Interest rates: an imbalance to be grasped

12 July 2023 _ News

What happened

Over the past few weeks, and particularly since the Sintra conference at the end of June, the bond market has experienced a sharp rise in interest rates, resulting from statements by leading central bankers that their prime focus continues to be on reducing inflation, with a particular attention to the labor market.

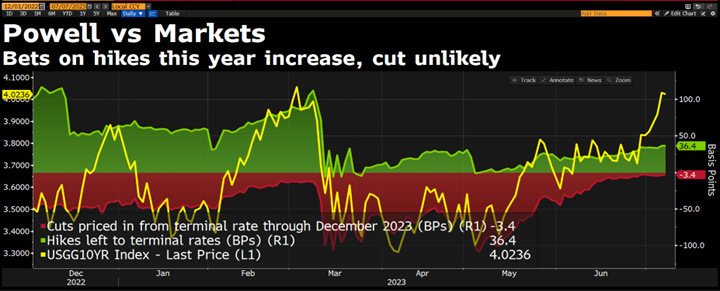

As shown in the chart, the surge in the U.S. 10-year (yellow line) was driven both by a slight increase in the Fed's expectations of rate hikes (green line) but mainly by a reduction in the likelihood of rate cuts by 2023 (red line).

The reduction in the likelihood of rate cuts was driven by macro data that continue to paint a picture of economic resilience: housing, consumer confidence and durable goods exceeded estimates. This was complemented by an upward revision of GDP for Q1 23 and weaker claims for unemployment benefits. A positive surprise from Macro data, also highlighted by the strongly expanding U.S. Citi Economic Surprise Index (CESI).

What to expect in the coming months

This economic resilience is likely to slow because of the high level of interest rates, which is beginning to take its toll on businesses and households.

Indeed, it should not be forgotten that rate hikes have a lagged effect of at least 12 months on the economy, and a year ago the Fed's rates were only at about 1.6 percent. In addition, the U.S. real rate has reached about 2 percent, a level seen only before the 2008 crisis when economic growth was between 3 and 4 percent; current levels are therefore inconsistent with expectations of GDP growth in the coming years closer to 1.5 and 2 percent. Finally, U.S. consumers have so far enjoyed not only a strong labor market, but also the excess savings accumulated during the pandemic, which, however, is gradually diminishing.

The economic slowdown in the coming months, accompanied by sharply declining inflation data, will be the driving force behind the rate cut.

In this context, we believe there is still an open window of time for investors to lengthen duration and seize opportunities on bonds.

Effects on equities

Given this view of a natural economic slowdown, the question that comes to mind is: what to do in equity?

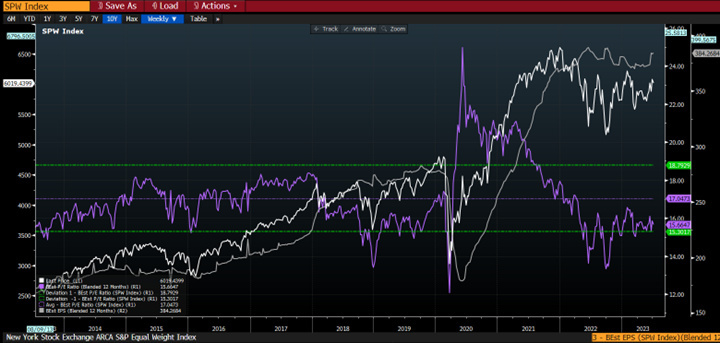

In our view it is necessary to focus on two things: prefer the equated index, choose discount sectors. Market performance so far has been driven by a few leading large companies belonging to sectors that were steeply discounted at the end of 2022, but are currently significantly more expensive. In fact, analyzing the S&P500 equated index, we note that valuations remain at a discount, highlighting that an economic slowdown is embedded in prices:

At the sector level, it is best to focus on those that are demonstrating the greatest value: consumer discretionary, real estate, health care, telco, financial, and utilities.

Conclusion

There is great value in the bond market, expressed by yields that remain too high, inconsistent with expectations of growth in the coming years and the deflationary trend we are experiencing.

On equity, we continue to see great value on both discount sectors and the market, weighing less the large companies that have become a bit more expensive than in late 2022.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.