The paradox of risk: What the Chinese rally is teaching global markets

10 October 2024 _ News

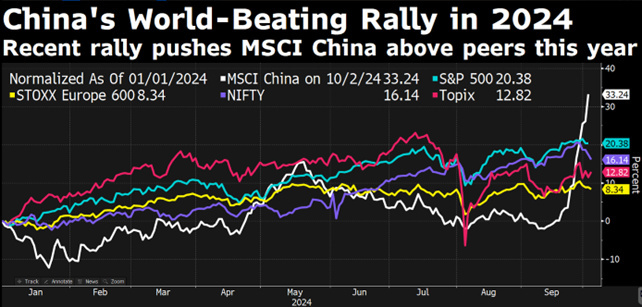

The week was characterised by flat global equity indices. On the other hand, the Chinese market continued to rise, gaining 35%, its best performance since the beginning of the year and almost double that of the Nasdaq. On the bond front, we have seen rising interest rates in both Europe and America.

With the exception of China, the rest of the markets, after hitting all-time highs, are holding back due to geopolitical tensions, particularly in the Middle East between Iran and Israel. As a result, oil also rallied on comments from Biden who, when asked if he would support an Israeli attack on Iranian oil facilities, replied that they were discussing it rather than just not doing it.

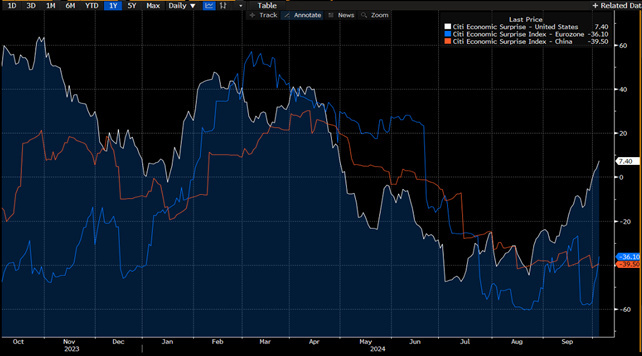

Looking beyond geopolitics, the environment for risk assets remains positive. On the macro front in the US, the Citigroup Economic Surprise Index turned positive this week for the first time in five months, showing stronger-than-expected economic data overall, justifying this week's interest rate hike.

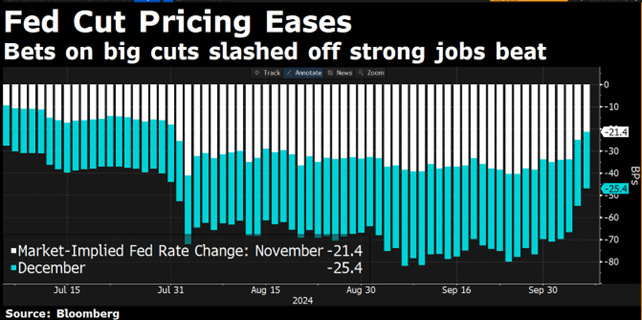

Macro data included jobless claims, which were slightly worse than expected but still at a non worrying level, and ISM services data, which pointed to a non-recessionary scenario. Most surprising, however, was the strength of the non-farm payrolls data, which came in well above expectations at 254k vs. 150k expected, with the previous month's figure also revised higher, leading investors to price in that the 50bp cut we saw in September is unlikely to be repeated by the end of the year.

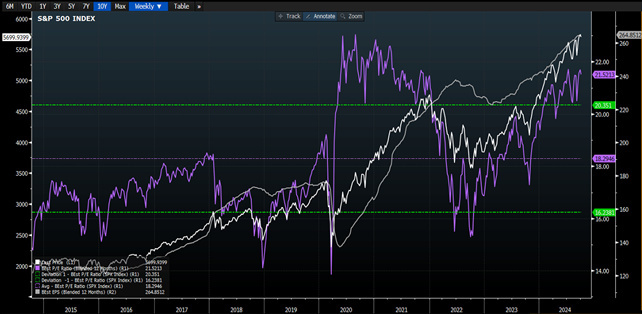

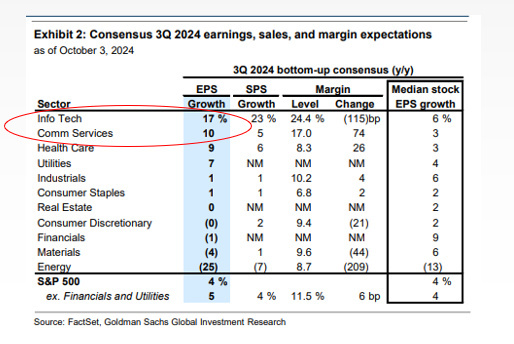

Meanwhile, we are approaching 11 October, the real start of the new earnings season, with indices close to all-time highs, earnings growth forecasts still in double digits and valuations still high for many markets. All this against the backdrop of a potential increase in volatility related to geopolitical risks and the upcoming US elections.

In other words, the market today is not only expensive on a historical basis, it is also willing to pay for earnings at period highs with multiples that are also high.

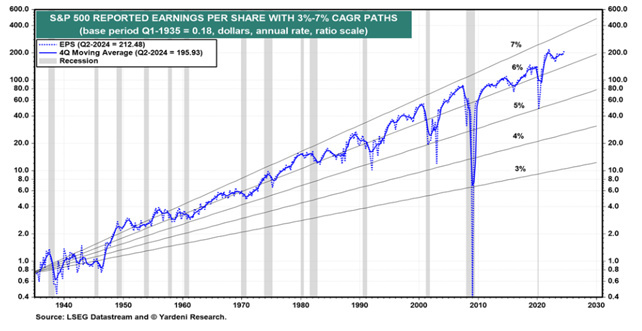

A rational investor, on the other hand, should reason in the opposite direction and be willing to pay little when profits are very high because of a potential peak. Profits tend to rise in the long run, and it is impressive to see on a graph the linearity of profit growth in the US market, which has grown relentlessly since 1950, averaging between 6 and 8% per year.

There are periods of excessive euphoria such as the current one, so we would not be surprised to see a downward revision in the coming months, with the highest growth sectors likely to be the hardest hit.

This dynamic between earnings performance and the associated valuations allows us to talk about one of the most important factors contributing to investment success, namely risk management. One of the most counterintuitive aspects of investing is the idea of risk versus the perception of risk.

The nature of investing is such that the more risk an investor perceives at any given time in the market, the lower the risk of the investment. An example from the insurance world is that over the years the use of large SUVs has increased and with it an unexpectedly high accident rate for these vehicles.

For insurance companies, the explanation lies at a behavioural level: people who drive these SUVs feel safer and therefore become more dangerous drivers, taking excessive risks; on the other hand, people who drive small cars are much more aware of the risk of an accident and therefore become more cautious.

In investing, it is crucial to recognise that the times when you are most worried about falling prices are actually when the risks have been taken out of the market and it is therefore less dangerous to invest, whereas when all investors are enthusiastic and positive, believing in perpetual growth, risk takes its place.

The fact that profits are now expected to grow by 10% in 2024 and 15% in 2025, when historically growth has always been between 6% and 8%, puts us in a risky situation.

The fact that market valuations are also high compared with historical averages should also raise the alarm and lead us to adopt defensive strategies. This principle of understanding risk as the ultimate loss of capital, rather than as the traditional doctrine understands it in terms of price volatility, leads us to the concept of margin of safety.

Margin of safety means investing only when I believe there is a cushion to protect me from unforeseen or negative changes and buying a company that is worth 100 and paying 70 for it, but you have to be prepared to invest when negativity has caused prices to correct, knowing that in the short term the irrationality of the market could drive the price down further.

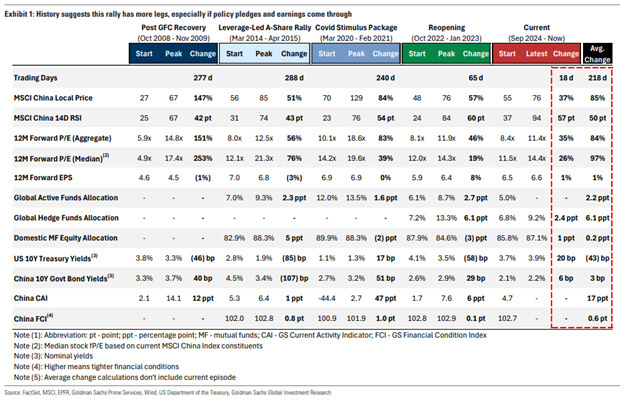

There was a large margin of safety in China, which has been partially reabsorbed in recent weeks as valuations have returned to historical averages.

However, as the history of previous rallies in the Chinese market suggests, there is still plenty of room for further gains.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.