Deepseek vs. Big Tech: the AI challenge between the US and China

27 January 2025 _ News

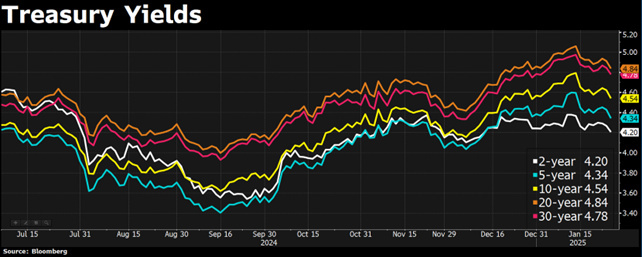

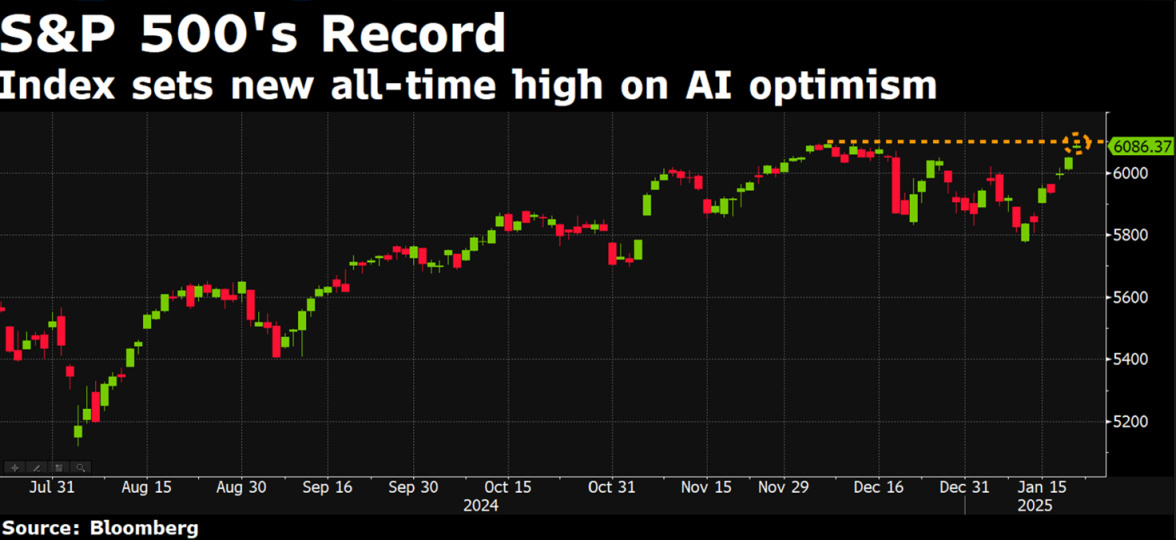

It was another positive week in the financial markets with stocks and bonds both rising and new highs for theS&P500.

In the absence of significant macro data, the anticipation was all about the inauguration of Donald Trump, who was sworn in as the 47th President of the United States on 20 January. In his inauguration speech, after announcing the beginning of a new golden age for the USA, he presented a series of policy measures that he intends to pursue with his administration. To tell the truth, all the executive measures he presented were widely expected by consensus, and the fact that on the first day he did not immediately announce any new tariffs was very positively received by the markets, which currently see tariffs as the element of greatest uncertainty compared to tax cuts and deregulation, which are the areas of intervention viewed positively. Other announcements include no more wars around the world, a return to traditional US values, no more media censorship and freedom of thought, an end to illegal immigration and an end to the political use of justice. An end to all woke and gender policies, No more green cars (despite Musk), no more green policies, full energy autonomy from fossil fuels, military investment to defend the country. Also noteworthy was Trump's speech in Davos, where the new president called for lower interest rates (not only in the US, but globally), urged OPEC to lower oil prices, and urged that the war between Russia and Ukraine be ended as soon as possible.

The presence of the CEOs of all the magnificent seven at the Trump inauguration did not go unnoticed. On the contrary, the CEOs of Meta, Amazon, OpenAI, Google, X side by side in the front row represented the prelude to a new relationship between the American administration and the big technology companies. A relationship that the president was not slow to establish, announcing the birth of Stargate: a gigantic new artificial intelligence project that translates into a 0 billion joint venture that aims to build key infrastructures for AI development with a plan that will run from now until the next four years and will start with 100 billion in investments. The joint venture is a collaboration between OpenAI, Oracle and Soft Bank But it is not excluded that other investors interested in the massive construction of data centres around the United States, which are fundamental to managing the enormous amount of information and computation required for artificial intelligence to function, will join it. Among the measures anticipated by the president are also ‘emergency’ ones, to enable Stargate to generate electricity and have access to reservoirs.

Trump thus throws down the gauntlet to China claiming that he wants to return America to the position of global leader in technology. A leadership position embedded in market expectations that has allowed the Nasdaq to grow at 20% per year since 2018 compared to zero growth in Chinese tech.

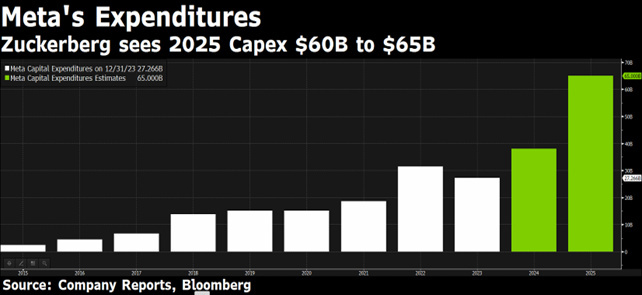

From China, however, comes the answer immediately, over the weekend, and it goes by the name of Deepseek, potentially creating a kind of mini black swan in the markets. This Chinese company has just shocked the tech industry by reportedly announcing that it has spent only .6 million in just two months to develop an artificial intelligence that has already outperformed US rivals Meta and ChatGPT. Meta, which the day before had announced to the market a significant increase in capex by 2025.

From China, however, came the answer immediately, over the weekend, and it is called Deepseek, potentially creating a kind of mini-black swan in the markets. This Chinese company has just shocked the technology industry by announcing that it has spent only .6 million in just two months to develop an artificial intelligence that has already surpassed US rivals Meta and ChatGPT. Meta, which the day before had announced to the market a significant increase in investment by 2025.

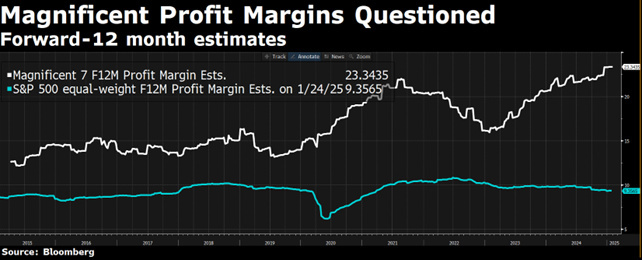

All this is happening on the eve of the start of the earnings season for many big tech companies that will report in the coming days and on which there are very important earnings growth expectations that are likely to be disappointed.

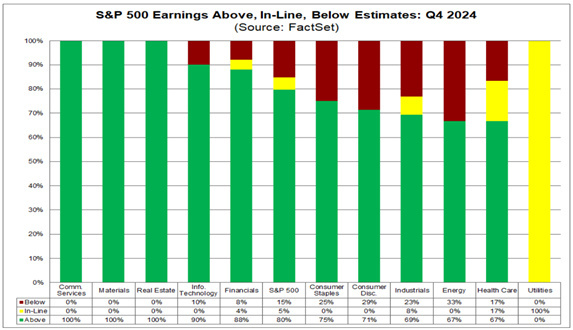

Indeed, the fourth quarter earnings season is underway with 30% of the market reporting so far and 80% of companies exceeding estimates.

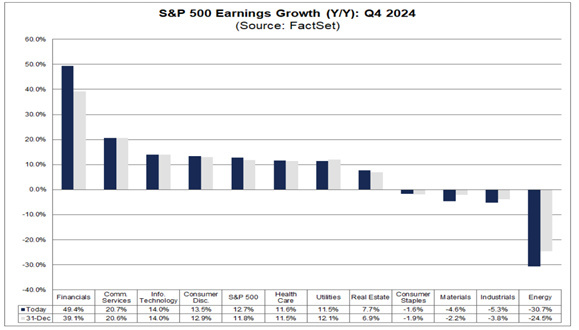

It is still too early to draw conclusions, but the odds seem to be that the quarter is well set to close with good year-on-year growth, with expectations now for +13%.

The earnings cycle remains well set, and having started less than two years ago it is expected to continue, although the resilience of these expected growth rates, which remain well above traditional averages, remains to be closely monitored, and with the news on DeepSeek potentially representing that new narrative leading them to be revised downwards.

Overall, we are still within a cycle of rising earnings and a bullish market. This suggests that there could be good performance, but at a less impulsive pace than we had in 2024. Earnings will have to do the bulk of the work (and they are doing it), but the most debated issue seems to be less about earnings and more about valuations at this point.

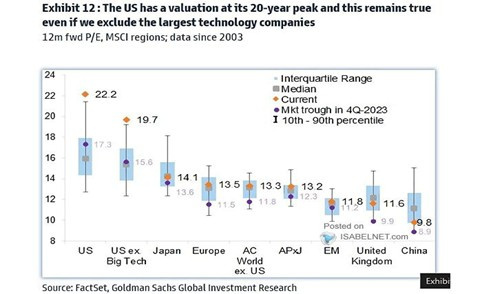

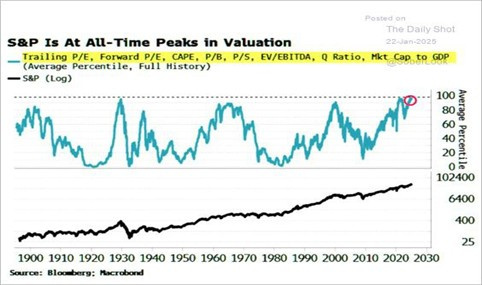

Here the considerations are always the same, i.e., the United States has reached a peak in valuations which, according to some analyses examining a basket of valuation ratios, would see American equities at their historical peak in valuations, while the same analyses would show China at a deep discount and Europe at an average valuation.

We now know very well that valuations do not historically impact performance in the short term, but in the long term they become essential in driving returns.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.