Prices and incentives: navigating the market storm

11 March 2025 _ News

The past week was characterised by volatility in the markets, and offered a mix of financial and macroeconomic events with significant impacts on market dynamics.

In theory, markets should move according to fundamentals: economic growth, corporate earnings, monetary policy. In practice, these are days when logic is set aside and investor sentiment and emotion dominate the scene, driven in particular by statements from Trump and the German Chancellor.

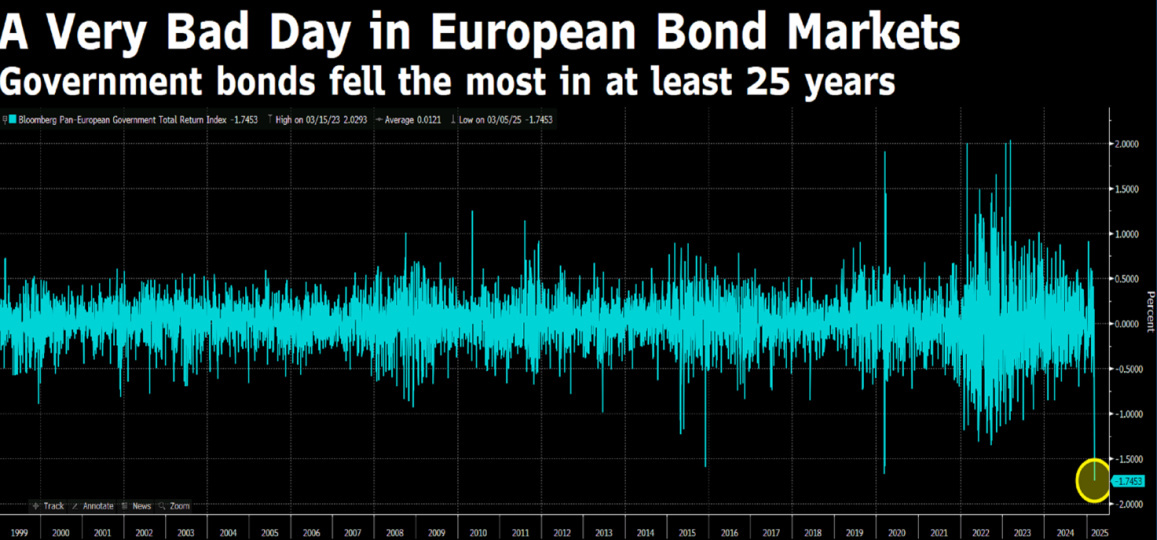

In this phase of the market, it is not the real value of a company that drives the market, but the expectations that investors create for themselves by absorbing the various and contradictory statements of politicians in a very short period of time. This is the market where fundamental analysis is worth less than a post on social media, and where great rationality is required. As a result, global equity markets ended the week down around 1%, with China and Europe continuing to outperform, but the real shocks came from the world of government bonds, especially Europe.

Let us look at what is happening in detail.

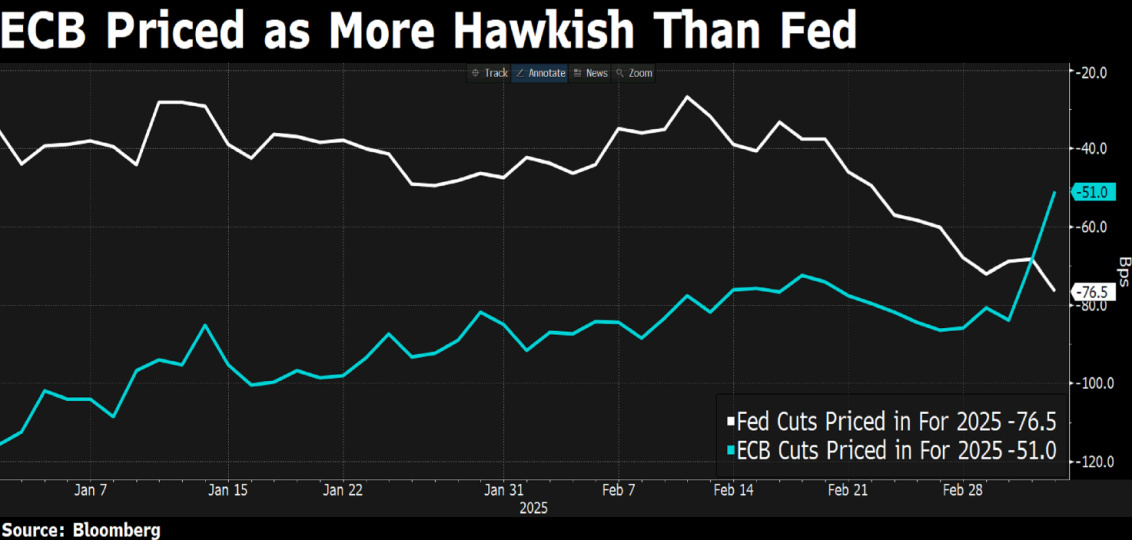

The European Central Bank decided, as expected, to cut interest rates by 25 basis points, bringing the deposit rate down to 2.50%, the sixth cut since last June. However, the ECB's statement was more cautious than expected, stressing that interest rates have now become "significantly less restrictive", while reiterating a data-dependent approach. In addition, a marked increase in uncertainty was highlighted, suggesting that future monetary policy decisions will be closely linked to developments in the macroeconomic environment.

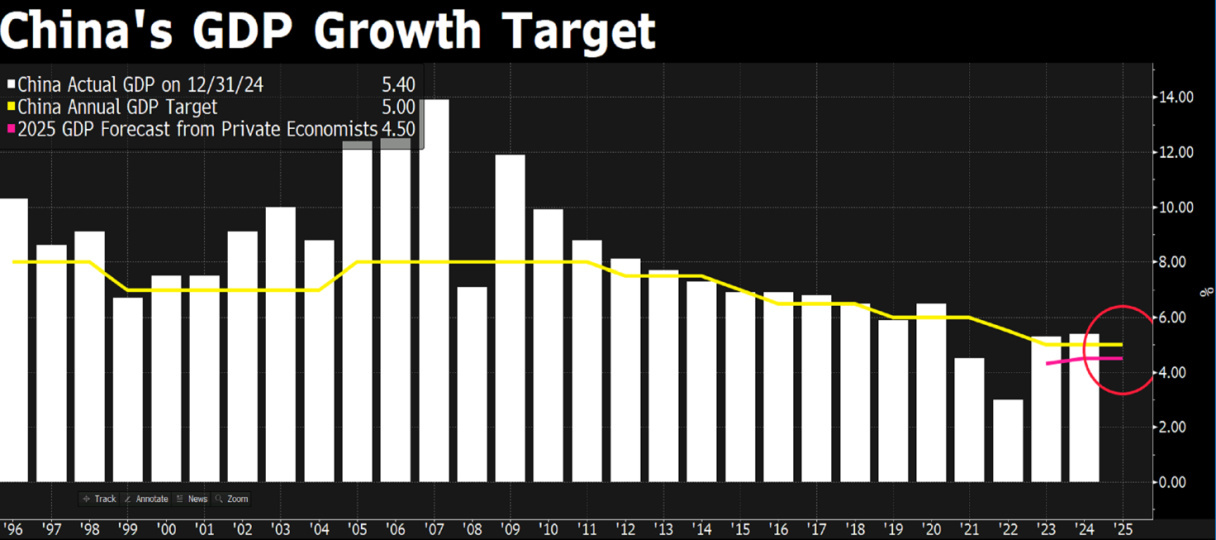

If the ECB was cautious, the real breakthrough came from Germany. The new chancellor-designate, Friedrich Merz, announced an unprecedented fiscal revolution, breaking with traditional German budgetary rigour and setting the stage for a paradigm shift in the European Union by announcing a fiscal stimulus plan of historic proportions, which the market has already dubbed 'whatever it takes' or the 'German fiscal bazooka'. The plan includes EUR 500 billion in infrastructure investment over the next ten years (1.2 per cent of annual GDP) and an increase in defence spending, with a budget of EUR 800 billion that would be exempt from the constraints of the debt brake. All this will be combined with a loosening of fiscal constraints on state and local governments to stimulate growth. China has also announced its intention to increase the budget deficit to 4% of GDP in order to stimulate its economy, which is expected to grow by 5% this year.

All expansionary fiscal policies financed by debt. In yet another example of how quickly market narratives can change, only a few weeks ago the most expansionary fiscal policy was expected to come from the US, which instead adopted a policy of mainly spending cuts for the time being, which was reflected in a divergence in government bond yields (down in the US and up in Europe), exactly the opposite of what the market consensus was expecting.

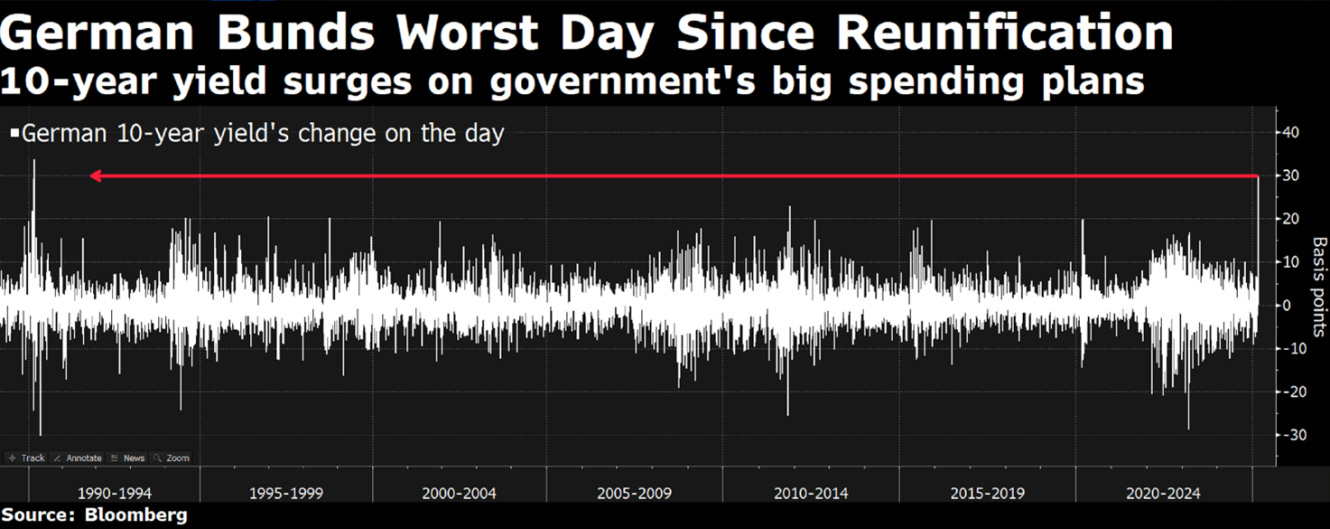

The market reaction was immediate and violent: European equities were celebrating what should have been one of the most impressive investment plans ever announced, and instead the yield on the 10-year Bund shot up 30 basis points, a daily change not seen since 1990, all on fears of new debt creation.

This momentum was also reflected in the euro, which strengthened to over 1.08 against the dollar, a sign that investors see this move as a potential turning point for European growth.

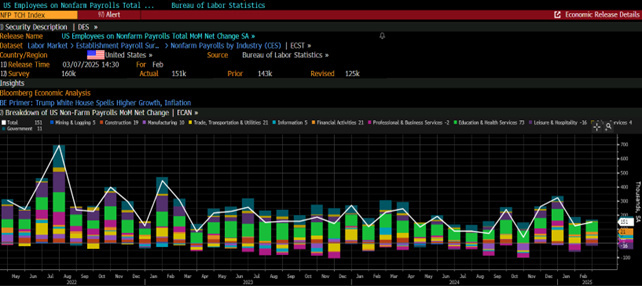

On the other side of the Atlantic, uncertainty prevails. The labour market is showing signs of weakening: the ADP reported a sharp slowdown in hiring, suggesting that the US economy may be entering a cooling phase. In contrast, February's non-farm payrolls data were in line with expectations, while the unemployment rate rose slightly, suggesting that the labour market is stabilising after a period of sustained growth.

Powel also returned to speak in New York, where he struck a reassuring and optimistic tone in contrast to the uncertain investor sentiment. However, he gave no concrete indication of the Fed's next moves, leaving the market waiting for clearer signals on future monetary policy.

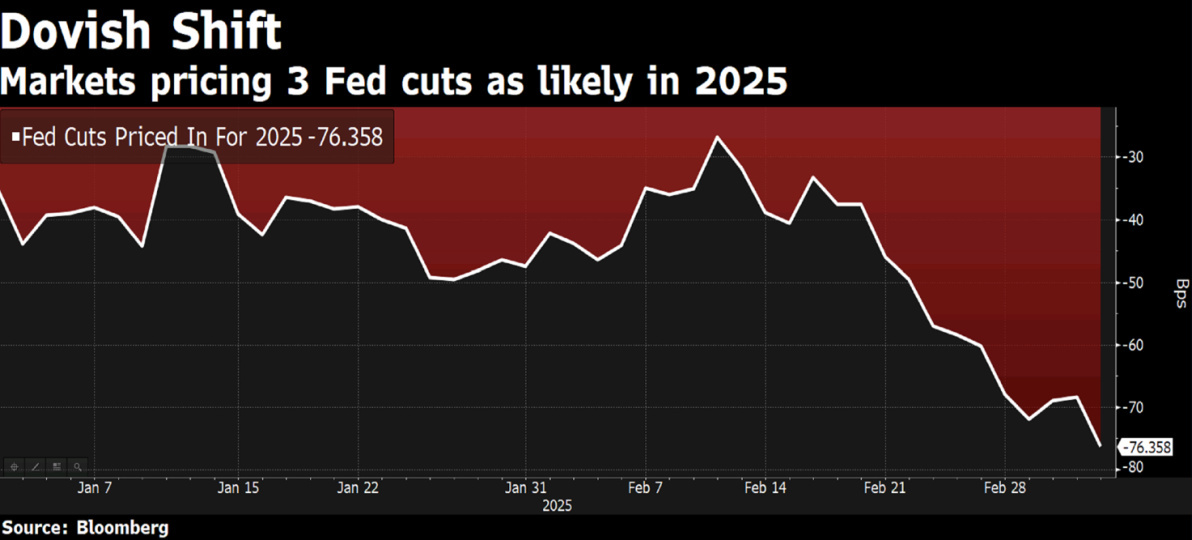

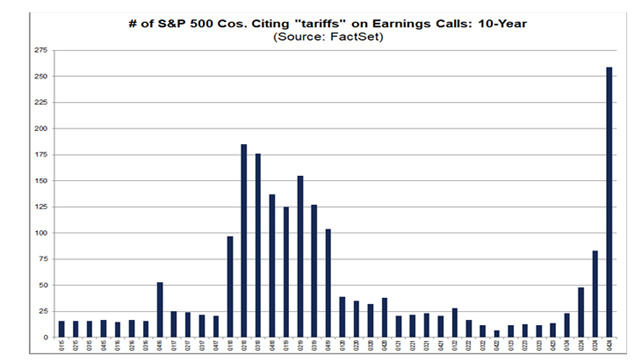

Wall Street analysts are beginning to consider a scenario in which the Trump administration could deliberately push for a controlled recession in order to bring back inflation and get the Fed to cut interest rates more aggressively. Tariffs and their impact are increasingly being talked about, and the term "tariffs" is often used during companies' conference calls with analysts when commenting on quarterly results.

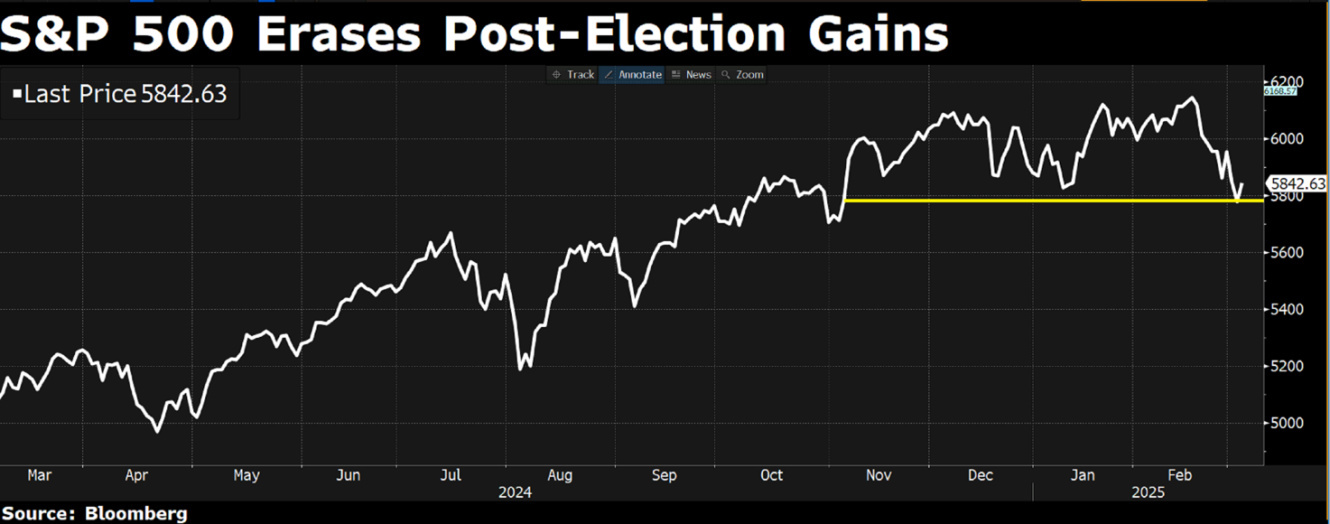

Warren Buffett recently likened the tariffs imposed by the US to a veritable "tax" on American consumers. Buffett's point is simple but powerful: when the government imposes tariffs on imports, the cost is not passed on to foreign companies, but directly to consumers in the form of higher prices. This means that instead of hitting foreign economies, tariffs end up hitting Americans' wallets, making goods and services more expensive, leading to inflation and slowing consumption and economic growth. The 10-year Treasury rose to 4.32%, a sign that the market is pricing in more uncertainty over monetary policy. The S&P 500 and the Nasdaq experienced days of high volatility, with moves above 1% for five consecutive days and the Nasdaq below its 200-day moving average.

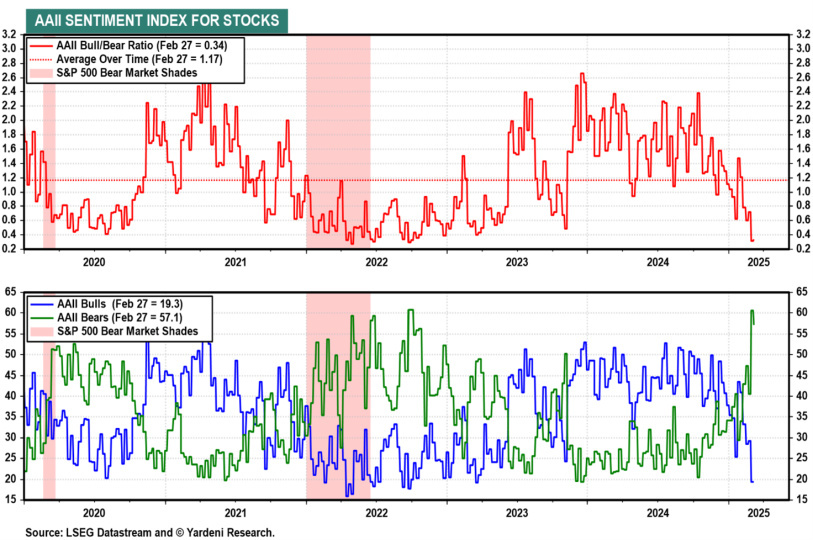

The good news is that several sentiment indicators are already at lows last seen in the bear market of 2022, while equity indices are in a marginal correction of less than 10% from their highs.

Such negative sentiment is statistically associated with market rallies or rebounds, so it can be viewed positively from a contrarian perspective. On the other hand, the market correction has been more than healthy so far. What is really important is that the picture of the earnings growth cycle is not changing. We have commented several times in recent weeks that estimates were a little too high and that US valuations in particular were the most expensive of all valuation averages.

The causes of corrections are always different, but when valuations are high we need to be prepared for a healthy retracement that brings them back to more reasonable levels.

When markets experience this volatility, it is important to be able to insulate oneself from short-term noise and understand the true underlying dynamics of the market. If the correction is driven by a potential structural change in the earnings cycle, then it could be the beginning of a bear market, and in my experience all bear markets are born that way. If, on the other hand, as seems to be the case today, the correction is more related to some sort of normalisation of the multiple and a scaling back of high growth expectations, then the declines may turn into buying opportunities, knowing that valuations are still around 21 times PE compared to the average of 19 over the past 10 years.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.