Rationality pays off in times of panic

07 April 2025 _ News

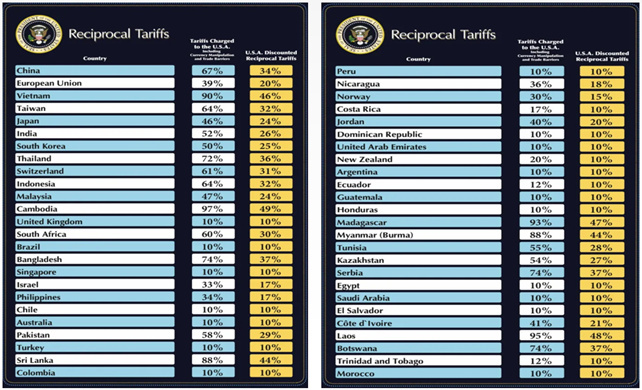

The issue that has captured investors' attention in recent days has undoubtedly been Trump's big announcement on trade tariffs. After weeks of anticipation and rumours, the Trump administration released the official statement on reciprocal tariffs: the new measures include a basic tariff of 10%, with rates rising to 20% for the European Union and 34% for China (i.e. a cumulative tariff of 54% including the existing one). It also confirms a 25% tariff on cars and car parts, in addition to those already announced for Mexico and Canada. There are concerns that these aggressive tariff increases could dampen global growth and increase input costs for US companies that rely on international supply chains. In response, the European Union has vowed to retaliate, while China says it will impose a 34% tariff on all US imports (incidentally, a slowdown in US Treasury purchases by China - historically one of the largest lenders of US debt - would be a far stronger response than any tariffs). South Korea's interim president is calling for negotiations, while Japan is taking a wait-and-see approach.

We are witnessing a clear escalation in the global trade confrontation, with potential implications for trade flows, geopolitical relations and the economic trajectories of major areas of the world, with these tariffs remaining in place until the White House deems the "threat" resolved. The stated aim is to rebalance trade deficits. The implicit risk is a global recession.

The market reaction has been violent, and it is understandable that perhaps the interim measures announced by Trump were expected to be useful in opening bilateral negotiations; instead, the American response has been sharper than expected and the Trump 2.0 tariff turmoil has triggered a stock market sell-off that is now in full swing.

The risk premium, which was at historic lows, is now soaring towards long-term averages, just as valuation multiples are rapidly contracting instead, always in a process of normalisation towards the averages. Volatility, as measured by the VIX index, has reached a level of 60 not seen since the flash crash of August 2024, and even earlier since Covid 19. In short, the excesses are now coming back, albeit in a disjointed way: it was not possible to predict that this comeback would happen because of the tariffs, but the process of normalising valuations towards the averages is one of the few rules that work in the markets.

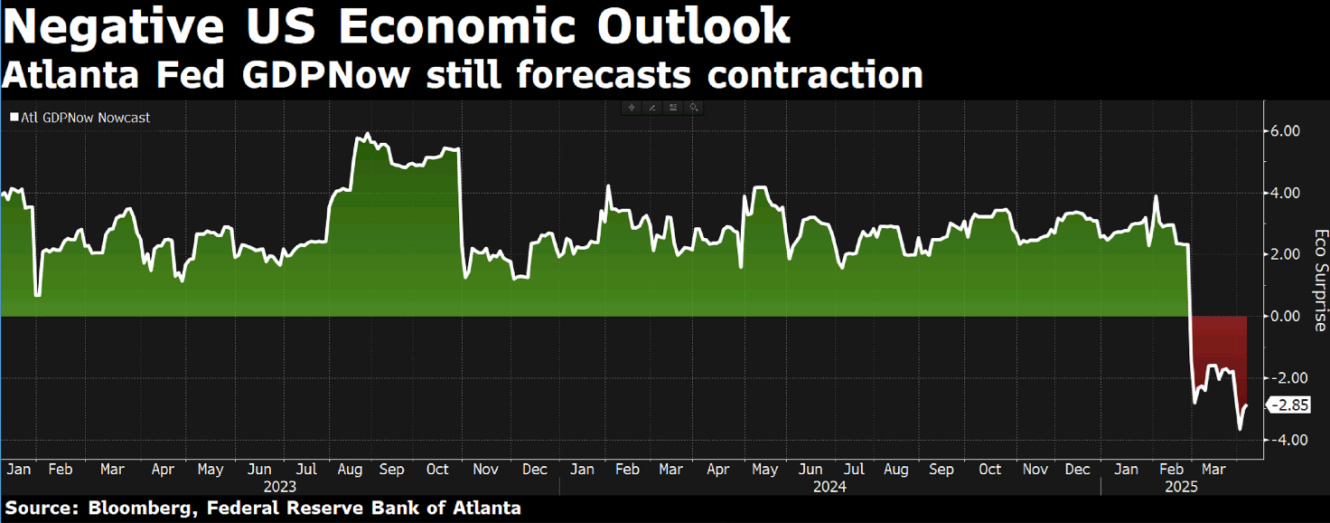

The Nasdaq is down about 25 percent from its highs and the S&P 500 down about 20 percent, so we are in the territory of what can begin to be called a bear market, with the yield on the U.S. 10-year falling below 3.9 percent and a generalized Fly to Quality with defensive sectors clearly outperforming as recession fears are now becoming more concrete. Inflationary fears do exist, but they would only be temporary and considered one-off by policy makers and especially by the Fed, which we believe will be ready to cut rates to address the economic slowdown. For now certainly, the Fed remains cautious. The Atlanta Fed's GDPNow-a sort of measure of real time GDP growth-shows U.S. GDP for the first quarter of 2025 slowing sharply to -2.8 percent and Estimates by some large investment houses indicate that the impact of tariffs could reduce real growth to -1 percent in 2025.

On the corporate front, it is really difficult to say how companies will react to the tariffs; in general, companies are considering at least five approaches to respond to the new scenario: relocating or expanding production in the US (but this will take time), passing on cost increases to end consumers (for companies with high pricing power), absorbing costs with a direct impact on margins, and lobbying for sectoral exemptions. It is important not to underestimate the ability of companies to surprise on the upside in the face of adverse scenarios, often managing to mitigate the negative impact, especially when the difficulties are industry-wide rather than company-specific. When we often talk about the durability of the business model of the companies we want to hold in our portfolios, we are also referring to the ability of management to adapt very quickly to exogenous changes and to maintain an important competitive advantage in any market environment.

We reiterate that what is happening in the markets, especially in the US, should be seen as a "painful" correction of some of the excesses (particularly in terms of valuation) that have been built up in recent years.

We have repeatedly pointed out the exceptionally high valuation levels of US equity indices, particularly in the technology sector, and the expectations of very generous and hardly sustainable earnings growth. At the end of 2024, the S&P 500 was trading at a multiple of almost 23 times earnings, with earnings expected to grow by 15% per year over the next two years, well above the historical average of 8-10% earnings growth and a multiple of around 18. We are now back to a multiple of around 17, just below average, and while we expect earnings growth (now revised up from 15% to 11%) to be further reduced by the new economic slowdown scenario, current valuation levels are starting to reflect the attractive earnings prospects expected over the next few years. Emotionalism seems to be taking over the market these days, we are seeing one-way selling and we are reading media descriptions of economically catastrophic scenarios, but it is at these times that we need to be guided by rationality and the realisation that this level of exposure is unsustainable for anyone for very long and it may only take one statement or one negotiation to bring calm back to the markets.

Certainly, in the short term, it can help to be selective and look for areas of the market where expectations and valuations have not been as high as in other sectors, and we are talking in particular about defensive sectors, which help portfolios a lot. On the bond side, we see an attractive opportunity in long-dated government bonds for patient and dispassionate investors. The yield on the 10-year US Treasury, for example, has fallen to 3.8% for the first time in six months, partly because the word "recession" is back in vogue and partly because, in a risk-off climate, a "safe" annual yield of around 4% on US government bonds is certainly a nice opportunity.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.