Growth fears: markets under pressure

04 March 2025 _ News

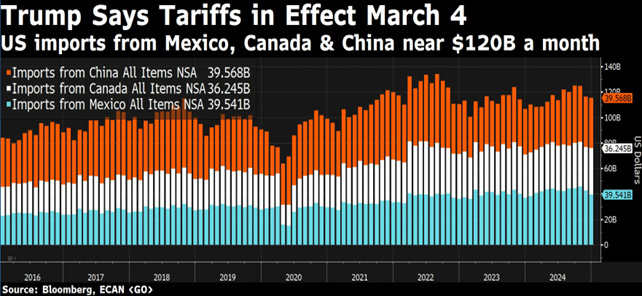

Financial markets continued to send out mixed signals, particularly in the US where fears of a slowdown in growth dominated sentiment and global equity markets ended the week down around 1%. In the US, the continued announcement of new executive orders by the Trump administration has created some noise and confusion, and uncertainty in the markets, particularly on the topic of tariffs. Trump announced that tariffs on Canada and Mexico will come into effect on 4 March instead of 2 April, while China will see a further 10% increase on existing tariffs, with investors beginning to anticipate a possible scenario of slowing economic growth.

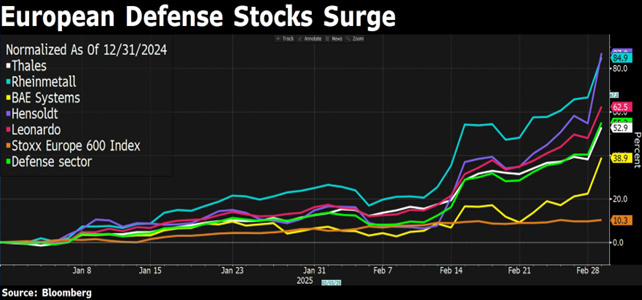

Markets were also rattled by Friday's meeting in the Oval Office between Trump and Zelensky, who made Europe's strategic independence a priority.

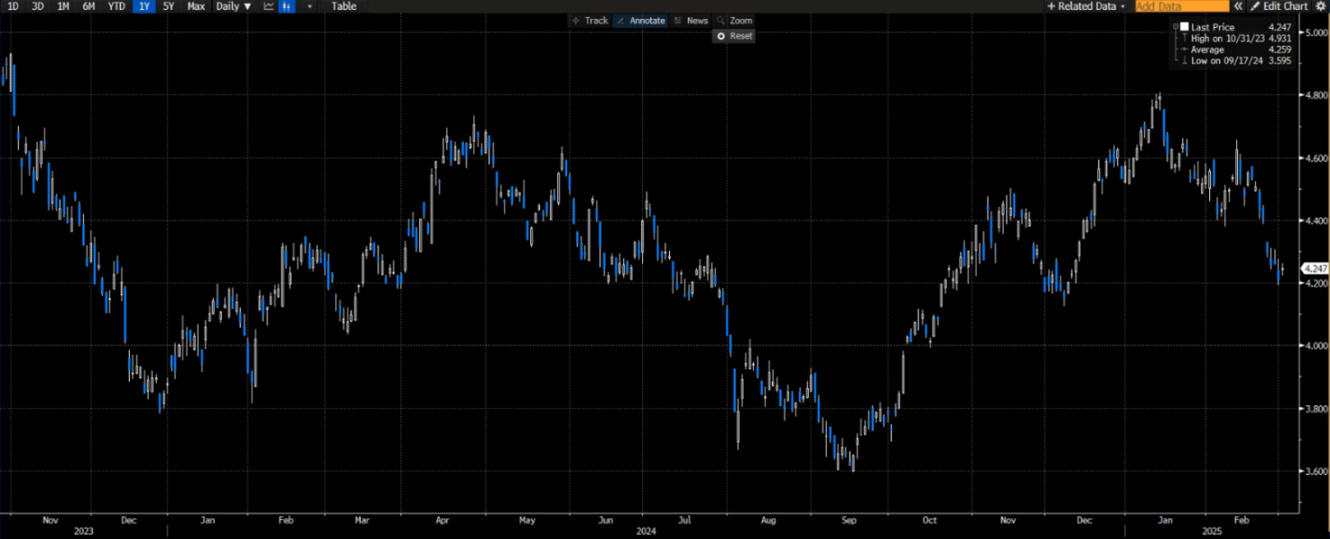

US government bonds in particular benefited, with the yield on Treasuries reaching 4.2%, now down for five consecutive weeks.

Finance Minister Bessent emphasised that lowering long-term interest rates was one of the goals of the new government. However, this dynamic was greeted with scepticism by the market, which fears that the reduction in yields is more related to a cooling of growth than to an effective monetary support strategy. These concerns were reinforced by the consumer confidence figure, which fell to 98.3, well below expectations of 102.5. The decline reflected a more pessimistic mood among consumers, who expect the economy to slow and inflation to pick up.

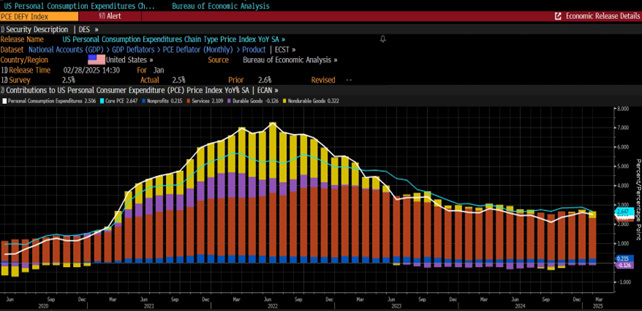

Macroeconomic data is not yet pointing to an imminent recession: annualised US GDP for the fourth quarter came in at 2.3%, in line with expectations, and durable goods orders were good, coming in above expectations. On the other hand, the labour market showed higher than expected jobless claims, but not yet in worrying territory. The most anticipated data of the week was certainly the PCE, the Fed's preferred measure of inflation, which came in line with expectations on both an annual and monthly basis.

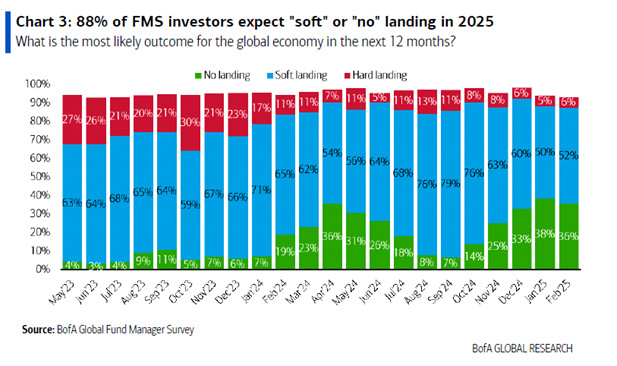

However, despite the macro data being broadly in line with expectations, the market seems to be more focused on the risks of a slowdown and whether Trump 2.0 could depress the economy before stimulating it. This is a reminder of how quickly market narratives can change when we consider that according to Bank of America's fund manager survey published last week, only 6% of managers surveyed considered a recession to be one of the possible scenarios for 2025, while 36% (at the highs of the last two years) did not expect a slowdown.

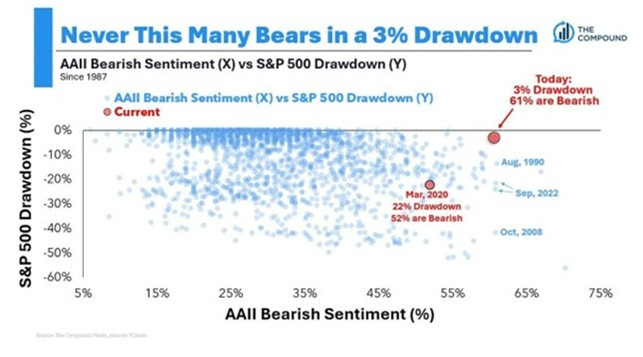

Equity investors have also become very cautious in recent days. The American Association of Individual Investors (AAII) sentiment survey showed that 61% of respondents were bearish, the highest level ever, compared with a market drawdown of just 3% from the highs. In essence, people have never been so afraid of such a small correction in market prices. A widespread pessimism that can be interpreted as bullish from a broader contrarian perspective.

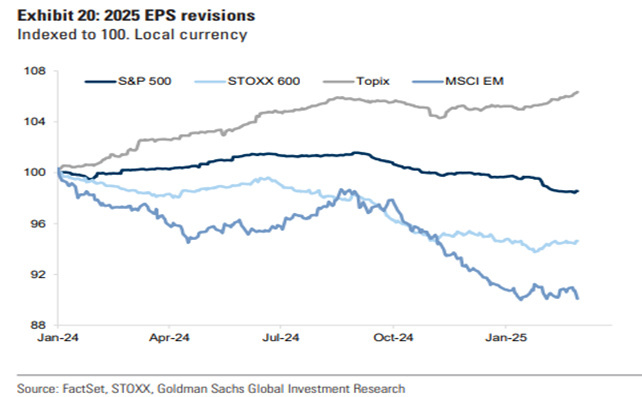

The earnings season continues to show a stronger trend for European companies than for US ones, not so much for 2024 results, but especially for 2025 expectations, where European companies gave better indications, partly thanks to the dollar helping exporters and less challenging expectations than their overseas counterparts. The result is a diverging trend in earnings estimates for 2025, with a slight upward revision in Europe and a slight downward revision in the US.

In the US, there was a lot of anticipation for Nvidia's quarterly earnings report, which showed very good numbers and growth of over 50% across the board, but as always in the markets, it is not so much the results that matter but the expectations, which in Nvidia's case were (and still are) very difficult to beat, so the stock took profits and fell over 8% the day after the numbers were released.

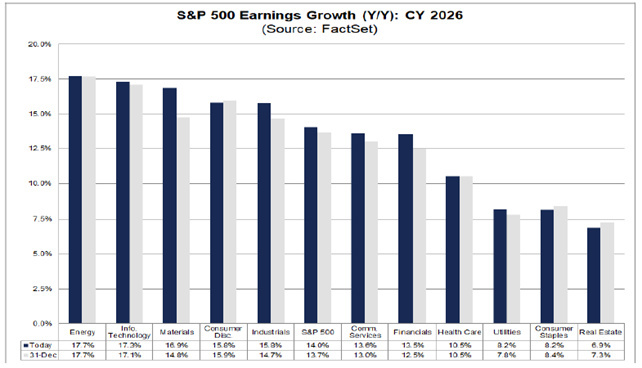

The US earnings cycle remains strong, as we have highlighted on several occasions, with Q4 earnings up 13% year-on-year, but the risk of overvaluation based on unrealistic estimates exists and is real. Analysts are forecasting earnings growth of around 13% a year for the next two years, which is not impossible but would require a dramatic acceleration in economic growth. However, the current macroeconomic conditions - characterised by tariff tensions, cuts in government spending and a slowdown in the labour market - make this scenario difficult. As a result, a downgrading of estimates, which we are already beginning to see in the US, is perhaps more likely in the short term.

The market's attention seems to have shifted to international markets, namely Europe and China, where we are also seeing upward earnings revisions. The MSCI Europe index is up more than 10% year-to-date, as expectations grow that Europe has no choice but to look after itself economically and geopolitically. This means much more spending on defence and supply chains in general, with investors discounting a more proactive industrial policy and rewarding defence stocks in particular.

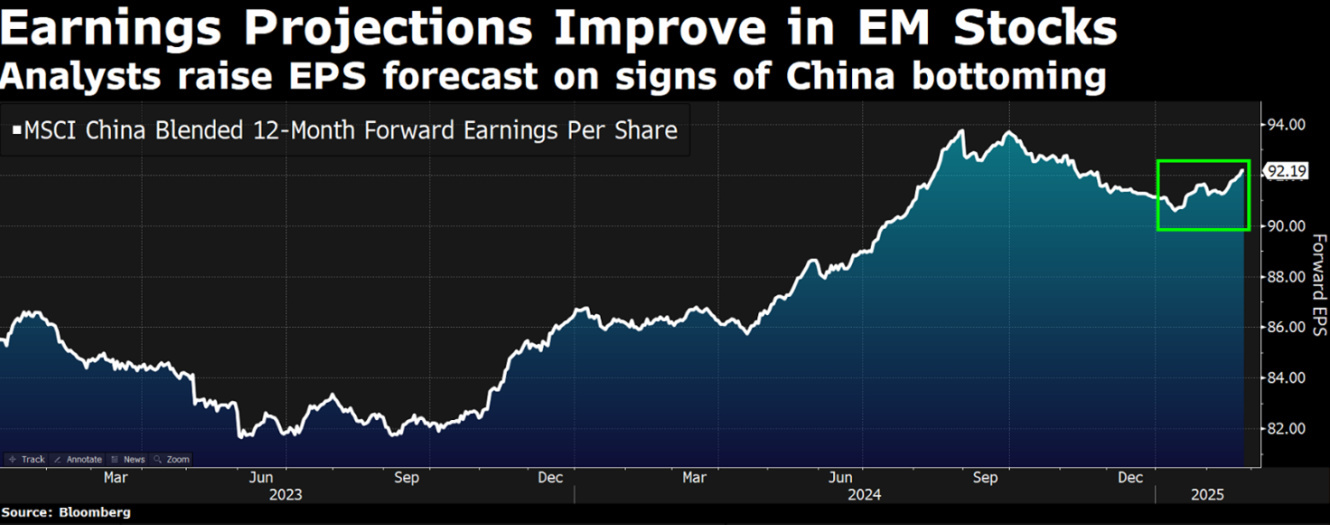

China has also woken up. The MSCI China index is now back to where it was last year, when talk of stimulus began, and the forward P/E is up 4 points from its 2024 low.

In summary, the mix of falling bond yields, a flat curve and equity selling signals that the slowdown theme is back in market valuations. The next phase will depend on how the Fed and the administration respond to these pressures. Uncertainties remain high as earnings growth expectations remain challenging for many sectors, particularly in the US market.

Caution will be the key to navigating the current macro uncertainty, and we continue to avoid areas of the US market where expectations remain very high, favouring an allocation to defensive sectors in the US that are at a valuation discount. More generally, we continue to favour international markets over the US, with opportunities in China and Europe, where valuations are more reasonable and earnings are being revised upwards, which could further support their recovery.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.