Between contrasts and opportunities: The outlook for equity and bond markets

20 November 2024 _ News

The rally in global equity markets has paused, with US markets in particular continuing to digest the post-election gains. This is not at all surprising, as the initial post-election rally was very fast and strong, which normally requires markets to consolidate. Suffice it to say that in just a few sessions after the US election, the market had already rallied almost 5%, fully pricing in the impact of the potential tax cut on corporate earnings. Meanwhile, the nervousness in the bond world continues, with interest rates generally on the rise.

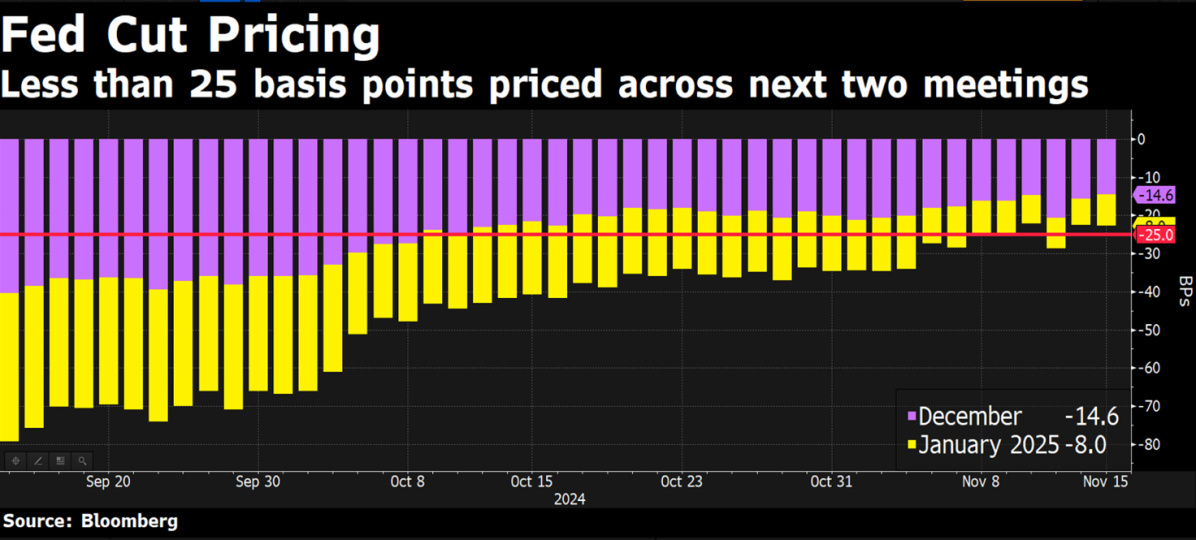

Equity markets were also weighed down by Powel's words from Dallas, warning that the Fed was in no hurry to cut rates as the US economy remained strong. As a result, the market priced in a 55% chance of a rate cut in December, down from 80% previously, and also increased the odds of just one 25 cent rate cut by mid-2025.

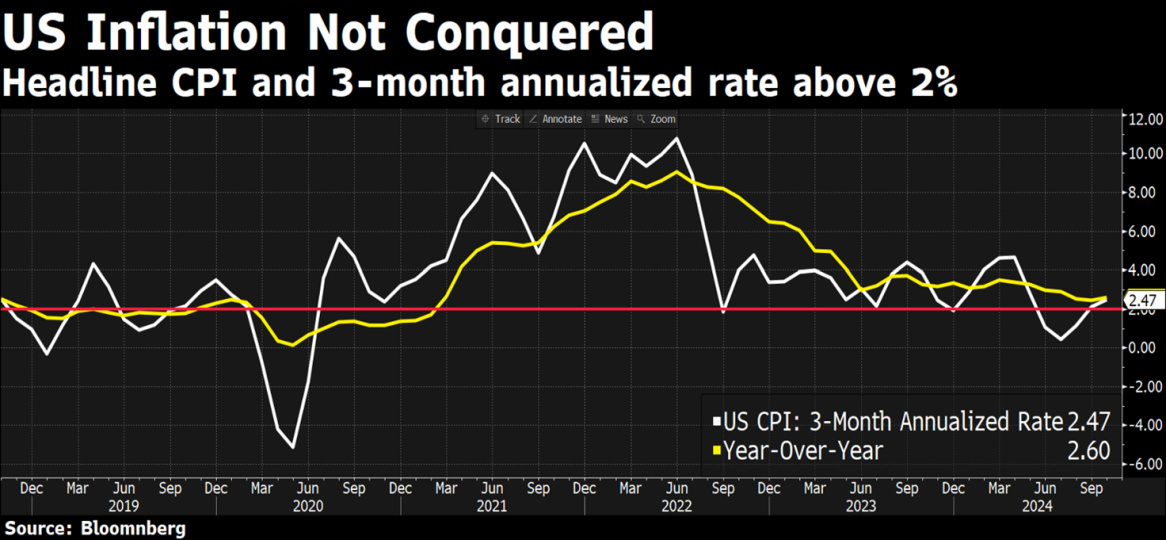

On the macro front, we saw that US inflation, as measured by the CPI, came in in line with expectations, allaying some latent fears in the bond market that it would come in above expectations. However, the PPI figure, which measures inflation on the production cost side, was slightly above expectations. Finally, initial jobless claims came in at 217,000 versus the consensus of 224,500, pointing to a resilient US labour market.

Beyond the near all-time highs in equity indices, which would suggest a simple reading of the markets, the reality is that we are experiencing a very complex period with many apparent contrasts, which we will now highlight.

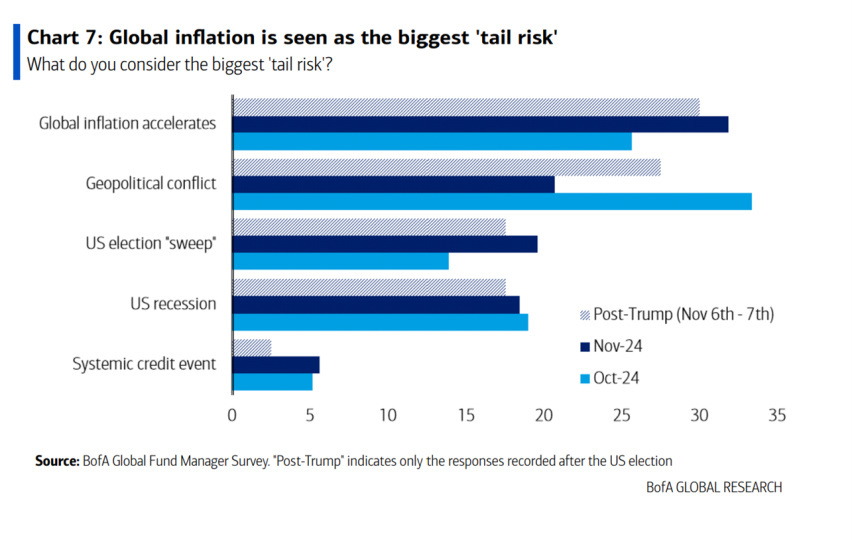

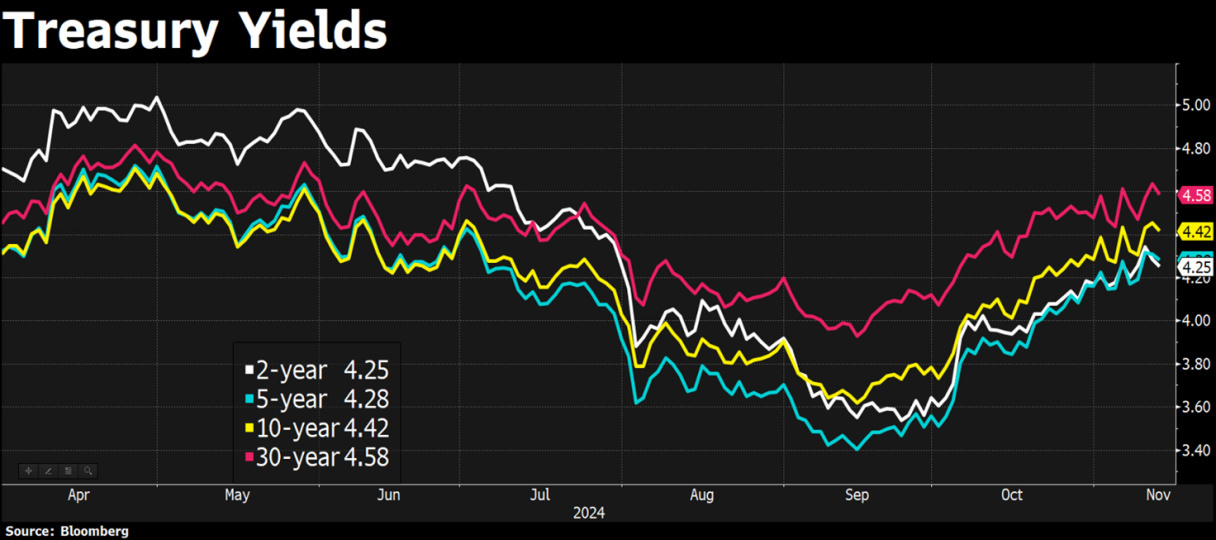

While the market narrative has focused on the Trump trade, bond yields have continued to rise, with the 2-year now at 4.35% and the 10-year approaching 4.45%. Both were at or below 3.6% just 6 weeks ago, certainly an extraordinary move in a very short period of time and driven by a significant increase in new inflation risks, with inflation returning as the main risk in the eyes of investors.

Ma, mentre i rendimenti obbligazionari sono aumentati, i mercati azionari si sono spinti su nuovi massimi ignorando finora l'aumento dei tassi, e questo scenario potrebbe continuare se il decennale Americano si mantenesse sotto il livello anche psicologico del 5%. Ma i rendimenti contano davvero ed anche le azioni potrebbero finire sotto pressione a un certo punto se il decennale dovesse arrivare a toccare il 5%.

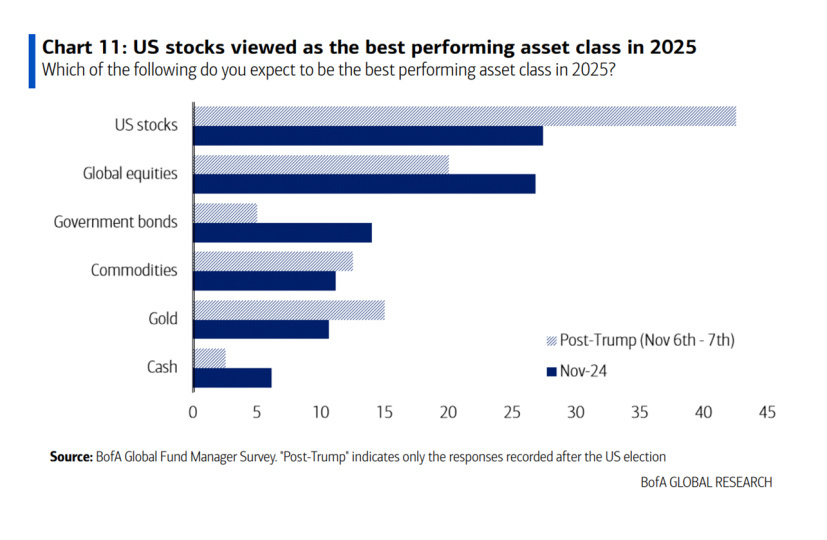

This sense of great optimism towards the US is also well represented in Bank of America's November fund manager survey, where when asked what they see as the best asset class for 2025, 45% of institutional investors said US equities, up from 25% before the election.

The key point for investors is to be aware of the short-term risks in an overall overvalued US market, despite a stronger long-term bullish outlook driven by a still-extending earnings cycle and sectors within the market that have already experienced an earnings downturn. We continue to take a closer look at those sectors that have a reasonable margin of safety and where expectations are on the low side.

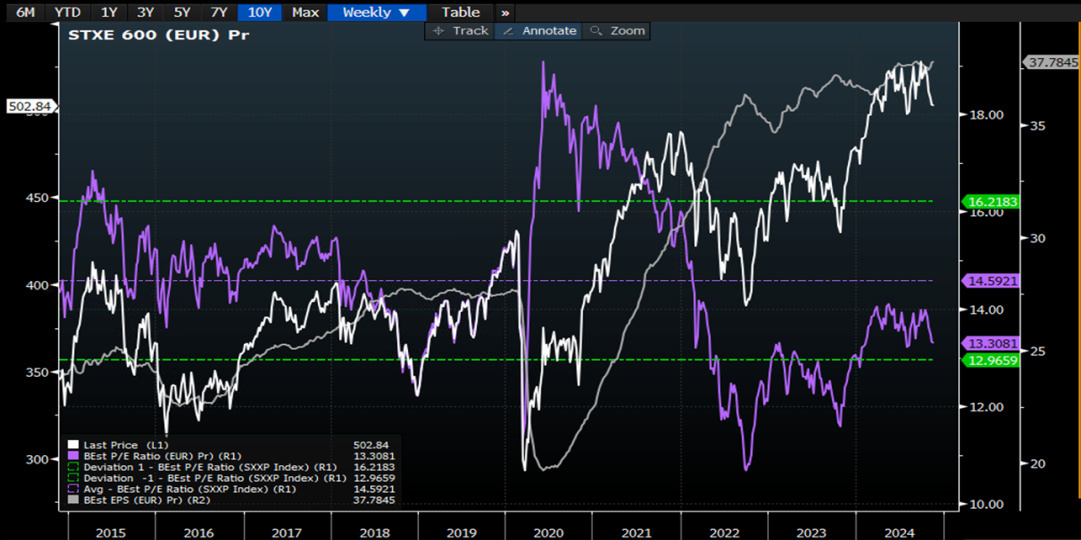

The situation in Europe, on the other hand, is very different, with an economy in obvious trouble, which will have to deal with the new Trump-imposed dazzi, and a much less attractive economic growth and corporate earnings environment than in the US. Against these negatives, however, we have valuations that are at an all-time high discount to US valuations, with a P/E ratio of 13.5 at the low end of the 10-year range, compared with 23 in the US, a 40% discount, with some particularly interesting sectors such as consumer discretionary or luxury goods, which are experiencing one of the worst valuation and earnings recessions in their history.

As in the case of the overvaluation of the US market, here too no one can know the moment when investors will return to discover these sectors, the consensus may continue its path of cutting estimates for a while longer, but we know the consensus is always lagging and the market is easily surprised positively when it discounts the worst. This is the case of Burberry stock, to give an example, a company undoubtedly in trouble suffering from strategic and managerial errors, which reported results in line with expectations recording a 20% drop in turnover combined with operating losses, but which were greeted with a 20% rise in the share price. In fact, with the stock losing about 70% from its highs and profits reduced to zero, and with all the analysts (hence the consensus) advising a sell-off and continuing to cut profits, it is not difficult to think that it would take very little to make the stock rise again and violently reverse course. A great deal of patience is needed, however, and an awareness that not only is it impossible to take the lows, but that you are also very decoupled from a market that may continue to reward the usual stories and narratives for a long time yet before paying you back.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.