2025 like 2018? Signs of déjà vu

18 March 2025 _ News

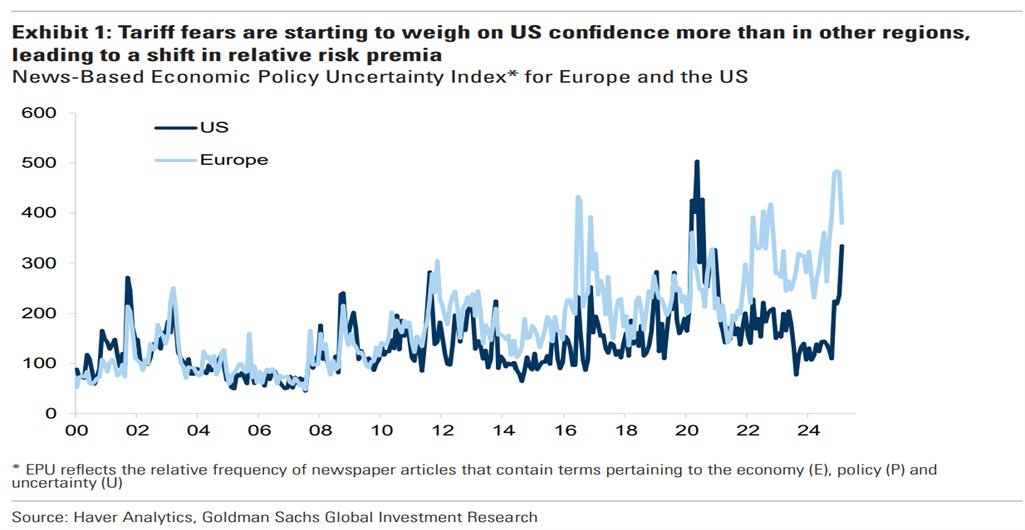

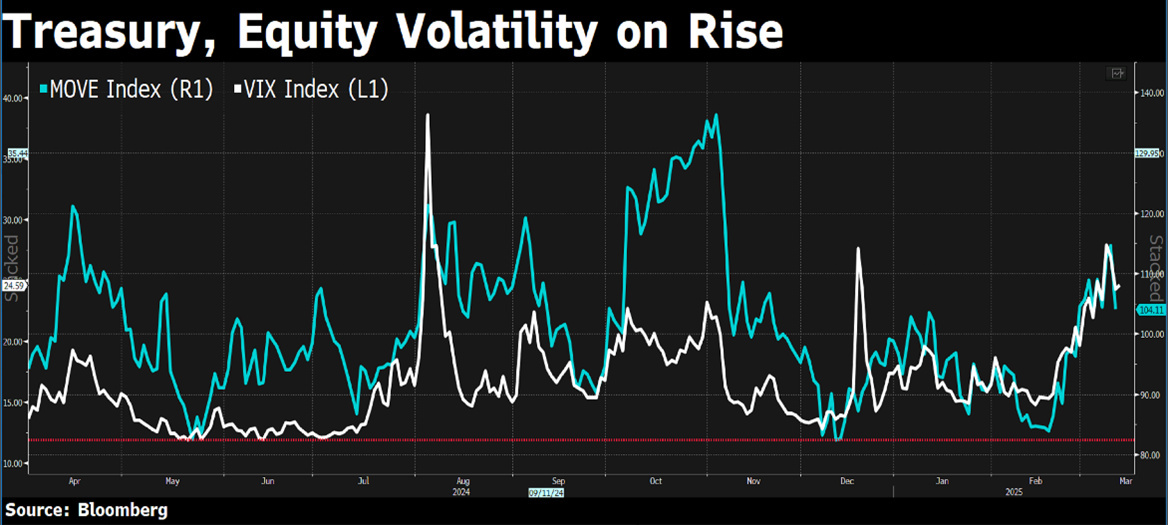

In recent days, financial markets have been characterised by a growing climate of uncertainty and a marked deterioration in sentiment. Geopolitical tensions and concerns about the resilience of the US economy have contributed to an increase in the risk premium in the markets.

Almost all equity indices posted weekly declines of between 1% and 2%, US ten-year rates were stable or slightly lower and European rates were higher, with volatility indices at period highs.

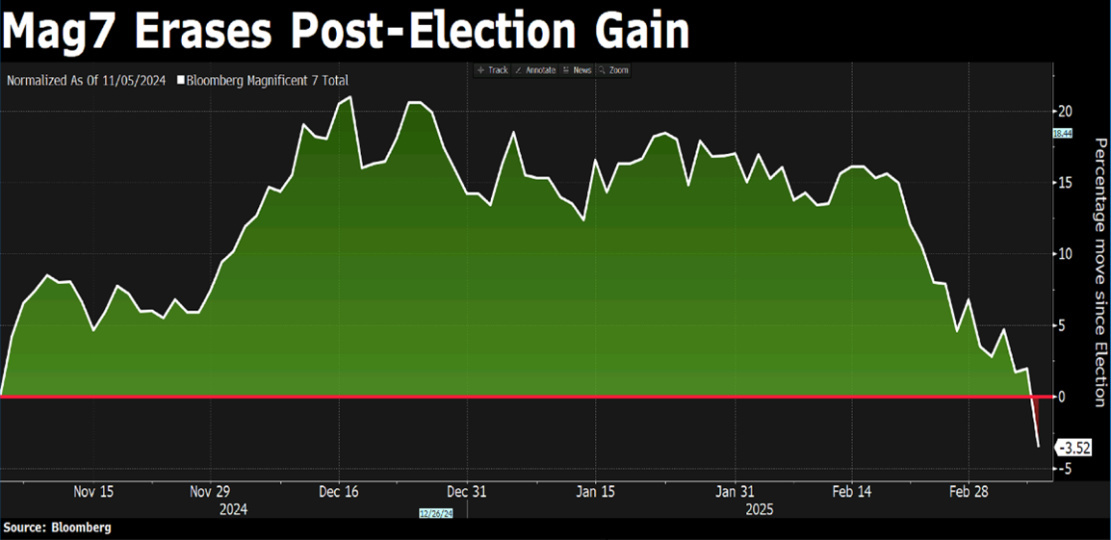

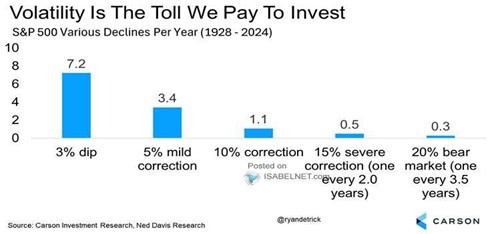

The MSCI World Index in euro terms is down around 10% from its February highs, which is the technical definition of a market correction. However, declines of this magnitude are part of normal historical fluctuations and statistically occur once a year. A key component of this decline was the appreciation of the euro, which rose by around 5.5% against the dollar. This has had a negative impact on the performance of US equities, particularly the large technology companies that make up a large proportion of global indices. Not surprisingly, gold remains one of the best performing assets at the moment.

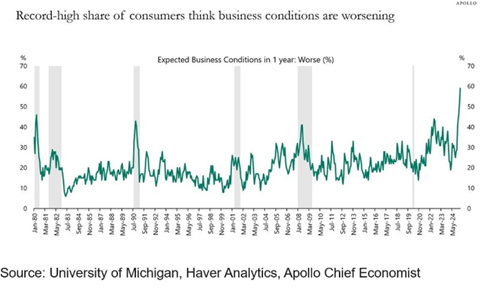

The markets seem to be in a dizzying situation where everything seems to be spinning, with the epicentre of all this dizziness continuing to be the White House and Trump's continued comments on tariffs in particular. Speaking outside the White House, where he was testing his brand new Tesla car with Elon Musk, Trump called the stock market 'a fake economy'. This after saying on Sunday that you can't always look at the stock market alone. The so-called Trump PUT seems to have been put aside for now, with more and more economists raising their odds of a US recession, with JP Morgan economists raising their odds to 40%.

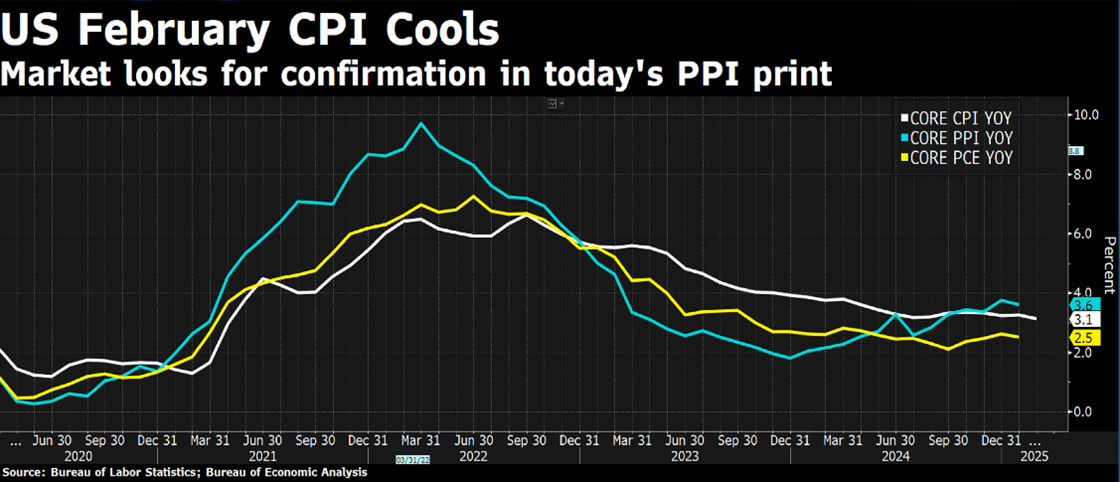

On the macro data front, one of the most eagerly awaited events of the week was the release of US CPI or inflation for February. The figure surprised to the downside, with headline inflation at 2.8% and core inflation at 2.9%, the lowest since 2021.

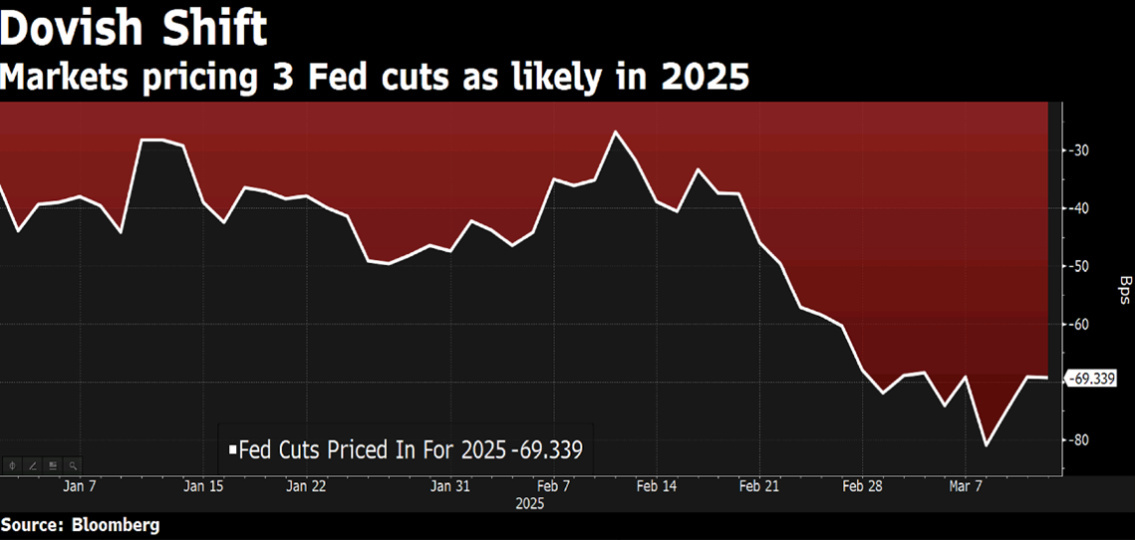

PPI, or inflation as measured by the cost of production, also came in lower than expected, unchanged from a year earlier and below the 0.3% increase that economists had been expecting. A closer reading shows that the components of both indicators that go into PCE (i.e. the Fed's preferred measure of inflation) were actually a little higher, so the reading reinforced the market's view that the Fed will leave rates unchanged next week and supported the comment that the next rate cut is unlikely before the second half of 2025 given the uncertainty and economic volatility.

In addition, the Treasury Department reported that the US budget deficit hit a record .15 trillion in the first five months of fiscal year 2025, and investors are beginning to wonder about the long-term implications.

While 2025 is proving to be a complex year, markets have faced similar situations in the past.

Indeed, Donald Trump's new term began with an economic policy that could be seen as a throwback to his previous term, with tariffs once again taking centre stage. As in his first term, tariffs on a wide range of products are at the heart of the economic strategy, flanked by a programme of public sector redundancies, with Trump's stated aim of reducing the US budget deficit and public debt, a message that has been missing for years and that many had hoped to see again.

But let's start with a look back. During his previous presidential term (2017-2021), Trump implemented several tariff manoeuvres, mainly as part of his 'America First' trade policy, aimed at protecting American industry from foreign competition. The most important tariff manoeuvres were the tariffs on steel and aluminium in 2018, the trade war with China in 2018-2020, the tariffs on automobiles in 2019 and the withdrawal from the Trans-Pacific Partnership Agreement.

But beyond the tariff interventions, the similarities between 2018 and 2025 are mainly found in US market valuations. Indeed, in 2018, the S&P 500's PE (price-to-earnings) multiple of 19 was at its highest level in at least a decade, a sign of a market that seemed to reflect unwavering confidence in the economic outlook. However, the political uncertainty created by Trump's trade policies and tariff manoeuvres has contributed to significant volatility, with markets experiencing sharp swings of as much as + or - 20 per cent to a level of 14 times earnings, i.e. its long-term valuation average.

Valuations at the end of 2024 are also at 10-year highs, with the P/E ratio above 22x. Despite a global situation with some differences, the context of political and economic uncertainties combined with still high valuations is fuelling a similar dynamic of volatility and instability as already seen in 2018.

We do not think or have the elements to say whether 2025 will be like 2018, but history is always a valuable resource and market behaviour is always very similar as it is driven by human emotions. What history teaches us is that markets do not like uncertainty, and this assumption is even more true when valuations are high. The higher valuations go, the more optimistic scenarios are discounted to the point where a near-perfect scenario is expected, leaving no room for the slightest margin of error. As soon as these expectations are disappointed, or simply when uncertainty arises, valuations fall back towards their average and markets correct.

History is never the same, but it tends to rhyme, so the recipe for dealing with this period of turbulence is patience and rationality, the two main virtues of the intelligent investor.

While high valuations and geopolitical tensions call for caution, long-term investors know that volatility is part of the game. Since 1927, the market has experienced corrections of 5% between 3 and 4 times a year and drawdowns of 10% every year. Bear markets, defined as declines of more than 20%, statistically occur every 3½ years, but over the long term, equities have delivered an average annual return of 11%, underscoring the importance of a long-term view and rationality.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.