Slowdown or growth? The markets' bet for 2025

24 February 2025 _ News

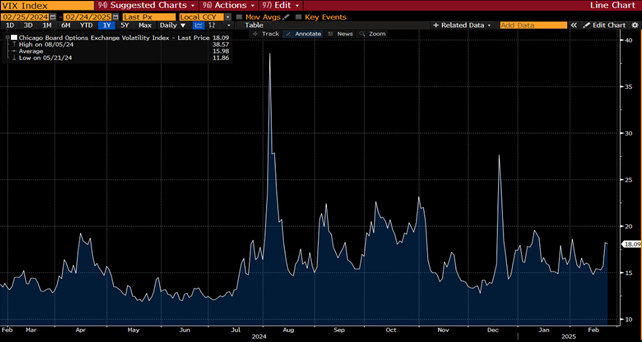

It was a volatile week in the markets as global equities moved on earnings and macroeconomic concerns to close down 1%.

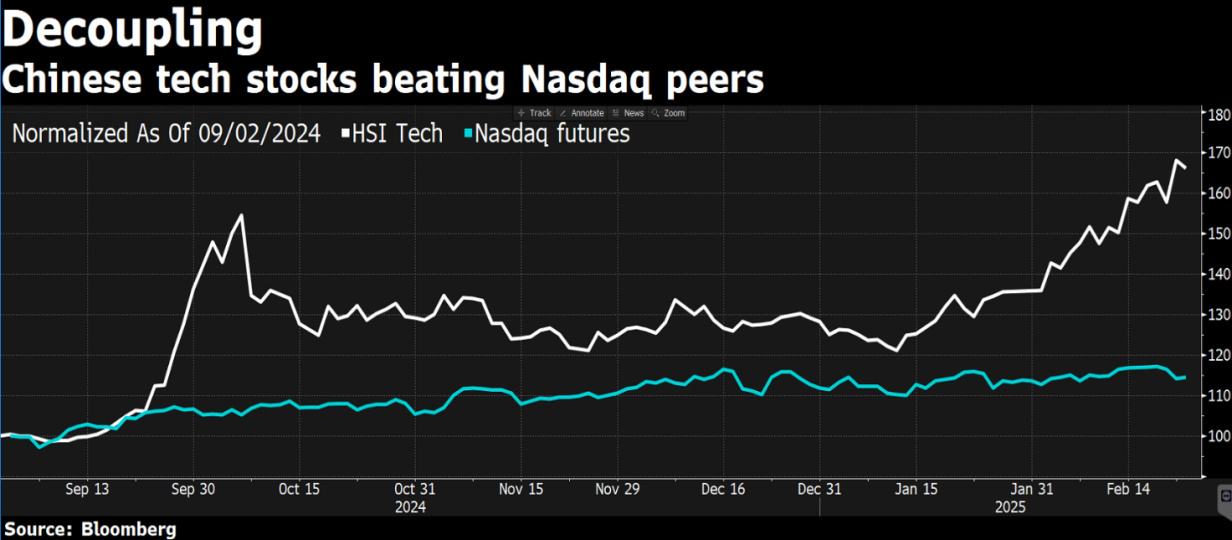

Still in positive territory, however, were China, led by the Chinese technology sector, and European banks, up 4% and 2% respectively. Meanwhile, the Federal Reserve and other central banks continue to cautiously manage the delicate balance between economic growth and the inflation outlook, with 10-year interest rates virtually unchanged in both the US and Europe.

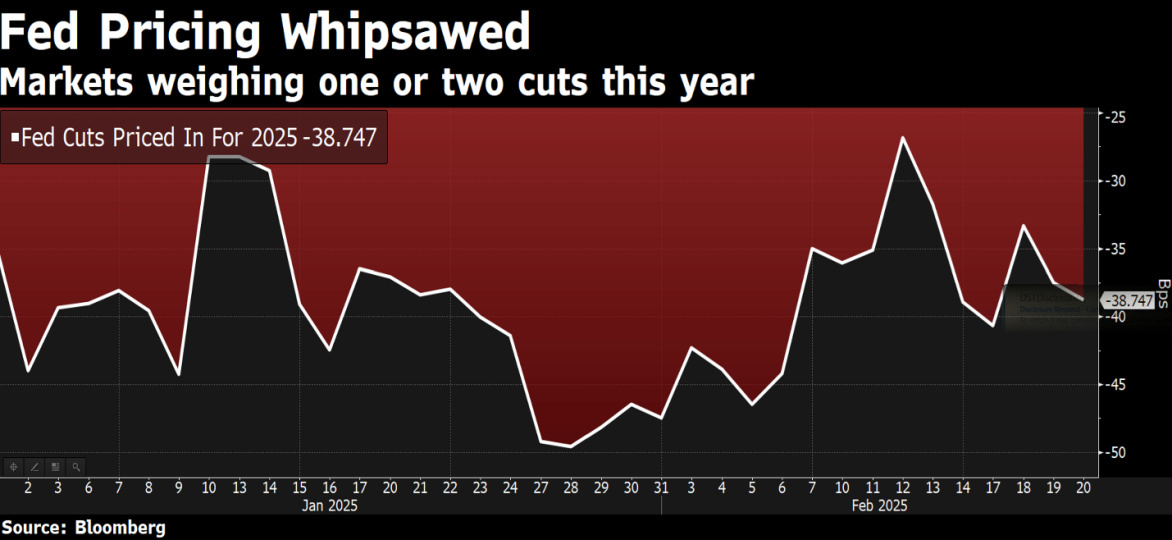

This week saw the release of the so-called 'minutes' of the FED's January meeting, which confirmed a wait-and-see approach by the US central bank, ready to cut rates but only when there are clearer signs that inflation is moving back towards 2%. Equity and bond markets have found support in this 'accommodative' pause.

Another key issue to emerge from the Fed minutes was quantitative tightening (QT), the reduction of the central bank's balance sheet through the sale or non-renewal of government bonds. The FOMC indicated that it may suspend or slow down this process due to uncertainties surrounding the debt ceiling and the volatility of bank reserves. A suspension of the QT would reduce the pressure to sell Treasury securities, indirectly supporting the bond market and helping to keep long-term interest rates stable.

In Europe, the European Central Bank also faces a dilemma. ECB Governing Council member Isabel Schnabel has stated that the ECB's monetary policy may no longer be as restrictive as previously thought and that inflation remains a variable to be monitored. According to Schnabel, recent increases in energy prices pose an upside risk to European inflation and could delay the return to the 2% target for longer than expected. For this reason, the ECB may decide to slow down the pace of rate cuts and adopt a more cautious approach in the coming months, following the Fed's lead.

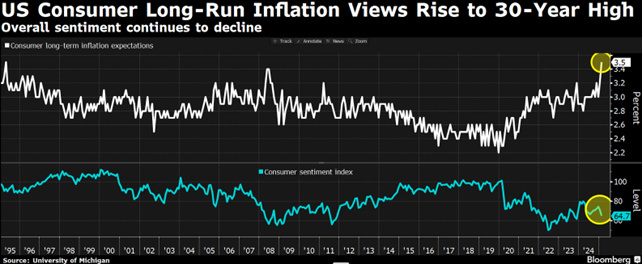

Inflation remains one of the hot topics for investors, who are therefore in a phase of uncertainty: is the slowdown in inflation sufficient to justify the next rate cut as early as the middle of the year, or should we prepare for more persistent inflation that could force the Fed to adopt a more cautious stance? For now, the market seems to be betting on the former, with Treasury yields falling.

Bank of America's fund manager survey also shows that 77% of the managers surveyed expect the Fed to cut rates at least once in 2025, with 46% expecting two cuts.

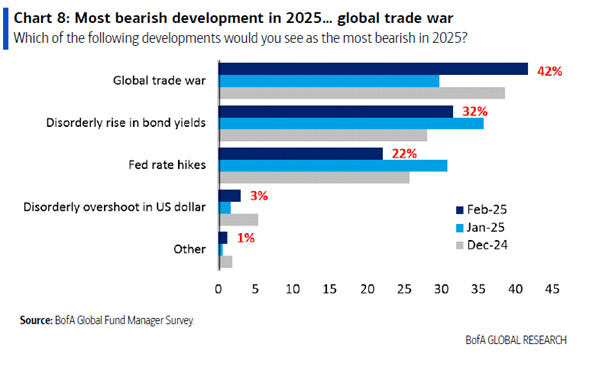

Also according to the fund manager survey, 42% of managers (up from 30% last month) see global trade wars as the biggest risk in 2025.

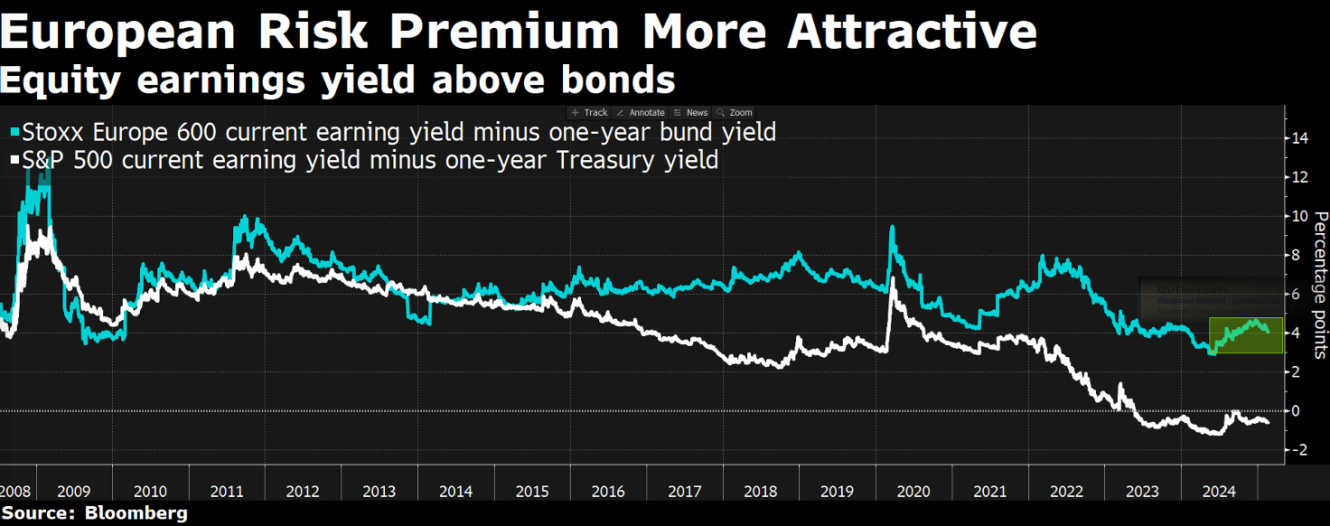

On the equity front, although the S&P500 has been in positive territory since the beginning of the year, there are some signs that we may be entering a period of consolidation. The so-called 'Trump trade' appears to have reversed, while international assets such as Chinese equities, commodities, gold and Europe are gaining ground. Europe in particular had its biggest week in 3 years with 4 billion buying into equities.

The US reporting season is drawing to a close, with only Nvidia missing from the big names, due to report on 26 February. Among the latest corporate results, Walmart and Alibaba are worth mentioning for their relevance.

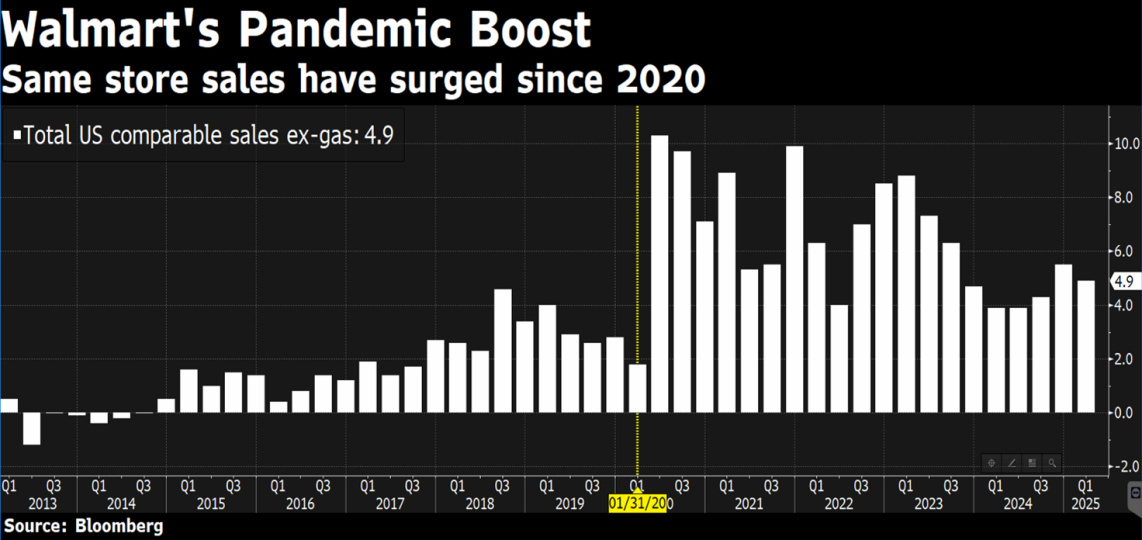

Walmart had a particularly bad session following the release of its fourth quarter results, falling 7%. This is not just a retail giant, but a benchmark for consumer spending, which accounts for around two-thirds of US GDP. When the company reports results, the market listens, and last quarter was good, but the full-year guidance was disappointing. Sales growth is expected to be between 3% and 4%, the same as last year and lower than the 4% that analysts were expecting. The CFO said it was prudent to take a "somewhat cautious" approach at the start of the year given the potential unpredictability of the macro environment, with the market pricing in the possibility that consumer spending could weaken in the face of the inflationary impact of tariffs. In reality, expectations for Walmart have been incredibly high: the stock has risen 65% over the past year and its valuation is at historically high levels of around 35 times earnings, compared with an average of 19.

Alibaba's results, on the other hand, were very good, with the company reporting its strongest quarterly revenue growth in more than a year, with cloud services revenue in particular posting its biggest quarter-on-quarter expansion in nearly two years. During the conference call with analysts, the CEO said that Alibaba will spend more on artificial intelligence infrastructure over the next three years than it has in the past decade, going so far as to say that AI is the company's primary focus and that this type of industry disrupting opportunity only comes around once every few decades.

This allowed the stock to rise by 14% on the day, dragging the entire Chinese tech sector that we have been talking about for several weeks higher, with the index up 30% since the beginning of the year.

With equity markets at all-time highs, central banks in wait-and-see mode and inflation still an uncertain variable, caution remains the watchword for investors. The Fed is still expected to cut rates in 2025, but only if macroeconomic data justify it. The ECB, on the other hand, is in a more complex situation, having to balance the need to support the economy with the risk of persistent inflation. The German elections ended in line with forecasts, with the centre-right winning and markets looking favourably on the likely next German Chancellor, Friedrich Merz, who was quick to say that Europe must strive for independence from the US, hinting at a possible round of very significant investment for European companies.

In the coming months, the focus will be on three key elements:

Inflation trends, including those related to tariff policy and central bank responses; bond market developments, particularly 10-year yields; and corporate earnings growth, which should support the equity rally.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.