Equity and bonds: between perception and reality

18 January 2024 _ News

Earnings season has begun and we are coming into it with a macroeconomic backdrop of a general slowdown, with interest rates starting to weigh on companies' growth forecasts.

Macroeconomic situation

The macro context of slowdown is well described by the analysis on the following three aspects:

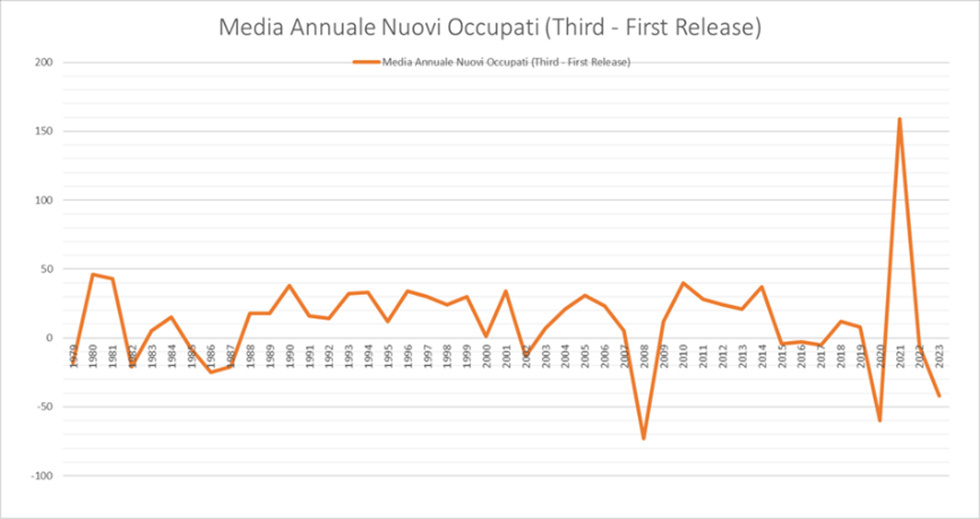

- Labour Market: at the beginning of the month, the labour market data showed that the labour market is resilient, but there are some interesting considerations to be made. In particular, the differential between the first data released on new jobs and the revision made in the following months is little discussed. In fact, in 2023 we had a negative revision of the first data seen only in 2008 and 2020, since 1979. This stems from the fact that the first figure also had economists' estimates in it that were a bit too high. This has led the market to have a perception of labour market strength that is different from reality.

- Inflation: last week's inflation data showed the continued decline in prices. While the consumer price index seemed more resilient than expected, but still declining, the producer price index, PPI, even showed deflation, highlighting a negative month-on-month change of -0.1%. Thus, the message was a continued decline in the price level, generalised across all countries. China, for example, has continued to show deflation for several months.

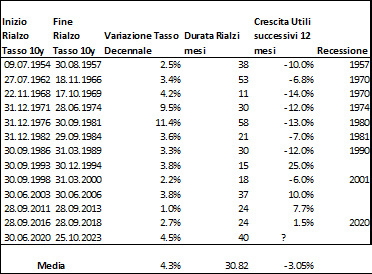

- Central Banks: At the beginning of the month, we had the FED's minutes and Lagarde's words highlighting how central bankers are aware of this macroeconomic slowdown and are intent on no longer raising rates, and are therefore starting to talk about when to cut them. When the cut will come, we don't know, however we would like to quote Powell's words which highlighted that it is too late waiting for inflation to reach 2%; it is important to act sooner because monetary policy has a time lag.

Earnings season

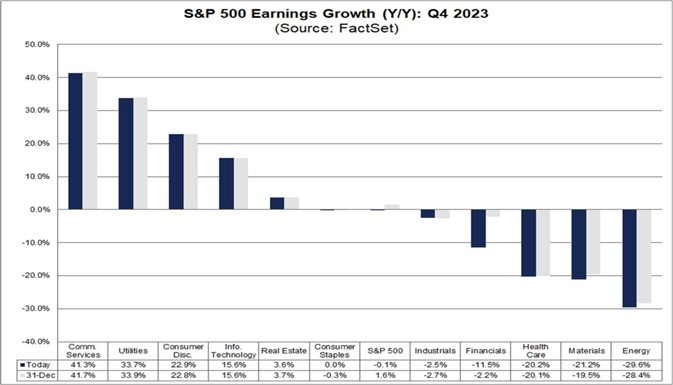

The fourth quarter earnings season got off to a weak start, with US companies reporting earnings 10% below estimates, mainly due to negative surprises reported by companies in the financial sector. These negative earnings growths brought forth-quarter earnings growth estimates to -0.1% from the +1.6% expected a fortnight ago (see chart below).

Here there are some of the major US banks:

- Wells Fargo reported earnings per share that, excluding some special assessments, beat the consensus estimate. The positive results were driven by higher net interest income, higher fee income, lower loss provisions and a lower tax rate, partially offset by higher operating expenses and more shares. Guidance was lower than expected and this penalised the stock.

- Bank of America reported higher-than-expected earnings per share and better-than-expected provisions, in-line expenses and worse-than-expected fee income. At the same time, unrealised losses improved and guidance exceeded analysts' estimates.

- JPM reported better-than-consensus earnings per share led by net interest margin and better-than-expected expenses. Its outlook for 2024 includes a higher-than-expected net interest margin. JPM's purchase of First Republic was included for a full quarter in both 3Q23 and 4Q23.

Value view

In this context of economic slowdown and falling inflation, it is normal to expect weak earnings guidance, which certainly has to deal with the high level of interest rates. However, history teaches us that earnings tend to slow down with high rates (see chart below).

We therefore believe that the investor should not be surprised by this decline in guidance but continue to focus on the value that is always present in the market, especially in certain sectors and markets compared to others, which have less margin of safety. In the US, we continue to favour sectors such as utilities-financial-communication, non-discretionary consumption and health care. In particular, the health care sector, after having experienced a recession in 2023, is showing a lot of value and this allows the sector to be the best performer so far, with +3%. In Europe, however, we prefer non-discretionary consumption, health care, real estate and discretionary consumption, particularly luxury.

Conclusione

In conclusion, we are entering earnings season and we are in a situation where reported earnings are still good, but with companies that are lowering guidance because interest rates are starting to bite. This pressure, for now, is not being felt so much on companies but rather on consumers.

To deal with this slowdown, we believe it is crucial to focus on value, both in equities and bonds. Value that leads us to overweight sectors and companies that are already priced into the slowdown and to lengthen duration on bonds.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.