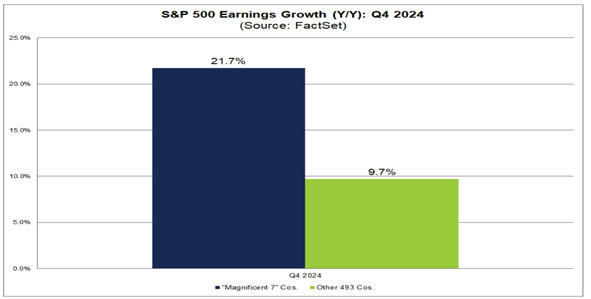

This week, and especially next week, the reporting season will be in full swing and we will see if analysts' expectations are confirmed. For the fourth quarter of 2024, analysts expect US earnings growth of 12.5%, which, if confirmed, would be the highest earnings growth since the end of 2021.

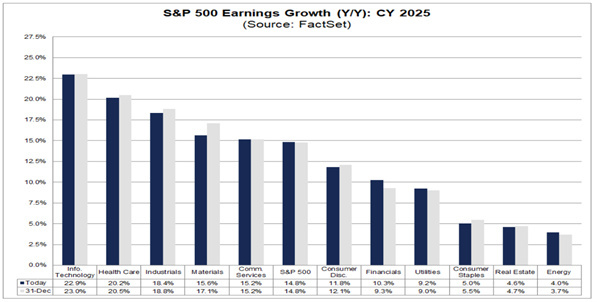

This growth is expected to continue through 2025, with annual growth of 15% expected, well above the historical average, with a particular focus on the technology and finance sectors.

Among the stocks where growth expectations remain very high are the 'Magnificent 7', with a concentration of both growth expectations and valuations that raises concerns about the sustainability of such performance.

Interestingly, the market regained some breadth last week, with technology underperforming and some sectors such as energy, utilities, materials and financials lagging. Of particular note in Europe was a good report from Richemont, which rose almost 20% after the results were released, refocusing attention on the European luxury sector, which had accumulated a lot of negativity and is a candidate to outperform in 2025.

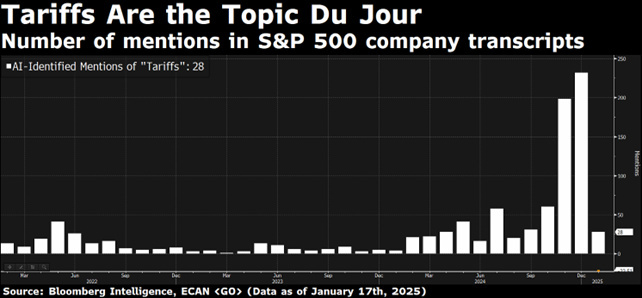

The year 2025 will be particularly uncertain, with unknowns and sudden narrative shifts in the markets, both on the trajectory and speed of central bank rate cuts and on fiscal policy or the implementation of tariffs. The market will also have to prepare for Trump's inauguration and his statements, with possible repercussions also on the geopolitical level.

Valuations are another key element in understanding the current complex market environment. The S&P 500 trades at 21.5x earnings, well above its historical average, with the top 10 stocks in the index, representing almost 40% of market capitalisation, trading at an average of 30x earnings, a level that can only raise questions about their sustainability.

From a global perspective, US equities continue to trade at a significant premium to international markets, while European equities trade at a 40% discount to P/E ratios. The valuation premium that the US deserves is unquestionable, but as the year progresses some European sectors, such as the aforementioned luxury sector, may also offer investors satisfaction and, in any case, the opportunity to diversify portfolios in a quality sector that is experiencing one of the worst earnings recessions and multiple compressions in recent history.

In addition, bond yields, although characterised by volatility, are moving towards normalisation, creating the conditions for very attractive yields and allowing bonds to be bonds again, i.e. to be a valid income component in balanced portfolios, where we believe it is worth pushing medium to long-term duration by accepting short-term volatility.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.