FED and ECB: Monetary policy challenges between cuts and inflation

06 June 2024 _ News

With the reporting season now over, resulting in yet another upward revision of earnings growth estimates by analysts, dominating the scene in the markets in recent days has been the release of various macro data along with rate decisions by a number of central banks including the ECB.

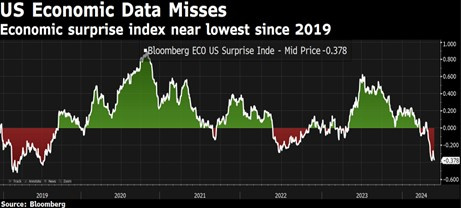

The macro data coming out have averaged below expectations, with economic surprise indexes at their lowest since 2019, and it seems to be starting to create suspicion in the markets that a sharp slowdown in the U.S. economy may be underway.

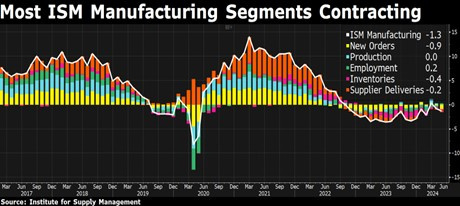

Some soft data such as the PMI or confidence data such as the ISM were found to be deteriorating, as well as bad indications came from some labor market data with lower ADP and Jobless higher than expected.

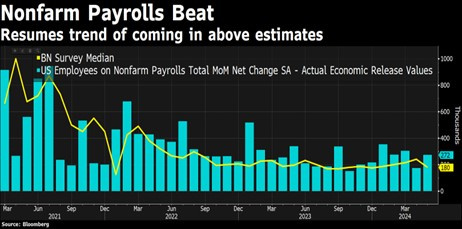

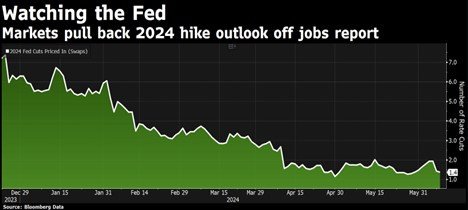

However, we also had other labor market data that surprised instead by their strength: in particular, last Friday's payroll data for the nonfarm sector came out at 272,000 well above expectations of 180,000 and the so-called whispered data that expected 165,000.

A very strong figure, accompanied, however, by the usual downward revision of the previous month's figure along with an above-expected unemployment rate and higher-than-expected wage growth, in an extremely complex set of data to decipher that on average came in lower than expected, but when read individually appear very controversial and capable of totally changing the markets' narrative between data. The market until two weeks ago was lining up for a no landing but is now beginning to discount some form of soft landing, with a real risk it could become a hard landing, however, if the Fed delays too long on rate cuts.

The reality is that reading macro data is now more complex than ever, and the data themselves are becoming, in truth, less and less reliable-simply consider that many data are either extensively corrected by statistical algorithms or seasonally adjusted before being presented. To make matters worse, the same data are often revised in subsequent months, causing the reliability of the data themselves to be lost. Not to mention the data constructed by doing surveys, which are increasingly numerous and are considered by many economists to be no longer credible. Macro data makes it extremely difficult to read the present reality, and this is true not only for investors but also for central banks, which, however, depend on this data in their monetary policy decisions, on which in turn investors seem very sensitive in directing their investment decisions. It is a vicious cycle of nonsense for the rational investor who is aware of this unreliability of macro data and instead relies on a more statistical reading of history and looks to the future through the eyes of companies that during earnings season are able to offer very interesting insights into business developments and trends in demand and the economy in general.

History teaches that the reading on business performance, provided by the CEO or management team of a company who have been in that industry for decades or generations and know every little nuance of the industry, is much more reliable than any macro data.

From this point of view, we have been highlighting for many weeks now several companies, especially in the consumer discretionary sector, that in commenting on their quarterly results have shown a deterioration in growth that in some cases has already translated into profit warnings. A deterioration in growth that should not come as a surprise, as it would be perfectly in line with what has always happened in history, where there has always been a time leg between the transmission effects of monetary policies and economic growths.

Speaking of economic growth, the deterioration of GDP Now calculated by the Atlanta Fed is causing much discussion these days. The GDP "Now" is a real-time estimate of U.S. gross domestic product growth as measured by the Atlanta Fed, and it is considered a very reliable indicator of ongoing growth. This estimate now stands at 3%, but what is surprising is that it had come in at 1.8% compared to 4% just 2 weeks ago. A trend not very much in line with the no-landing narrative and the very resilient consensus economy until last week.

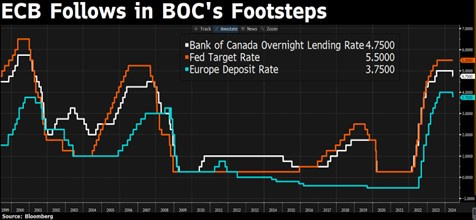

It was also the week in which the ECB, after the Chinese central bank, the Swiss central bank, and also this week the Canadian central bank, initiated the long-awaited rate cut. The ECB made good on its promise and delivered to the market a 25-cent interest rate cut for the first time since 2019, but again the markets were somewhat surprised by the hawkish tones used in the official statement and during the press conference in which Lagarde revised upward her inflation estimates for the next two years and gave no indication of the future path of rates, stating that they will evaluate meeting by meeting based on the data they collect and that they will keep official rates sufficiently restrictive for as long as necessary until they reach the 2 percent inflation target. This led market expectations to incorporate the next cut in September with 55 percent probability, with a subsequent cut in December with 52 percent probability.

We were talking at the beginning of the article about the upward revision of earnings estimates by analysts in response to the good reporting season. Our sense is that sooner or later the market will begin to realize that overly optimistic expectations are being discounted on some stocks, and this will not be taken well by large-caps trading at unsustainable valuations and weighing heavily in the overall market growth expected by consensus for year-end. We expect to start seeing the fundamentals of U.S. large-cap companies face more pressure, which will result in downward revisions for those stocks and sectors where expectations are now too generous.

When fundamentals begin to creak, they are typically driven by deterioration in revenues before earnings, and this quarter marks the third in a row where there are negative surprises in terms of revenue growth.

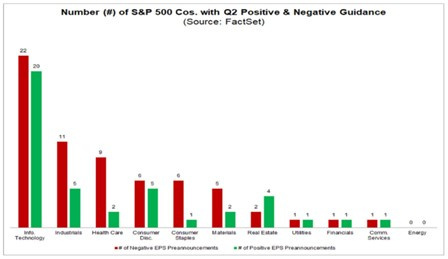

This scenario of possible deterioration in earnings growth also seems to be supported by the latest guidance provided by U.S. large-cap companies, with 64 companies reporting negative guidance for 2Q24, a number that is higher than the 5- and 10-year averages, with 1/3 of the negative guidance being issued by the Tech sector.

The good news is that there also remain many areas of undervaluation in the markets, which geographically we continue to see in Europe, UK, in U.S. small caps, not to mention China.

We continue to see large undervaluations in some of the more defensive sectors and in business models that are easier to understand (such as the non-discretionary consumer sector). We believe that selectivity within equity markets is now more critical than ever. Less selective because the opportunities are wide-ranging in the government world, where we see great value in duration on which we expect significant benefits for portfolios in the coming months.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.