The third quarter point

16 August 2024 _ News

We are almost halfway through the third quarter with the stock market showing a slightly negative performance of about -2%. Let's look at the main past and future relevant factors.

1. Profits

Good profits, signs of slowdown from revenues.

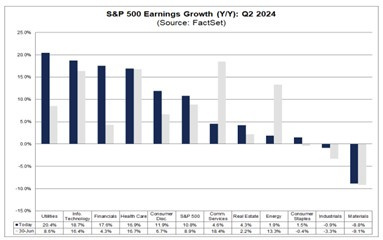

First, the earnings season has now ended, with about 91 percent of companies already reporting quarterly results, showing earnings growth of 10.8 percent, above expectations of 8.9 percent. The sectors that are driving earnings growth are Utilities, Technology, Health Care and Financials. However, if we go to analyze revenues, which are most often anticipators of future growth, we notice a different situation. In terms of revenues, 59 percent of companies in the S&P 500 reported actual revenues above estimates, which is below the five-year average of 69 percent and the 10-year average of 64 percent. So from a revenue perspective we see a slowdown in growth.

2. Sectoral Rotation

The third quarter began with a sector rotation, where the sectors with the largest valuation discount are outperforming the market. Real Estate, Utilities, Consumer Staples, and Healthcare are indeed showing very good valuations, and we expect this outperformance to continue. What could be the trigger for continued outperformance? The characteristic discount valuation of these sectors should support them in the coming months where deteriorating economic data will also lead the FED to cut rates.

3. Macro Data

Key macroeconomic data are disappointing expectations. This is evidenced by both the various indices of economic surprise, CESI, and the LEI index, which has returned to 2016 values.

This week we will have the U.S. inflation data which should confirm the economic slowdown.

4. Central Banks

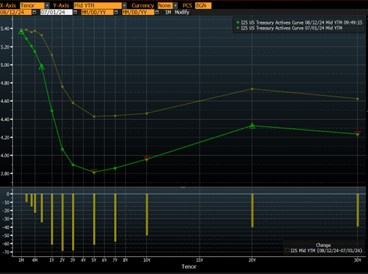

Excluding the FED the major central banks in developed countries have already cut rates. ECB, Swiss National Bank (even twice), Bank of England all have started the process of cuts. Toward the end of the month we will have the major Central Bankers meeting in Jackson Hole where we expect confirmation from the FED of the September cut. As we see from the chart on the right since the beginning of the second half of the year, the U.S. curve has had a reduction of more than 50 cents from 2 years and up. This shows us that investors' expectations are already moving toward a rate cut.

5. Valuations

The S&P500 continues to show an above-average valuation led by the weight of technology and large companies that have achieved very pulled valuations. The third quarter began with a slight market correction that, accompanied by an increase in earnings, led the multiple to correct.

For the coming months we prefer to focus on rotating the market toward those sectors and companies that have fallen furthest behind at a valuation discount.

Notable among these is the Chinese index, which is below 9x PE with earnings that after a sharp correction have started to rise again.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.