Growing Europe: The numbers you can't miss

18 February 2025 _ News

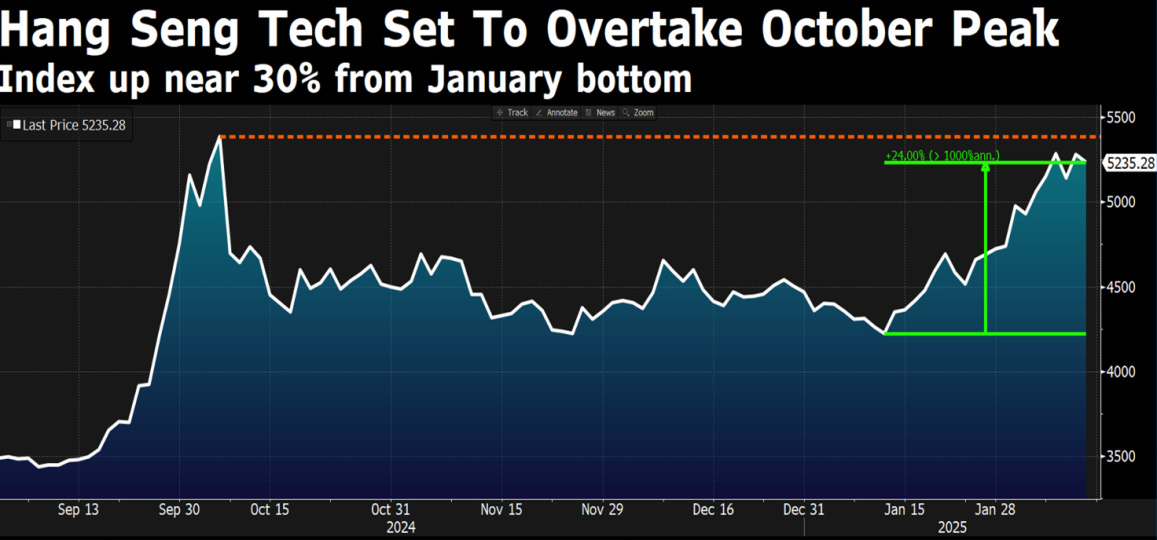

Financial markets are focused on four main issues: inflation trends in the US, Donald Trump's new trade policies, the evolution of bond yields and, of course, the earnings reporting season, which is also in full swing in Europe. The mix of these factors is influencing expectations for interest rates, economic and earnings growth and the Federal Reserve's monetary policy. Global equity markets are approaching all-time highs, led by Europe and China's technology sector, both up more than 10% and 24% respectively since the start of the year, while interest rates are trading between highs and lows at the same levels as last week.

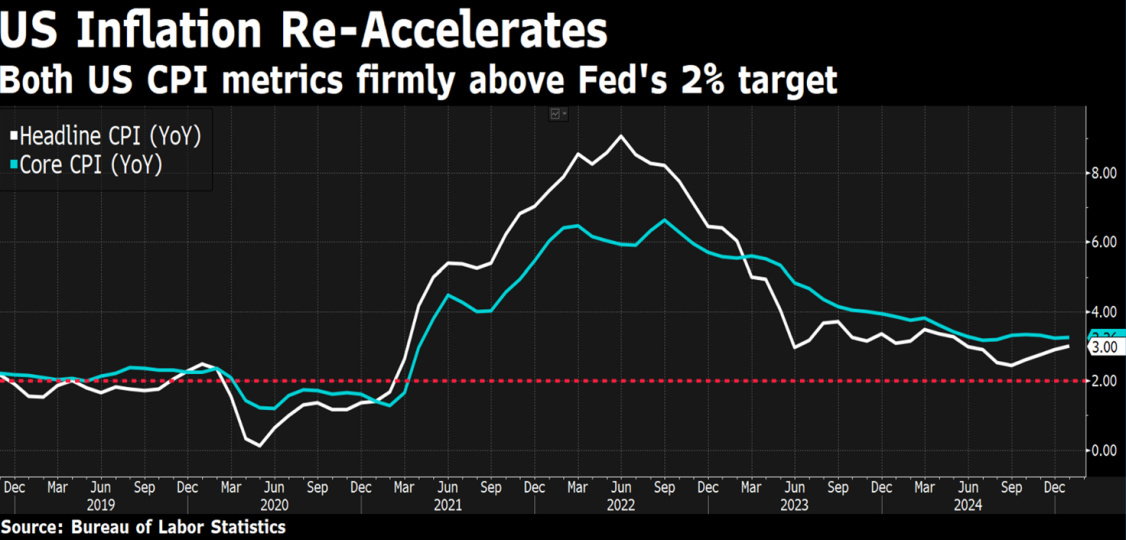

CPI inflation for January surprised the market with a 0.5% rise on a monthly basis, higher than the 0.3% expected, while the annual figure of 3% was also higher than the 2.9% expected.

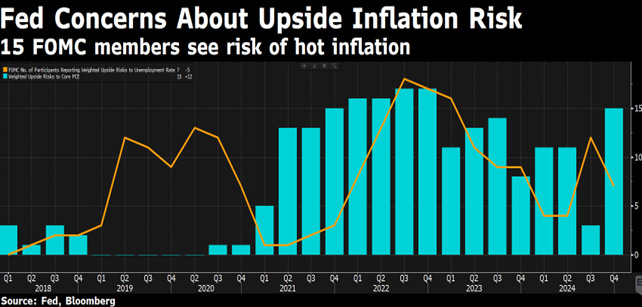

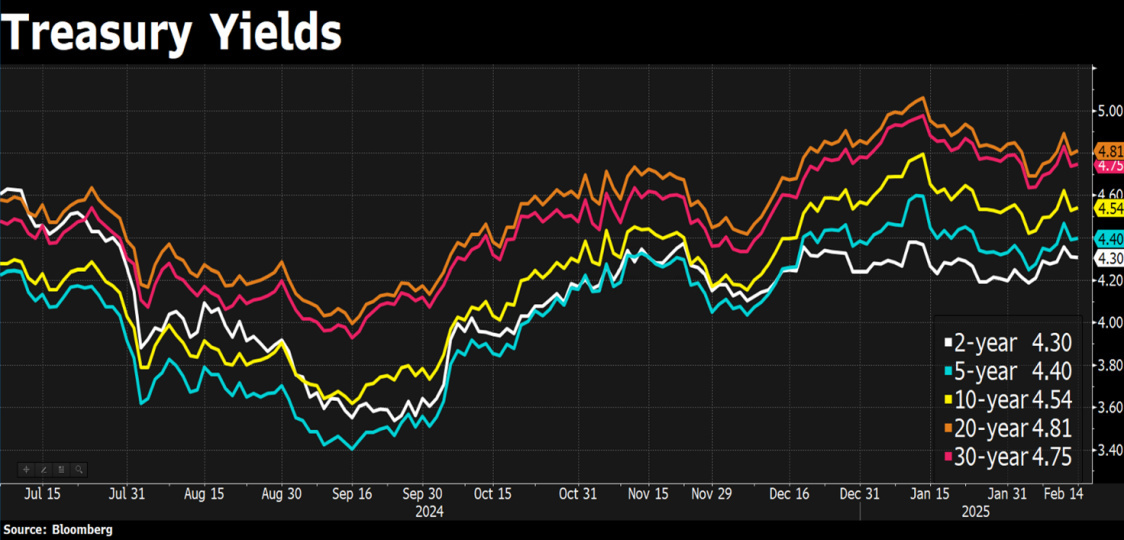

Core inflation was also higher than expected, reaching its highest level since January 2023. Of particular note was the sharp rise in the CPI supercore, i.e. core services excluding housing, which remained in line with levels seen in recent months. This, combined with the perception that potential tariffs pose a further upside risk to inflation, pushed Treasury yields up 10 cents and led the market to believe that the Fed will find it difficult to justify rate cuts in the near future.

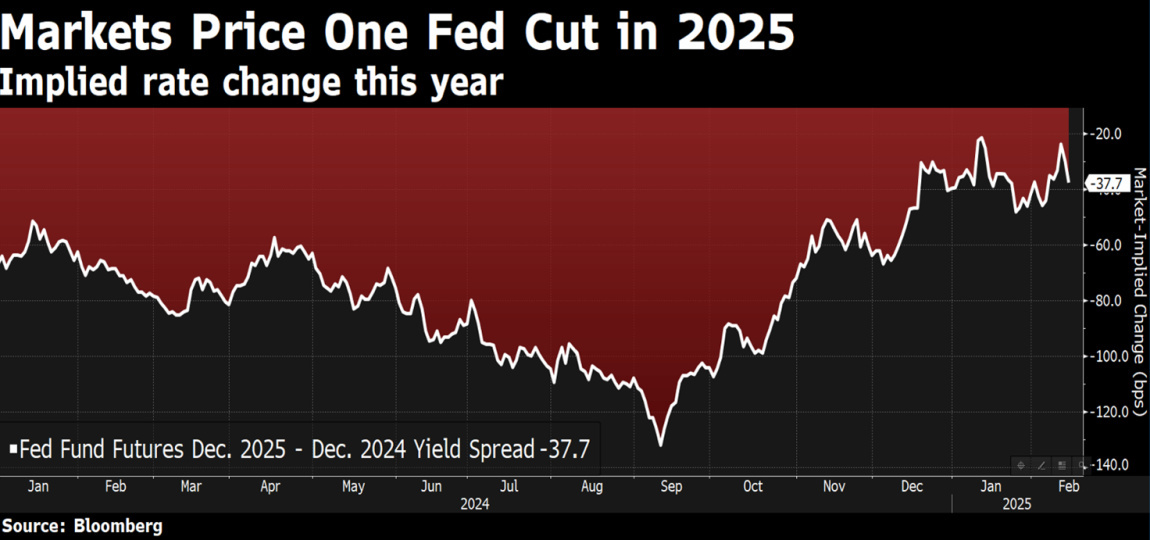

Markets are now pricing in only one cut for the whole of 2025, which is unlikely to happen before September.

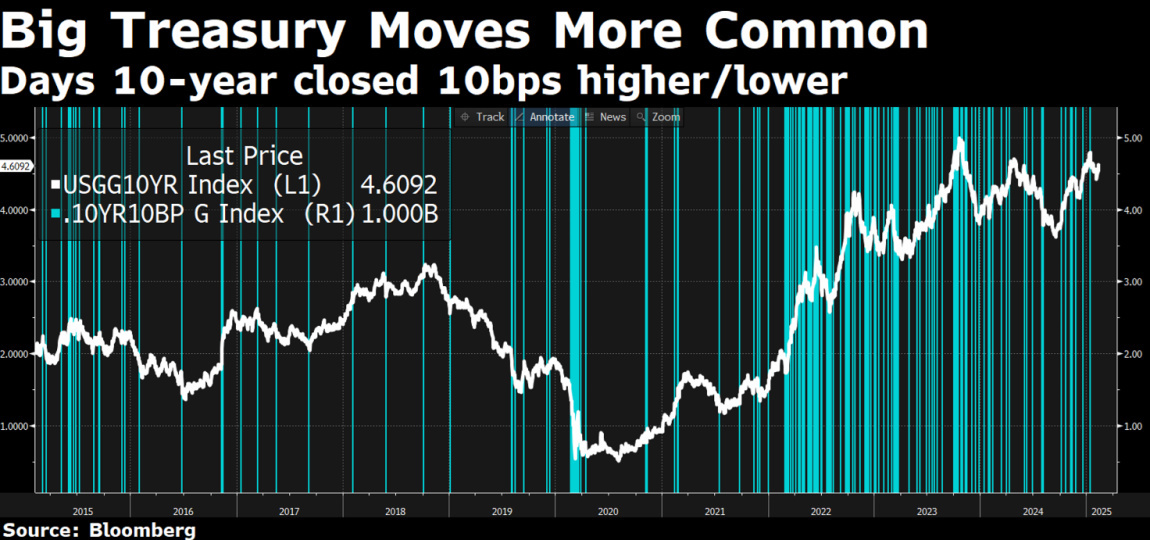

The day after the release of the CPI (i.e. inflation measured on the consumer side), it was the turn of the other measure of inflation, but measured on the production cost side, the so-called January PPI, which also came in well above estimates, accompanied by a fall of around 10 cents in the ten-year rates, thus reversing the previous day's rise. However, daily movements of 10 cents up or down have become increasingly common over the past ten years.

It seems counterintuitive that a higher than expected PPI, and even an upward revision to the previous month's PPI, would drive rates lower, but a closer look at the PPI itself shows that some of the key components of the PPI used to calculate the PCE, the Fed's preferred measure of inflation, were lower than expected. For example, health care, which has a weight of almost 20% in the PCE, fell by 0.1%. Air passenger services fell 1.6% m/m. The market is therefore pointing to a PCE (due on 28 February) that could, on the contrary, provide more favourable price indications, with a positive impact on fixed income in particular.

On the other hand, the yield curve is clearly in the spotlight, not only for the market but also for the US administration, and there are those who are talking again about possible yield curve controls in the US.

Indeed, there have been more statements from Trump that rates should go down, a sign of a growing awareness of the impact that high 10-year rates could have on the White House's economic policies. Treasury Secretary Scott Bessent clarified that when Trump talks about lowering rates, he is referring to 10-year yields, not short-term rates. If we strip away the short-term noise related to inflation data or Trump's comments, we are left with a Treasury that is certainly a little volatile, but which Trump does not want to see rise further, and which is in fact still in the 4.5% range, which, as we said, is an excellent yield to maturity on which to build portfolios.

As usual these days, the macroeconomic news was followed by Trump's announcements on tariffs, which according to the latest statements will be delayed until at least April and will be implemented on a reciprocal country-by-country basis. This means that there is much more room for negotiation and bilateral trade agreements. The US President said that reciprocity will also apply to the application of VAT, which will be 'considered in the same way as tariffs'. Tariffs on cars will also be coming soon, Trump said again, stressing that they will be in addition to reciprocal tariffs.

Despite the recent turmoil, equity markets remain bullish, with European markets and China's technology sector leading the way. In Europe, indices are being supported by a good reporting season underway, with many companies providing guidance for 2025 well above market consensus estimates, which, as we know, have been very depressed. Low estimates and investor depression had taken their toll on European market valuations, which remain at a significant discount to their fundamentals and in particular to US indices. In addition to the good news, there was also news of talks between US President Trump and his Russian counterpart Putin, which raised expectations of a possible solution to the conflict in Ukraine.

In the markets, when the price of an asset has fallen so much that nobody is talking about it, it is very likely that it will bottom out. This is the case with China's technology sector, which no one is talking about yet and which therefore has further potential for recovery.

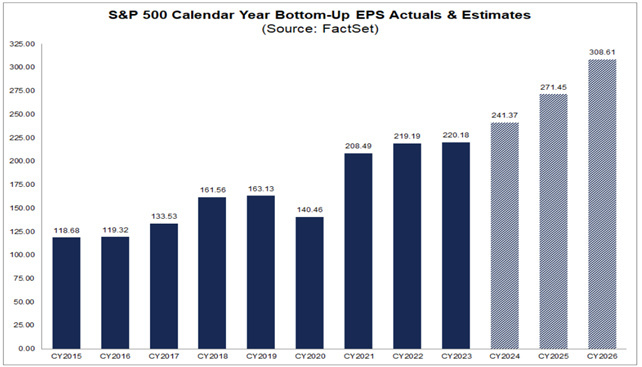

On the other hand, the one everyone is talking about - the US technology sector and the big seven - seems to be in a consolidation phase, with earnings maintaining solid growth but failing to surprise against already very high estimates. Overall, the earnings season continues to be positive, with 76% of companies beating estimates and quarterly earnings growth of 16.9%, compared with 12% expected at the start of the year. These figures are a strong endorsement for analysts, leading them to confirm expected earnings growth through 2025 and 2026, with estimates of 13% and 14% respectively for the US market.

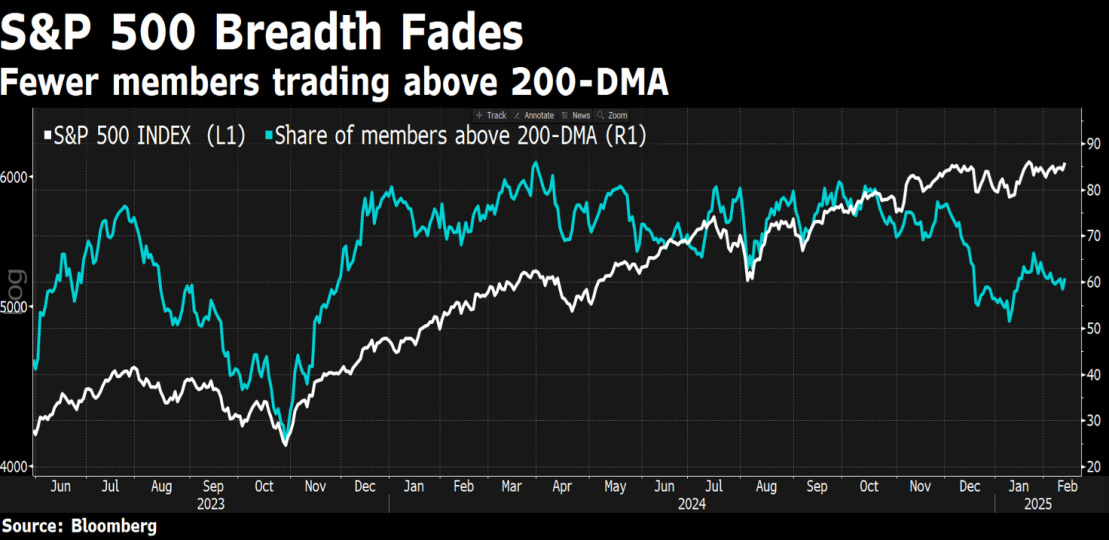

However, although global equity indices have returned to their highs, investor sentiment remains mixed and in the US market the percentage of stocks trading above their 200-day moving average is falling, suggesting a context of consolidation in the US and a possible further recovery in international markets, particularly in Europe and China. In Europe in particular, at a sector level, luxury goods and beverages appear to be among the sectors with the greatest potential for recovery.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.