How to move in the financial markets with the rate cut?

22 August 2024 _ News

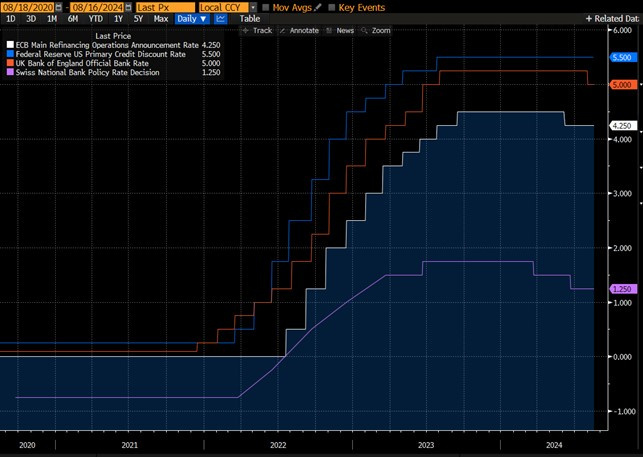

This week will be the Jackson Hole symposium, in which the FED's words on future monetary policy moves are expected. The FED's latest guidance for June 2024 shows only 1 cut planned for 2024. The FED remains the only Central Bank in major Western countries that has not yet cut interest rates (the Swiss National Bank has already cut twice, the Bank of England once as well as the ECB).

What will the FED say and what effect will we have on the markets?

To answer this question, let's start with the macroeconomic environment.

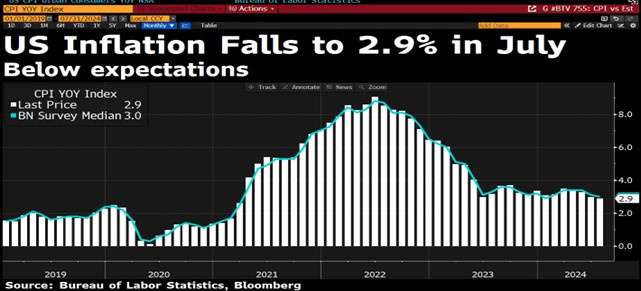

First, the data are confirming that inflation is coming back under control. Most sectors of the U.S. economy are experiencing deflation. Only fictitious housing prices are supporting the inflation data, which means that this data remains very lagging and real inflation is significantly lower.

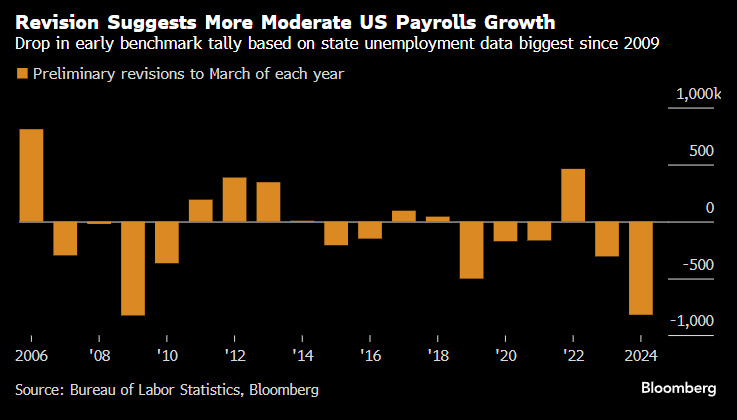

Secondly, we turn to economic growth. The growth data show us that the U.S. economy is experiencing a slowdown. The labor market is slowing, with the unemployment rate rising from a low of 3.4 percent to 4.3 percent. Labor slowdown also highlighted by the downward revision of the number of workers on payrolls by 818,000 for the 12 months through March-or about 68,000 fewer each month-according to the Bureau of Labor Statistics' preliminary benchmark revision, the largest downward revision since 2009.

In light of these considerations, we expect the FED to shift its focus from inflation to growth and start with cuts as early as September.

What can happen in the markets if they cut rates?

But does it make sense to focus too much on macro data?

In our opinion it makes little sense. Instead, it is necessary to prepare the portfolio, having the right margin of safety to deal with whatever scenario may come. Because it should not be forgotten that no one knows whether we will have a soft landing or not.

To prepare, we believe there are leading sectors and companies at a steep discount that have already experienced a recession. These companies will be able to face any scenario that will come with a margin of safety that is far greater than the market.

Which companies are we talking about?

We are talking about mid-cap U.S. companies belonging to the agricultural, consumer discretionary and even non-discretionary sectors. From John Deere to Ulta Beauty via Brown and Forman (just to name a few).

But we are also talking about European companies such as those in the luxury sector that have already suffered a major Chinese and European slowdown, such as LVMH.

Not to forget China where valuations have reached a relative discount to the U.S. (China PE is half the U.S. PE), seen few times in history:

To learn more about the opportunities listen back to the last webinar.

In conclusion, to prepare for the future and the uncertainties that will come, we believe the key is the margin of safety, that is, investing in sectors, companies that have a valuation discount and where investor expectations remain low.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.