The Return of China: The Chinese Bazooka is in Action!

03 October 2024 _ News

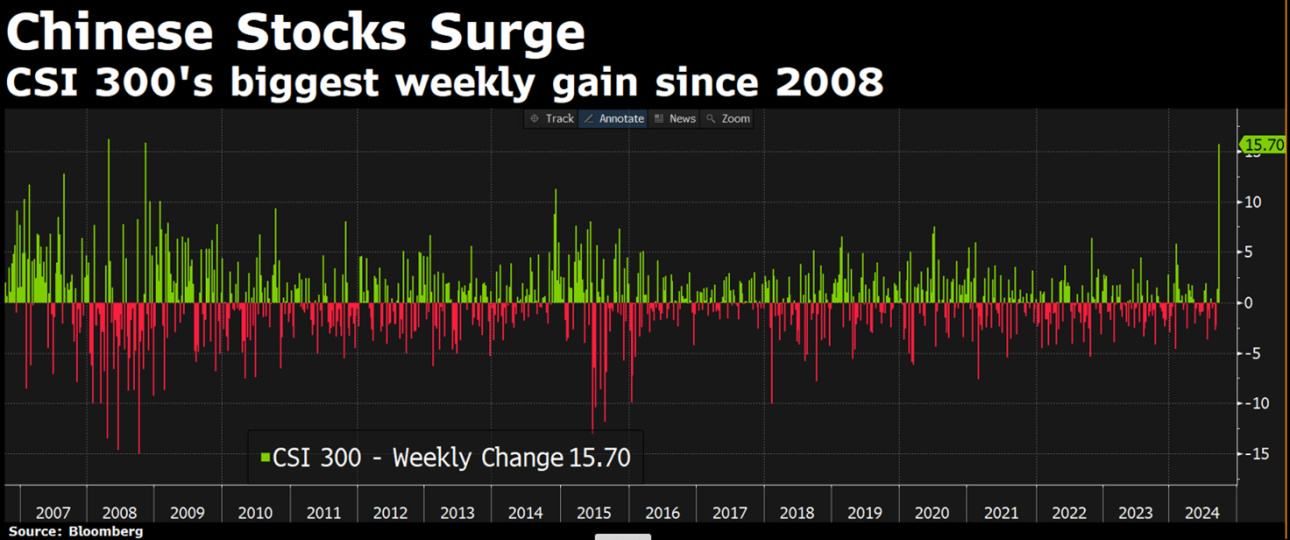

This week has seen global equity indices rise by around 1.5% to new all-time highs, led by one of the best performances in the last 20 years in the Chinese market. On the bond front, interest rates are falling, particularly in Europe, especially at the short end of the curve, while US rates are stable or rising slightly.

We have been talking about this for a few months now because the negativity represented by shorts had reached such extreme levels that no one wanted to hear about it, calling it "uninvestable". But today we really have to talk about China.

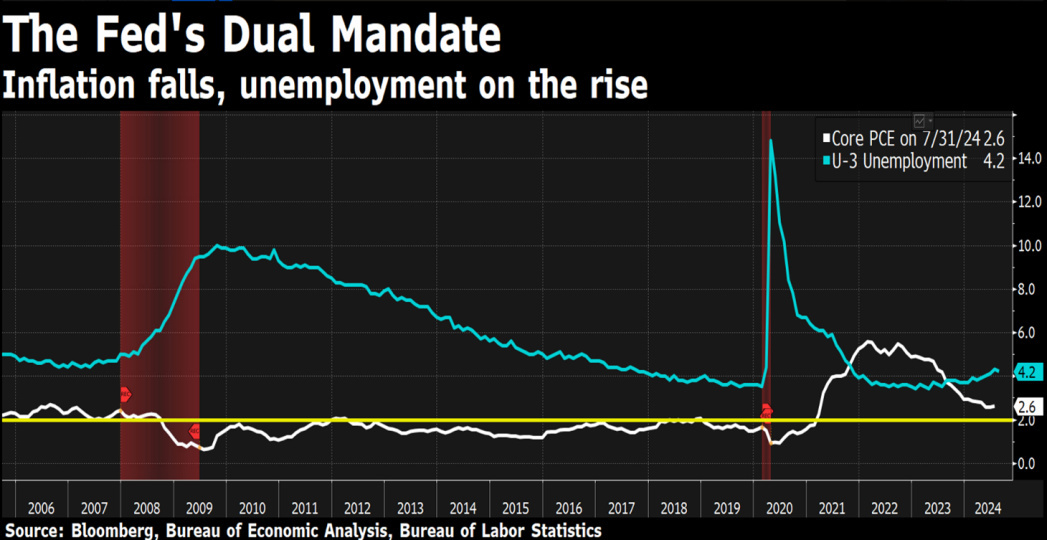

This week's macro news sees US data support the soft landing thesis for now, but this is normal and never in market history has the economy shown deteriorating macro data before a market correction.

But the big macro news comes from China, where the economic landscape has been significantly reshaped as the Beijing authorities have implemented a series of coordinated monetary and fiscal measures designed to boost consumer, business and, not least, investor confidence. Key measures include

- Reduced interest rates on both interbank and household loans, with a 50 basis point cut also applied to existing mortgages.

- Reducing the down payment requirement, including for second homes, from 25% to 15%.

- A reduction in the reserve requirement ratio for banks

- Equity Market Support Fund, in which the Chinese central bank, emulating the Fed in 2008, has allocated up to RMB 1 billion to support the stock market by buying ETFs and setting up a 1.75% subsidised interest rate financing system to facilitate share buybacks. In addition, the central bank is allowing brokers, equity funds and insurance companies to pledge shares to the central bank in exchange for liquidity, which in turn must be reinvested in shares, significantly increasing market liquidity. This decision immediately caught the attention of global investors and sparked a rally in Chinese equity markets that we believe will continue in the coming weeks.

Intervention to support the markets is very important in our view, because it is done at the right time and can create value for Chinese companies. If you are a major shareholder in a listed company and you have the opportunity to borrow at 1.75% to buy at a discount a market that has an average dividend yield of 3%, that seems to us to be a very attractive option for strategic growth and value creation. And there is already talk in the market of a real possibility that this stimulus will be doubled to RMB 2 billion, effectively providing unlimited ammunition.

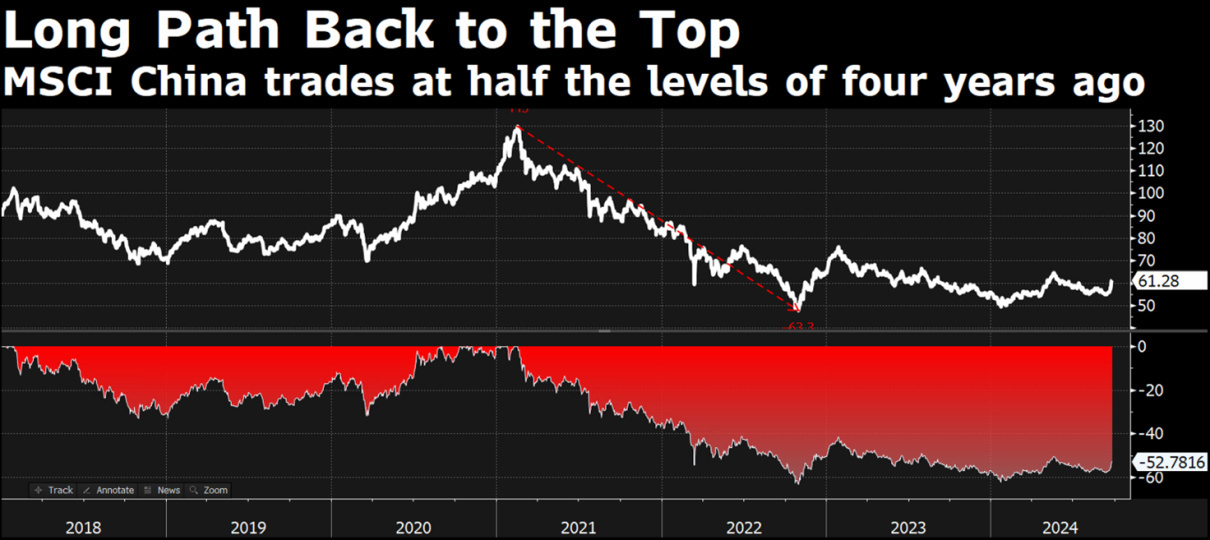

We are now seeing a move driven mainly by the closing of bearish positions; next will come the large institutional investors who currently have little exposure to the Chinese market and may find themselves almost forced to buy. There will be talk again of geopolitical risk, of relations with the new US president, but the fact is that China remains the world's second largest economy, investing massively in technology and AI, and trading on the markets at a 50% discount to America.

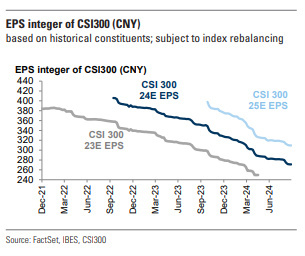

Chinese markets are discounting one of the worst recessions in their history, consensus earnings have already been cut by 20% and prices have fallen by 50%, leaving valuations (even after this recovery) at 10x earnings at potential cycle lows. The economic news on China will continue to be bad and analysts may continue to cut estimates.

It is a scenario that we believe is already priced in, and one that a qualified investor must look at with the knowledge that much of the negative news is already priced in, knowing how to exploit the nature of the markets rather than suffer from them.

This concept of exploiting the markets is one of the principles behind our investment philosophy, which we call the 'value philosophy', that the market is often driven by emotions in the short term, but tends to recognise the true value of companies over the long term. According to the theory of efficient markets, developed in the 1970s, share prices reflect all available information, making it impossible to consistently 'beat the market'.

However, this theory does not take into account the emotional nature of investors, which often leads to short-term misalignments between the price and the true value of a company. These misalignments can be caused by a variety of factors, such as lower-than-expected corporate earnings or, as in the case of China, a combination of factors such as an economic slowdown, geopolitical tensions and a loss of business and investor confidence.

Following the value philosophy allows one to exploit these inefficiencies: buy when the price is below intrinsic value and sell when the price exceeds real value.

But how do you estimate the true value of a company? It does not require a high IQ, but it does require an understanding of the company's business, an estimate of its future profits (which are the basis for assessing the company's value) and a comparison with the market price.

Warren Buffett sums this up by saying: "In the short run, the market is a voting machine, but in the long run it is a pair of scales.

In other words, with patience and analysis, it is possible to turn market emotions into profit opportunities, which is exactly what the Chinese market offers us.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.