March 2024:Someone's sitting in the shade today because someone planted a tree a long time ago

28 March 2024 _ News

'Patience, rationality and courage'

There is Value but it needs to be sought

The first quarter of 2024 ends in line with how 2023 ended, with some of the winning sectors maintaining their dominance. This trend tends to concentrate performance in certain areas of the market and leads to expanding multiples. The US index, for example, has a price-to-earnings ratio that has exceeded the highest standard deviation, approaching the highs of 2021 (chart below).

This expansion of multiples brings much disorientation to the investor, who continues to focus his attention on winning sectors and struggles to see a whole section of the market that instead presents very high valuation discounts. The beginning of the second quarter, and in particular the earnings season, may be the trigger for the recovery of leading sectors and companies with very attractive valuation discounts. The value in the market continues to be there, one just has to be patient, rational and courageous enough to look for it.

Stock

Profits

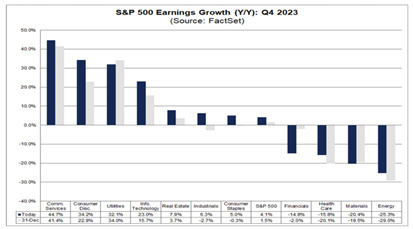

The fourth quarter earnings season closed with +4.1% growth compared to expectations of +1.5%. This earnings growth was led by communications, consumer discretionary, utilities and tech. Among the worst sectors in terms of earnings growth were materials, health care and energy. The earnings season also showed us the continued burden of inflation on companies mostly concentrated in the US.

In fact, if we take the companies that make more than 50% of their revenue in the US, we see a 5% growth in revenue, compared to a modest +1.5% recorded by the companies that export the most. However, if we look at earnings growth, we see that the companies that export the most only experienced earnings growth of 2.3%, compared to those that export which grew by 6.8%. This highlights how the US has had strong demand reflected in rising revenues, but how inflation has weighed on costs and margins. On the other hand, the rest of the world, which is slowing down, has seen a decline in revenues which, coupled with lower inflation, has pushed profits up more.

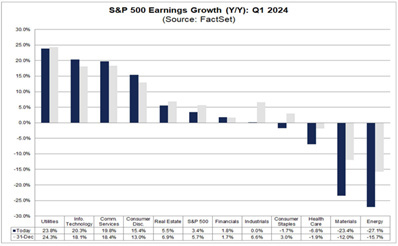

We will enter the first quarter of 2024 earnings season in mid-April with expectations of +3.4%, down from the +5.7% we had at the end of 2023.

We expect earnings to grow less than expected due to price pressure on margins.

Valuations

After analysing earnings, as always the value philosophy asks how much the market is charging us for these earnings, i.e. valuations. We continue to see more margin of safety for the investor, which translates into discount valuations in the stock markets: the US, Europe and China. (chart below).

Furthermore, we believe that mid-capitalisation companies currently have more attractive and discounted valuations than those observed 12 months ago, thus offering a greater margin of safety especially compared to large companies.

Stock sectors

The favourite sectors in the US continue to be Utilities, Non-Discretionary Consumption and Health Care. Utilities are also one of the best sectors in terms of earnings growth.

The preferred sectors in Europe, on the other hand, are: Discretionary Consumption, Non-Discretionary Consumption, Health Care, Real Estate and Industrials.

Bond

On the bond side, we continue to see opportunities in European and US long duration government bonds.

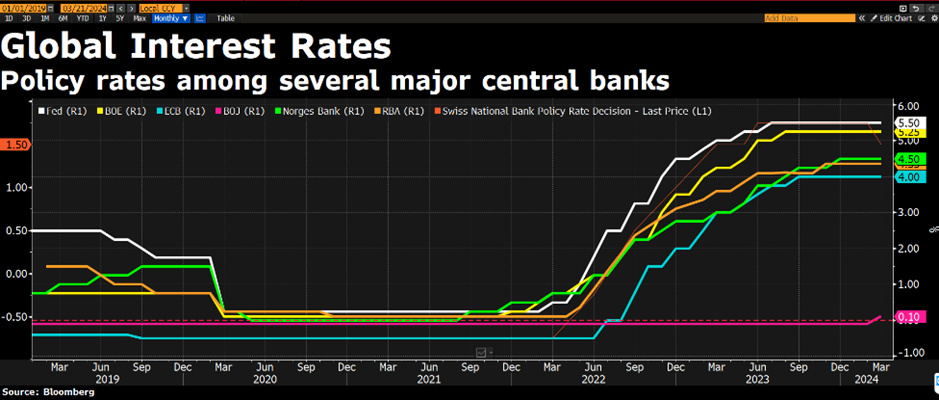

Governments

The Swiss Central Bank has kicked off the earnings cut season. The European Central Bank seems to be closer than the FED to a cut, precisely to combat PMIs that continue to be negative, as well as a particularly negative industrial production and inflation that continues to fall. On the other hand, the Fed may be taking more time to cope with a resilient labour market and inflation falling less rapidly than expected.

In our opinion, however, a commercial real estate market and the weight of rates continuing to show up in credit card delinquencies should continue to weigh in 2024, which is why we expect more consensus cuts.

Against this backdrop of anticipation and the onset of cuts, history suggests not to linger too long on the timing of interest rate movements, but rather to seize opportunities in the bond market by extending maturity.

Corporate

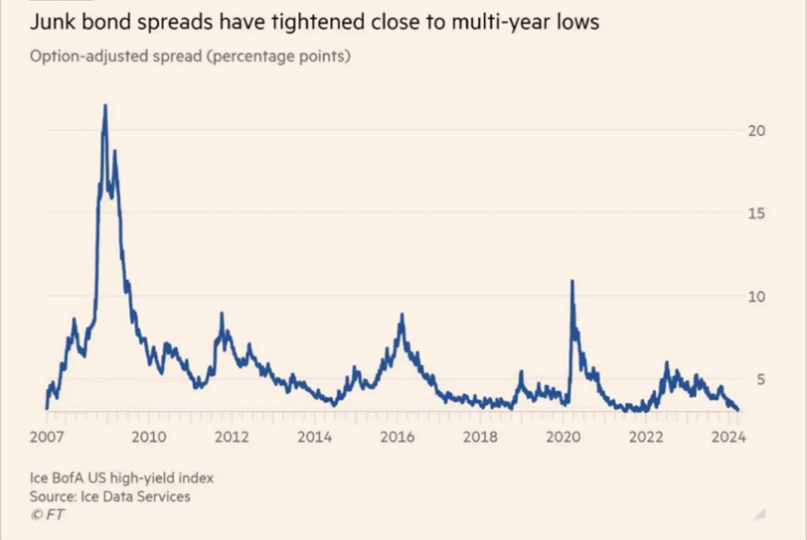

On the corporate bond side, we continue to prefer Investment Grade over High Yield. In fact, if we look at High Yields, we see that spreads are at their lowest level in years, which makes us very cautious.

Conclusion

In conclusion, we believe that patience, rationality and courage will enable investors to achieve excellent results in the coming months. Months that will be characterised by several points of uncertainty, among them monetary policy and the rate cut. History teaches us that building portfolios with safety margins allows investors to avoid focusing too much on macro analysis but to be ready for any scenario.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.