June 2024: The opportunities for the second semester

27 June 2024 _ News

Euphoria and Fear: the Sirens of AI

The first half of the year ends with a stock market split in two. On the one hand, large technology companies with exceptionally positive performances where valuations reached very dangerous levels, on the other hand, companies characterised by traditional businesses, some even more than a hundred years old, with truly interesting valuations seen few times in history. This market polarisation has been driven by expectations about Artificial Intelligence (AI).

We believe that Artificial Intelligence is certainly a revolutionary event, but we would like to remind you how euphoria is very bad for the investor through some historical examples. The first example, which also gives the article its name, is that of the 1849 California Gold Rush. In fact, the comedian Mark Twain, thinking back to the gold rush, summarised the historical episode with that quotation, which highlights how very complex it is to get rich in an industry that is on everyone's lips precisely because the increased competition combined with the uncertainty of the business does not provide the investor with a solid foundation. In fact, analysing the period of the gold rush, it emerges that it was the merchants who sold shovels, rather than the gold diggers, who got rich, hence those who sought the certainty of need in the uncertainty of business. In a way, a similar situation seems to have arisen today.

The race to AI, with all the benefits it will have, can be compared to yet another case of euphoria in the markets driven by uncertain expectations, especially considering that the possible monetisation of the business and the growth that this market will be able to achieve is not yet clear to everyone. Suffice it to say that the last revolutionary episode, the introduction of the Internet in the late 1990s, had, as in this case, greatly increased the euphoria only to normalise in the following years when the monetisation of the business was clearer. The market pendulum always tends to create euphoria in one part of the market and extreme fear in another part. In this case the fear and depression was created on very solid businesses, which have been around for more than a hundred years. For these reasons we believe that the investor must do as Ulysses did, not listen to the sirens of AI but follow rationality.

Equity

Profits

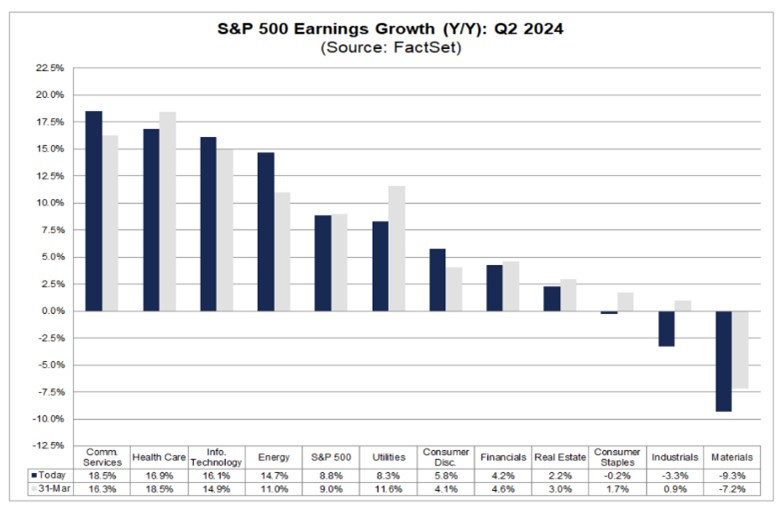

In the coming weeks, the earnings season begins. US second quarter earnings growth expectations are +8.8%, with +11.3% expected for 2024.

Looking at earnings growth by sector for the second quarter, we see that growth is expected to be led by the communication - health care - tech and energy sectors. The worst sectors expected to report earnings are materials and industrials.

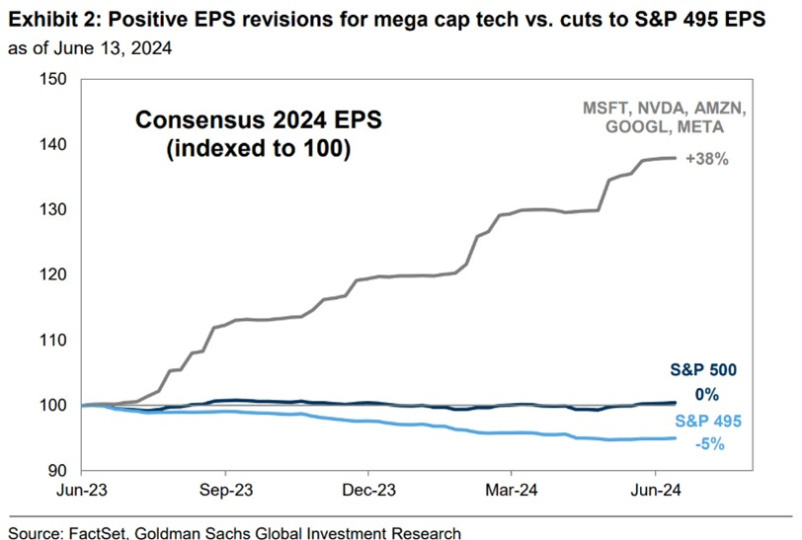

Furthermore, if we look at the earnings revisions, we see that excluding BIG tech, the market has negatively revised earnings growth by about 5%. This shows us how the weight of interest rates is being felt on corporate earnings.

Stock valuations

Artificial Intelligence is creating market imbalances that are clear when analysing valuations.

- Extremes::

- Firstly, the price-to-earnings ratio of the technology sector reached 31x, a level only seen in 2001.

- Rising valuations in the technology sector, linked to technology's increased weighting in the S&P500 to 31%, took the PE of the S&P500 to 21.3x, 25% above the average levels of recent years.

- Different discussion for:

- The US equated market remains at an average valuation of 16x PE, highlighting how if you get out of the big companies you can continue to find interesting opportunities.

- Small US companies, as measured by the Russell 2000, are below the average PE value, highlighting the attractive valuation.

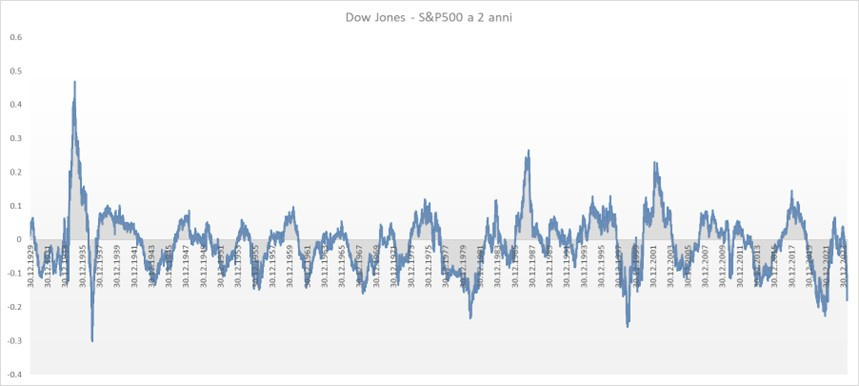

- If we also analyse the underperformance of the Dow Jones against the 2-year S&P500, we see that we are on a level seen few times in history:

The polarisation of valuations underlines how the US economy is experiencing a slowdown that is affecting all companies to some extent, with the exception of big tech, which continues to be buoyed by expectations of an artificial intelligence revolution. We too believe that there will be a revolution but, like all revolutions, it takes time and today, perhaps, expectations are a little too high.

Equity Sectors

We continue to prefer companies in traditional sectors that have strong discount valuations. Within these sectors we find companies that are more than one hundred years old and have experienced several revolutions, wars and recessions, and therefore we believe that they will not be replaced by this new revolution. We are talking for example about:

- UPS: leading American logistics company founded in 1907

- Brown and Forman: leading American wine and spirits company (famous for whiskey) founded in 1870

- Pfizer: American pharmaceutical company founded in 1849

- Hershey: leading chocolate company founded in 1849

- 3M: American multinational company founded in 1902

Bond

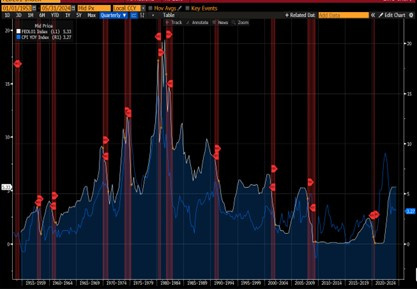

The inflationary excess was managed by an opposite excess on rates. The market pendulum continues to swing for fear on interest rates: the market narrative remains inflation-focused and is still struggling to take notice of the economic slowdown. As we see from the chart opposite, every time inflation has risen (blue line), the Fed has raised interest rates (white line) and this has led to a reduction in growth, as evidenced by the red lines representing recessions.

That said, the ECB and the SNB have started to cut rates, so we expect the Fed to start down this path as well.

Government

On the government side, history teaches us that high rates lead to a slowdown. This is why we continue to prefer government bonds.

Corporate

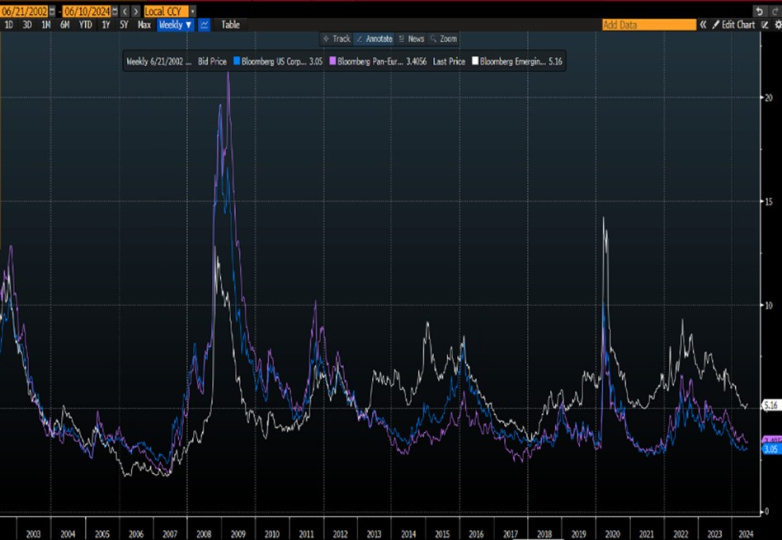

On the corporate bond side, we continue to believe that the current spreads do not provide investors with the right margin of safety.

Conclusion

In conclusion, every euphoria in the market creates fear in another part of it. Today the euphoria is in technology and the expectations are in Artificial Intelligence. This has brought fear on solid businesses, which have also been around for more than a hundred years, for which artificial intelligence represents yet another revolution that they will overcome and this represents a great opportunity on equities.

On bonds, on the other hand, we believe that we must continue to be patient. Corporate and economic numbers will naturally only slow, and Central Banks (like Switzerland) will have to intervene. But, as always, to fill an excess of inflation they are forced to create an excess on the other side by keeping rates high. Only in several months will we notice the slowdowns, which will be inevitable.

To face the coming months, we believe that the investor must make like Ulysses and not be lured by the sirens of AI but continue to follow value and rationality to avoid being disappointed by the market pendulum.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.