The stock market at a turning point: analysis of prices, earnings and expectations for 2025

26 November 2024 _ News

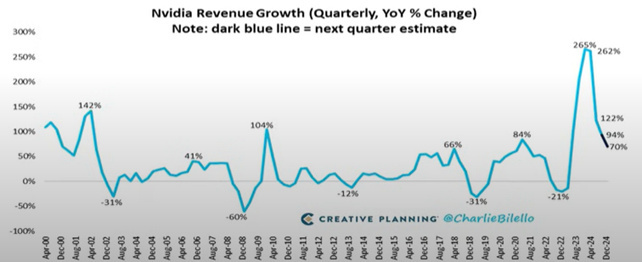

A week full of macroeconomic events, without any central bank intervention, and an earnings season that is now coming to an end, with only Nvidia's quarterly report to wait for. As usual, the leader in the production of chips for artificial intelligence reported exceptional figures, even better than estimates in some respects, with growth of almost 100%, but this did not excite the market, which began to see a gradual slowdown in growth.

Investors' doubts about the future sustainability of both growth and margins also increased, leading to a negative opening on the day after the results were announced and confirming the rule that market performance is driven by expectations, which, if they rise too high, pose a risk to investors.

However, Nvidia shares ended the session in positive territory and the release of this quarterly report effectively removes any potential uncertainty and therefore short-term risk for markets in general.

Overall, the week was characterised by slightly positive stock indices and the stabilisation of interest rates below 4.5% for the US Treasury and 2.25% for the German Bund, accompanied on the downside by the publication on Friday of the European PMI, which came in below expectations, and more generally by indices of deteriorating economic expectations, pointing to a European economy in difficulty.

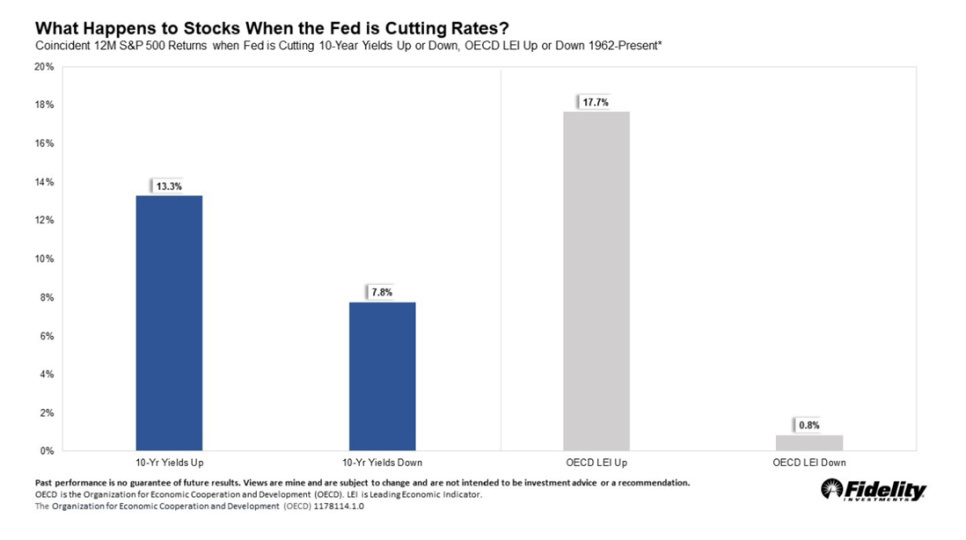

The absence of macroeconomic clues gives us the opportunity to look a little more closely at a very important dynamic in the markets relating to the bond world and, in particular, the rise in ten-year rates following the Fed's first cut in mid-September.

Most of the time when the Fed cuts rates for the first time, 10-year yields also fall. But higher long-term yields after the first cut are much more common than we might think, considering that in a 3-month period it happens almost 50% of the time that 10-year yields rise. Rising long-term rates are a little less common if we look at the 1-year period after the first cut, where it happens only about a third of the time.

There are always narratives in the markets that justify the rise in rates, as in this case, but if we look rationally, history tells us that it is not so strange to see long-term rates rise in the first few months after the Fed's first cut.

And one might be tempted to think that this event is bad for equities, but again, history shows just the opposite. 1962 shows that the market has produced better returns when long-term interest rates have risen after a Fed cut, and the reason is that when yields rise, economic growth tends to be better, so corporate profits are better.

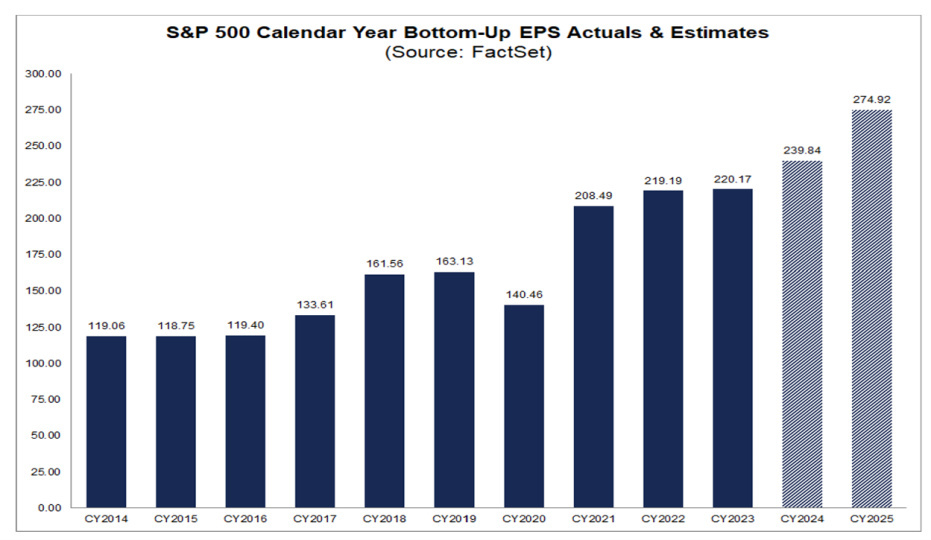

In fact, it is growth, and in particular earnings growth, rather than interest rates, that is driving the equity market. This is exactly what is happening at this stage of the market, where the consensus incorporates both significant economic and earnings growth, with estimates for 2025 earnings growth of 15%.

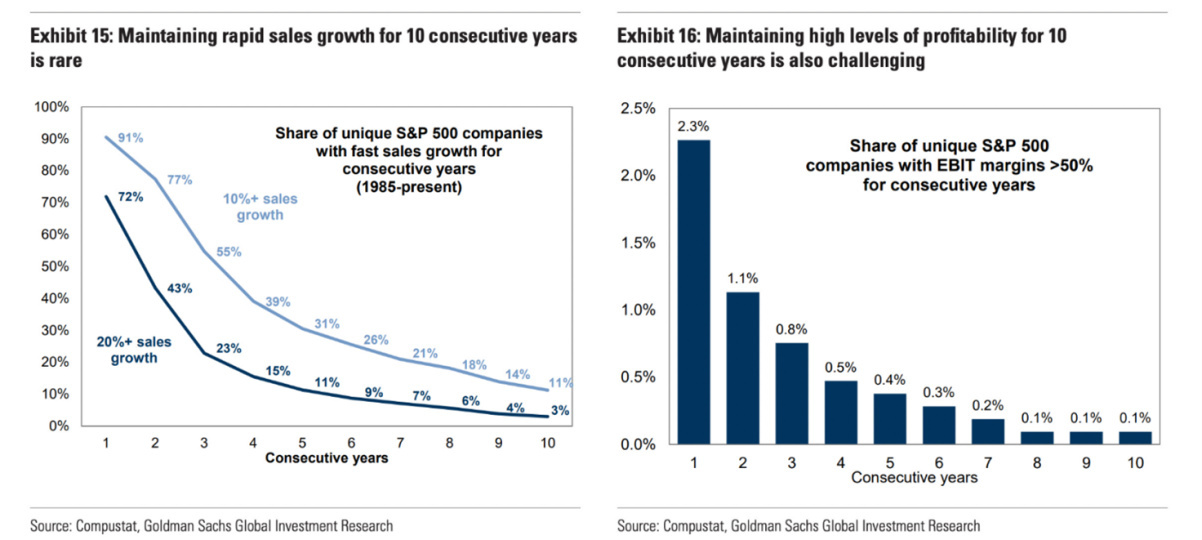

Earnings growth that we think is very challenging, or in any case already incorporates all the positive news related to the Trump presidency. The earnings growth estimates for the S&P 500 seem to us a bit like the Nvidia quarterly that we talked about earlier, exceptional growth and numbers, but short-term expectations fully priced in.

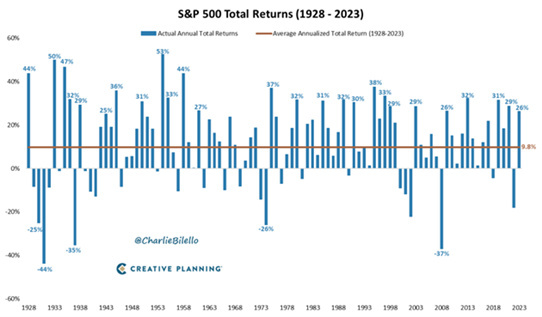

In the long term, the story is different: if you include dividends, the S&P 500 index is currently up over 25% in 2024, well above the historical average yield of 9.8%. 25% may seem unusually high, but it is actually much more common than you might think. The S&P 500 has closed with a total return above 25% in 26 of the last 96 years since 1928. That is 27%. But what if someone asks how many times has the S&P 500 Index closed the year down 25% or more? The answer is only 5% of the time, but achieving these returns requires a long-term view and the strength to stay invested while avoiding the pitfalls of valuation excesses.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.