Perspectives 2025: Quarterly and Artificial Intelligence

11 February 2025 _ News

The markets put the recent turbulence behind them, first with Deepseek and then with Trump's first announcements on duties, and amid rising profits and easing in the bond world, they also closed the first week of February on a positive note. In fact, statistically speaking, we can say that rises beget more rises, and after a January that closed positively for global equity indices with rises of 3.5%, the bullish market's resilience could continue

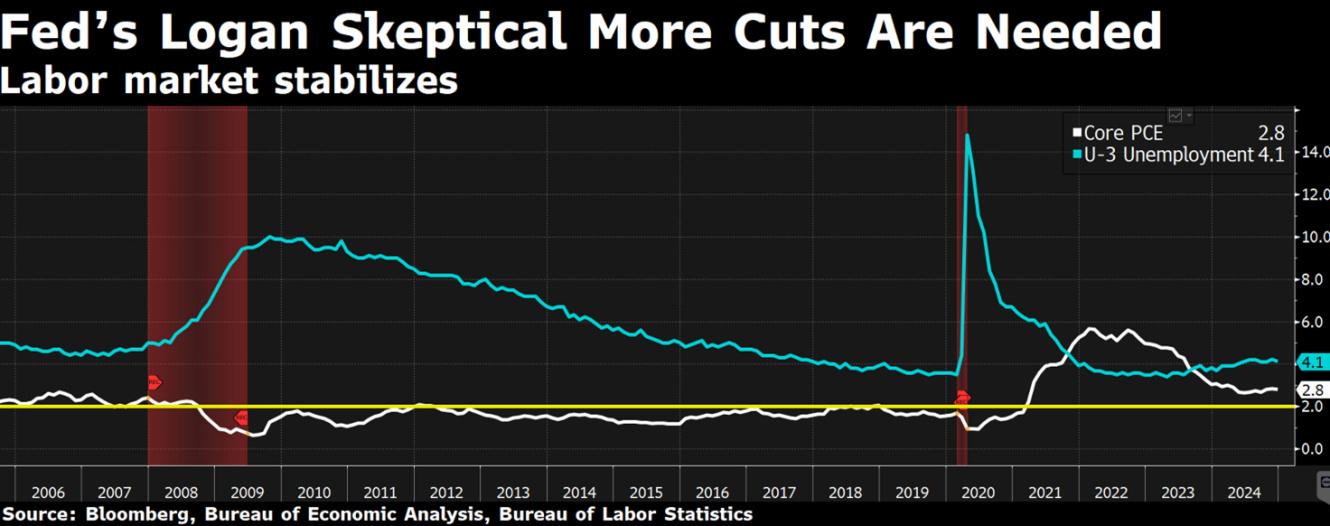

At the macro level, we had some data, such as non-farm payrolls and the unemployment rate, that showed a slowing but still resilient labour market. The employment data is always a risky event for the markets, but it is unlikely to change the Fed's stance on monetary policy in the short term after Powell reiterated that he and his colleagues are "in no rush" to cut interest rates further.

Expectations of one or two US rate cuts by 2025, implicitly priced in by the market, are already very low and perhaps leave more room for surprises in the form of further cuts than the opposite.

On the bond front, Treasury yields fell slightly this week.

Scott Bessent's debut as Treasury Secretary attracted a lot of attention, but his first quarterly Treasury issuance announcement turned out to be a non-event for the markets. Bessent had previously criticised the excessive use of short-term Treasuries to finance the federal deficit. Many investors feared that he would introduce more long-term bond issuance, which would push up yields and weigh on the markets. However, Bessent confirmed that issuance would remain unchanged over the coming quarters, providing some stability to the market. As a result, the 10-year Treasury yield fell to 4.43%, its lowest level since the Federal Reserve's last rate cut in December.

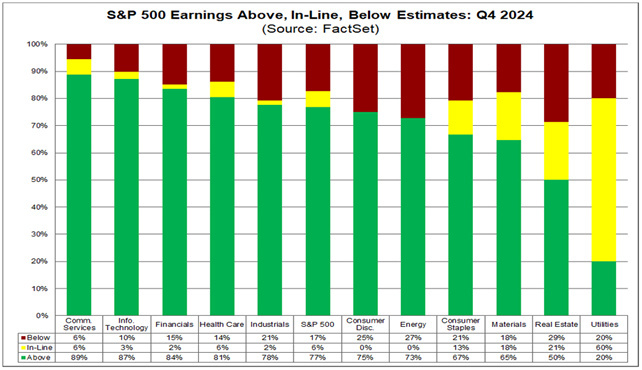

The quarterly earnings season is now in full swing and the results released so far point to a solid corporate environment. Some 300 companies in the S&P 500 have already reported and 77% have beaten estimates, with average growth of 10%.

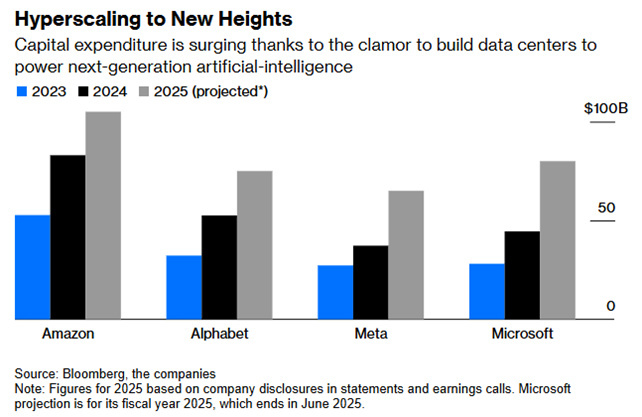

Of all the companies that reported, Amazon, which fell slightly short of its guidance, and Alphabet, the parent company of Google, which saw its shares fall by 7% after the results were released, are worthy of mention. This is because the company announced much higher investments for 2025 than analysts had expected. Alphabet will spend billion on CapEx in 2025, mainly to develop its artificial intelligence business. This is 30% more than analysts were expecting. The other US tech giants are also planning to spend on artificial intelligence infrastructure this year, with Microsoft, Meta and Amazon announcing billion, billion and 5 billion in capex respectively, in contrast to the Chinese announcement from Deepseek, which promises much more affordable AI developments.

Many investors, meanwhile, have become sceptical that AI profits will justify the huge expenditures of large technology companies, and this is weighing on the relative performance of the tech sector, which is beginning to underperform. The topic of AI capex and profitability will remain a focus for the coming quarters.

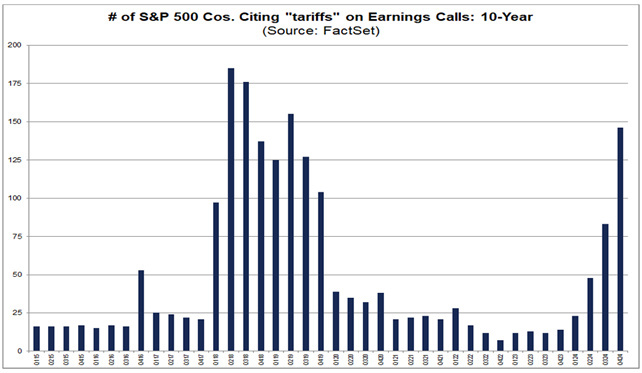

Among the topics we can list as the most debated during the conference calls commenting on the quarterly results we have Tariffs, in fact 146 companies mentioned ‘tariffs’ during their comments, with many companies that although they have not yet undertaken any solutions are very careful about their plans to adapt to potential policy changes under the new administration.

Many companies also highlighted the negative impact of the strong dollar, another much-discussed topic, especially among exporting companies or those with more global revenues. Then, of course, there is AI, with many companies continuing to express enthusiasm for AI in their Q4 earnings calls, with some highlighting how AI has led to improvements in internal efficiencies and for their customer base.

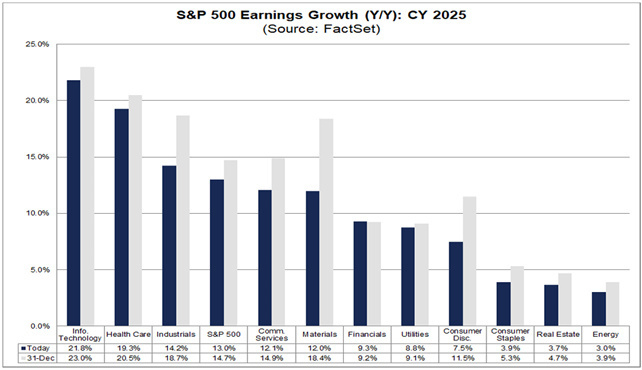

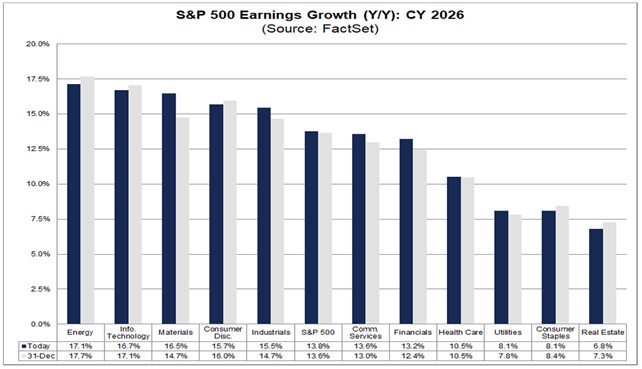

These quarterly results have boosted investor confidence in the ability of companies to create value and are fuelling optimism for the quarters ahead, with market consensus now expecting earnings growth of 13% in 2025 and 14% in 2026.

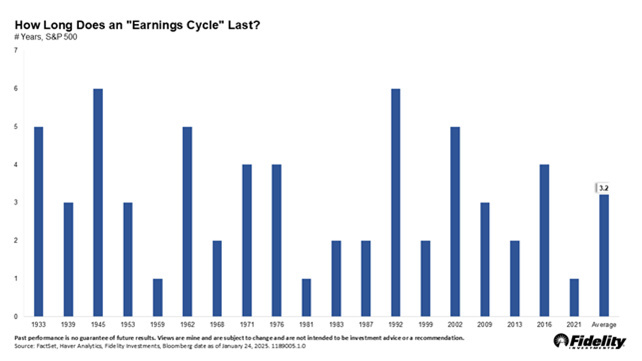

These are earnings growths above historical averages but which the market has already been able to realise in several previous earnings cycles. They are therefore expected growths that perhaps leave little or no room for an upside surprise, but are not impossible to realise. Analysing all the earnings cycles since 1933 we can conclude that usually an earnings cycle lasts between 1 and 6 years with an average of about three and a half years.

Although no cycle is ever truly ‘typical’, history teaches that most have a capacity for continuation once they begin. Moreover, even as cycles mature, earnings still tend to grow, albeit at a decelerating pace, and being now only in the second year of the cycle this suggests that we may just be at the beginning of a phase of sustained earnings expansion.

US companies continue to dominate the international landscape, thanks to sustained earnings growth and more generous redistribution policies towards shareholders, including dividends and share buybacks. This trend explains why US valuations remain high compared to the rest of the world: the forward P/E of the S&P 500 stands at 22.2x versus 13.7x for other markets. However, as long as earnings growth remains solid, high valuations do not seem to be a problem for investors.

Despite uncertainties in some sectors, the general climate among US companies is positive. Since the presidential election, many companies have announced ambitious expansion plans, with investments aimed at improving productivity and increasing employment.

These signs suggest that confidence in the business cycle is still solid, with a possible positive impact on markets in the coming months. Historically, when companies increase investment in growth and innovation, the economy tends to benefit from a multiplier effect, with a positive impact on employment and consumption.

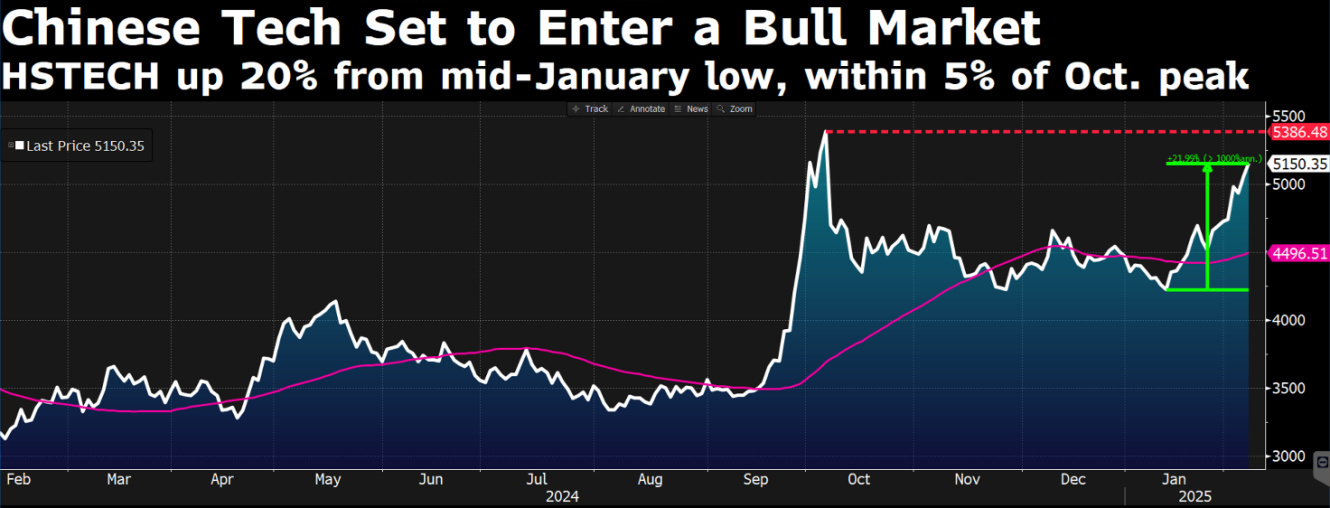

Little is still being said about Europe's outperformance and no one is talking about the +7% recorded by the Chinese tech sector, areas where in the general silence the valuations could potentially leave room for significant returns with investors having to keep their focus on earnings, valuations and monetary policies to best navigate this changing environment.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.