2025 is already here: the trade-off between risk and return

15 January 2025 _ News

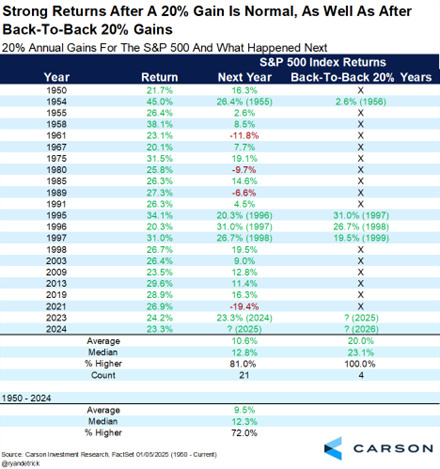

The year 2024 closed with double-digit performances for the world's stock markets, which, after the +21% of 2023, closed 2024 with +17%, led by the outperformance of the American markets (+24% and +23% respectively over the last two years), where it is now superfluous to highlight the polarisation of performance towards the technology sector and, in particular, the magnificent seven. This is therefore the second year in a row that equities have risen by around 20%, but we can immediately point out, for those who love statistics, that there is no historical evidence that such rallies must necessarily be followed by a negative year, or even the opposite.

It is a 2025 that begins with increased volatility, both on the equity side (as measured by the VIX index) and, above all, on the bond side (as measured by the Move index), both of which are on the rise.

On the macro side, we have a scenario in which the US data comes in better than expected on average, with the CITI economic surprise indices improving and returning to positive territory, while the macro data and economic surprises in Europe deteriorate.

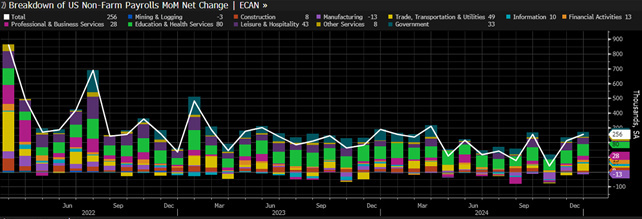

In particular, in the US, we had an ISM on services that was the highest since September 2023, the labour market also remained very resilient with unemployment benefits lower than expected and the most anticipated data of the week with non-farm payrolls coming in well above expectations at 256K versus 165K expected, with the unemployment rate also better than expected at 4.1%.

So let's start with the good news: the US economy appears to be in excellent health, and the macro data confirm this.

GDP in 2025 looks set to approach the strong 2.4% pace of 2024, the labour market looks very robust and various surveys continue to show that consumers see jobs as plentiful while employers find it difficult to hire qualified candidates. Progress on inflation has slowed somewhat recently, but in the absence of significant changes in monetary and fiscal policy, inflation is likely to resume its path towards 2.0% in the coming months.

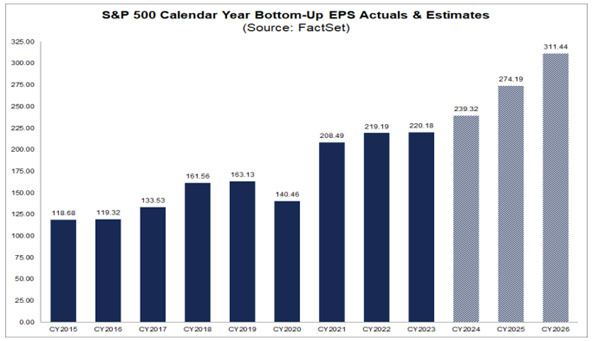

Finally, we are still in a very supportive environment for corporate earnings. Consensus analyst estimates predict earnings growth of 15% in 2025, following 10% growth in 2024.

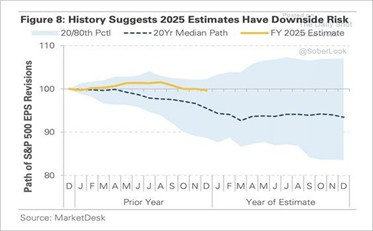

Interestingly, analysts still expect earnings growth to continue for the Magnificent Seven stocks, which are expected to grow earnings by 21% in 2025, compared with the other 493 companies, which are expected to grow earnings by 13% in 2025. In both cases, this growth reflects expectations that we consider generous and certainly above traditional historical average growth rates, suggesting a cautious approach to those areas of the market where expectations are very high.

While this may seem like a very favourable environment, there are a number of risks that investors should not ignore.

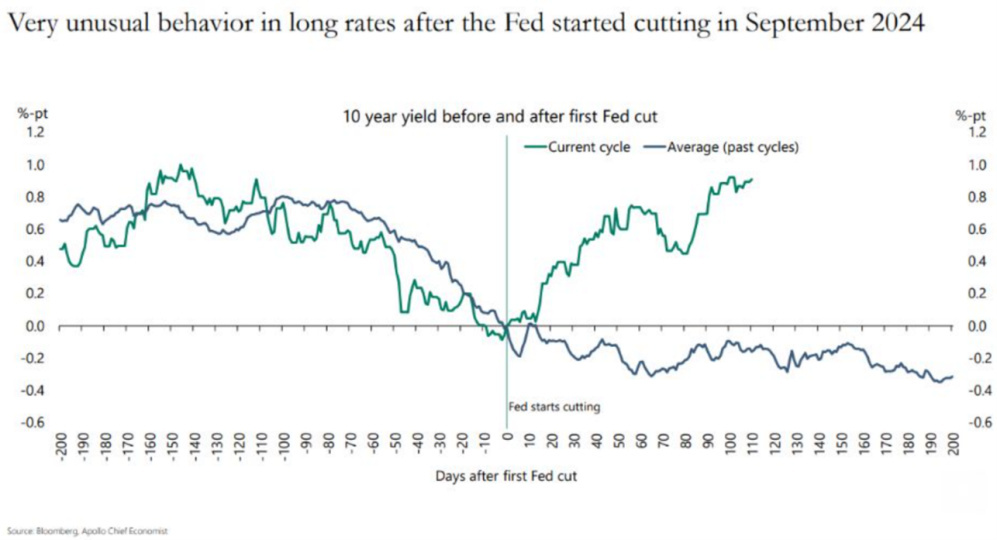

Firstly, Trump's aggressive policies, but especially his announcements on tariffs, deportation of illegal immigrants or tax cuts, are all potentially inflationary measures. The issue of interest rate hikes is undoubtedly one of the main topics in the markets at the moment. Since September, the Fed has cut rates by 1.00%, but over the same period 10-year yields have risen by around 1.20%, driven by a still-strong economy that will see further pro-growth impulses from Trump, fears of new inflationary risks linked to Trump's policies and, finally, a rise in the term premium linked to the growing uncertainties on the horizon in a context of public deficits approaching 8% of GDP in the US.

We are now back to a level of interest rates very similar to the pre-crisis investment world of 2008, and this is not a bad thing in an environment of economic growth; indeed, it is no coincidence that equity markets have continued to rise despite the rise in interest rates, but in the short term a further rise in US 10-year rates above 5% could be a temporary wake-up call for the equity world. We do not expect rates to rise much above current levels: The fact that market rates have risen since September, despite the Fed's cuts, does not represent monetary easing but tightening. The point is that the current conditions for the real economy are more restrictive than they were in September, and that is why the FED will continue on the path of rate cuts in 2025, as confirmed in the latest December minutes, and probably make more cuts than the one the market is expecting today.

In addition to potential sources of instability in the political and macroeconomic environment, investors should pay close attention to extremes in relative valuations and concentration in their portfolios.

The S&P500 currently trades at 21.5 times earnings.

Within the index, the top 10 stocks now account for almost 40% of total market capitalisation and trade at an average P/E of 30x. The US now accounts for a record 50% of global market capitalisation and non-US stocks trade at a 40% P/E discount to US stocks. We have explained in previous podcasts that neither of these extremes in valuation tells us much about short-term performance, but they are the best guide to long-term performance and where the risks lie.

For investors, the message is simple: don't just focus on the stability of the economic expansion, but also consider the current extremes: extremes of government debt levels, extremes of positivity on some themes and negativity on others, extremes of valuation and concentration in the markets and, finally, in a financial environment distorted by passive investing, potential extremes within personal portfolios that make them increasingly vulnerable to shocks because they are overexposed to sectors and themes with excessive valuations whose rising prices make them unaware of the risks.

The scenario is very complex and requires great selectivity, because there are some areas of risk in the markets that are not negligible, but for those with the right time horizon it is also true that the equity market is rich in valuation opportunities (think, for example, of the pharmaceutical or non-discretionary consumer sectors or, more generally, the European market compared with the United States). In the world of bonds, if we look at today's yields in terms of yields to maturity, a new regime of normalisation of interest rates, even at current levels, would make it possible to build portfolios with a solid yield base, a scenario that, frankly, we have not been used to for years.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.