The US Trade Chaos: Opportunity or Danger?

01 April 2025 _ News

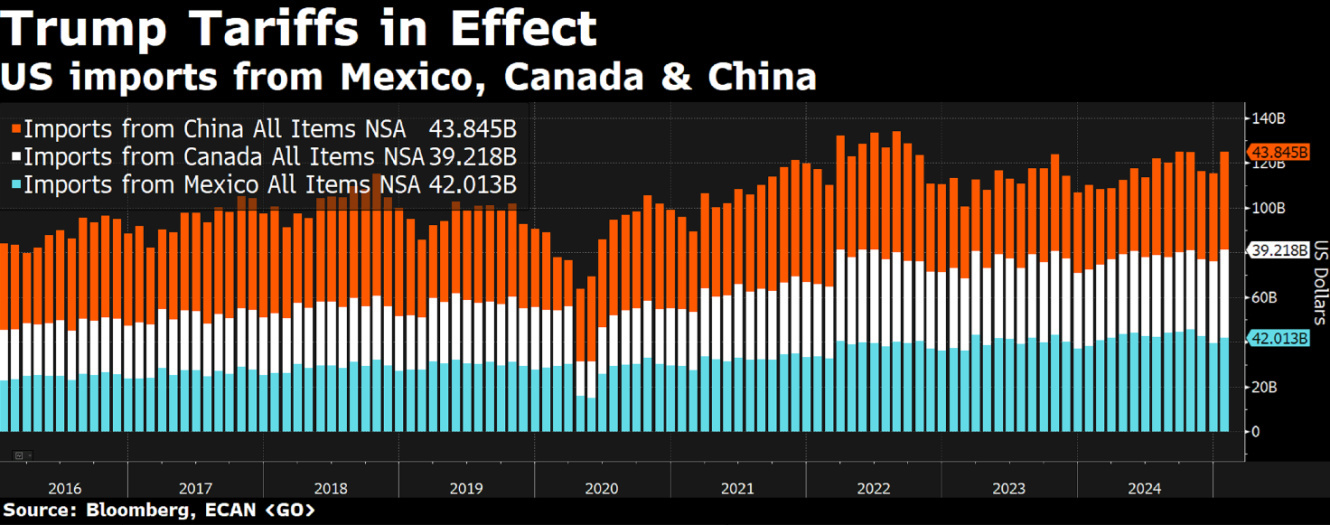

Calculated chaos: according to many, this is how we could define President Trump's approach to trade policy. A modus operandi that may at times appear haphazard and unpredictable, but which may conceal a precise strategy: create disorder to confuse trading partners, force them to react and then negotiate from a position of strength, perhaps by getting them to buy US bonds. Over the past week, markets have been living by this logic. After the slide of recent weeks, we have seen a small rally in equities and a recovery in growth stocks, fuelled by rumours that the tariffs Trump wants are flexible and negotiable, but not a day has passed since the President himself announced a 25% tariff on countries that buy oil from Venezuela, and market jitters have increased further after statements about new auto tariffs of 25% across the board on all imports, and the prospect of a global trade war is rapidly reducing investors' appetite for risk.

And it's not just the US that is to blame: foreign stock markets are also weakening as investors realise that Trump's tariffs are bad news not only for the US economy, but also for many other economies around the world.

In short, confusion reigns supreme and everything seems to revolve around the date of 2 April, when the US is expected to announce reciprocal tariffs against countries with the largest trade deficits with the US. The hope is that this will lead to bilateral negotiations to reduce tariffs, but with Trump, nothing is a given.

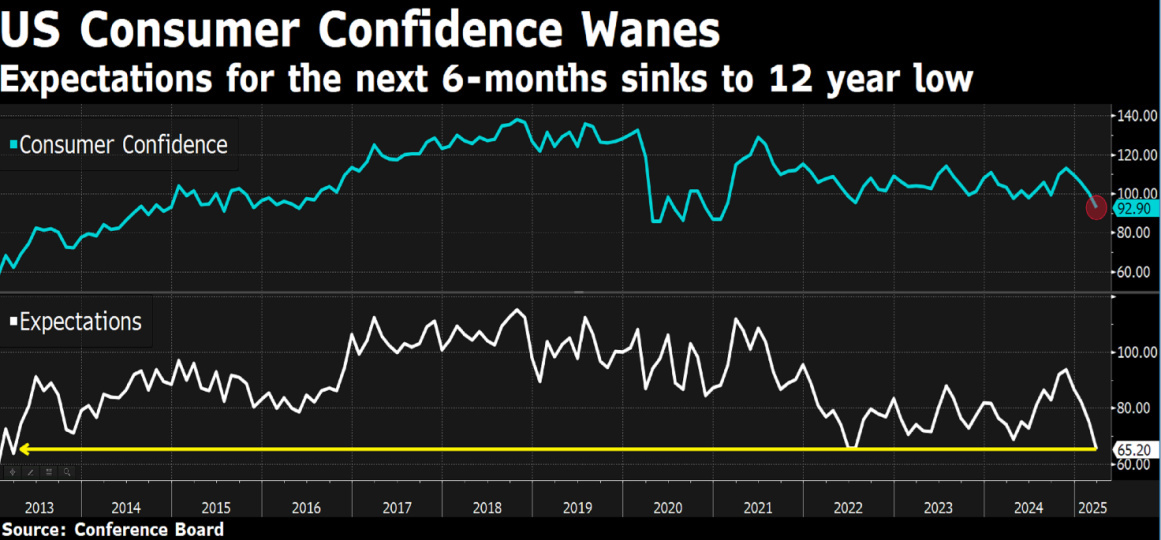

To make matters worse, US consumer confidence data for March showed a sharp deterioration. The index fell to its lowest level since January 2021, with the expectations component plummeting to 65, a level not seen for 12 years.

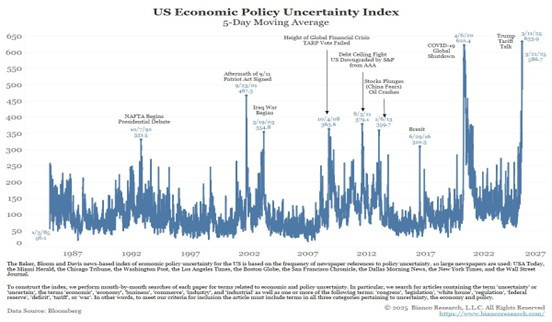

The Policy Uncertainty Index, an index constructed by taking political stories from the 10 largest US newspapers that contain words indicating uncertainty, reached its highest level in more than 40 years on 11 March, higher than 9/11, the Iraq war, the financial crisis and Covid-19. This decline in confidence is also linked to the recent performance of stock markets. The percentage of consumers expecting stock prices to fall over the next 12 months has risen from 21 per cent in November to 45 per cent today.

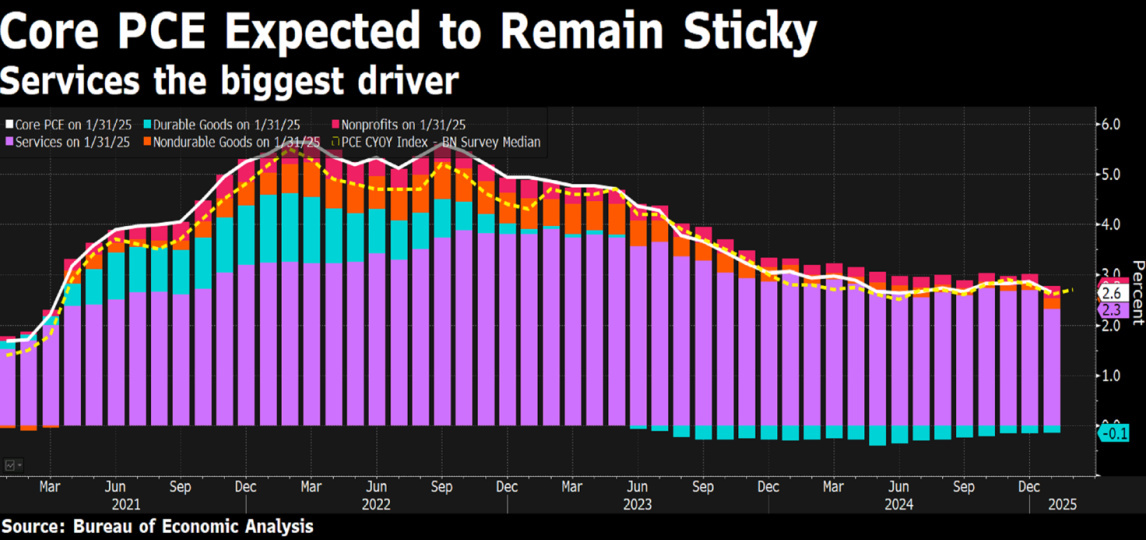

From a contrarian perspective, it is true that such negative sentiment has often anticipated market lows, but a key element is currently missing, namely the so-called Fed put or Trump put, i.e. market-supportive intervention. With the Fed in no hurry to cut rates given the resilience of the economy and the inflationary risks associated with tariffs, markets are likely to remain vulnerable for some time to come. Although PCE, the Fed's preferred measure of inflation, was in line with expectations and in line with the previous month.

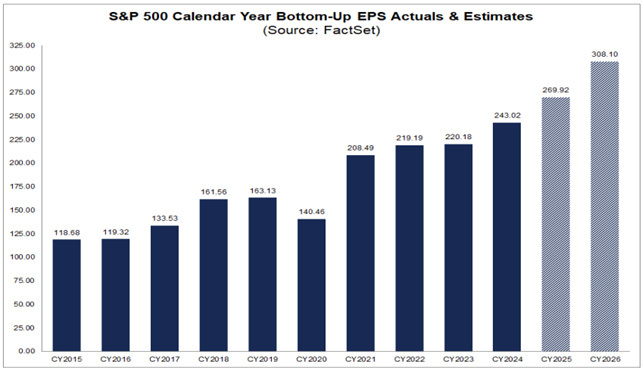

Rationality is particularly important in an "unstable and chaotic" market. Avoid chasing the noise, focus on the fundamentals and maintain a medium to long-term horizon. And as of today, the long-term fundamentals tell us of a still growing earnings cycle, certainly under downward revision, but this is not surprising, in fact it was a due process given the high expectations embedded in US corporate growth until a month ago.

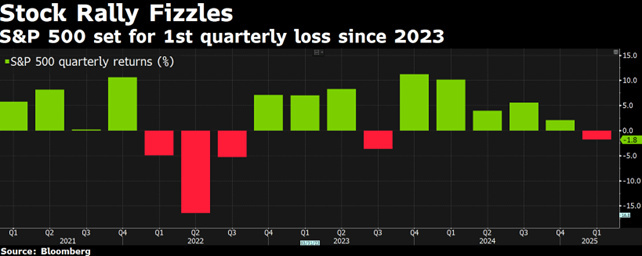

With U.S. stock markets under pressure, we are increasingly hearing the narrative about the possible end of what is referred to as U.S. exceptionalism. U.S. exceptionalism is the idea that the United States inherently differs from (and is sometimes superior to) other nations because of its unique historical development, political system, and values. The origin of the term is attributed to a French political thinker who described Democracy in America in 1835 as “exceptional” because of their unique political and social structures. Today the term exceptionalism is often misunderstood to mean superiority when a better description would be uniqueness. The fact that the U.S. economy may slow down or have a negative quarter in the S&P 500 and a couple of stocks of the magnificent 7 that have corrected by more than 20 percent, seems to us to be really exaggerated to define the end of the united states. For now, it looks like a typical 10% correction rather than the end of the country.

US risk assets will be unstable in the short term because a correction was due, but in the long term the return on investment in the US will remain high and even increase due to deregulation and a government that is very pro-business and supportive of the private sector. This is true regardless of who is in office, and history proves it: by analysing the performance of the US stock market indices, it is easy to see that the markets have always risen, maintaining a growth rate of around 8% per year, regardless of who has been in the White House. It just so happens that this average annual growth of 8% follows the historical average growth of corporate profits, the only real variable that explains the growth of stock markets in the long run, markets that are driven by profits, not macroeconomics.

European markets may rise in the short term on this European fiscal spending narrative, but the United States will continue to outperform in the long term unless Europe makes structural changes to become more “capital friendly” and thus less regulated.

When going through such uncertain times, we need to know that there is a shelter from macroeconomic uncertainties and geopolitical tensions. All we need to do is to focus on the fundamental strengths of the stocks or in general the assets that we own in our portfolios. So we need to think about balance sheet strength, that is, having durable business models in the portfolio, companies that are not economically fragile and that are able to get through periods of dislocation, shocks, booms, and crises. Companies led by a management team that has demonstrated over time that they have the ability to adapt, to support and represent their shareholders, but also to withstand the fads and bubbles that periodically appear in the markets.

I think this focus on fundamentals is more important today than ever. More than ever, in times of uncertainty and stormy seas, we need to regain the serenity and peace of mind that comes from having in our portfolios durable companies with strong balance sheets, proven management teams that can grow the business over the long term, not necessarily in a straight line, not even the darlings of hyper-growth, but rather durable and resilient growth that can be bought at attractive prices.

If our portfolios have these characteristics, the market correction is not a cause for concern but an opportunity.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.