May 2024: Optimism is the enemy of the rational investor

31 May 2024 _ News

"Optimism fuels excess"

Optimism fuels excess

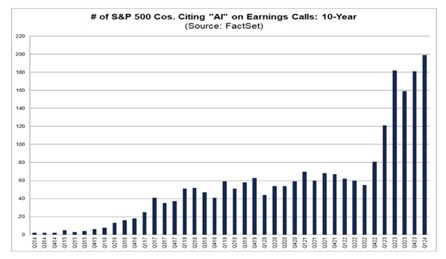

Our April commentary highlighted the return of gravity that had brought opportunities on leading companies at a valuation discount. In May we experienced a strong recovery in the stock markets that was driven by optimism.Optimism justified mainly by the earnings season that showed higher than expected growth. This optimism particularly affected some sectors, among all the technology sector, driven by expectations about the future of artificial intelligence (AI). AI that was mentioned a lot during the earnings season, with about 200 companies mentioning it in the first quarter 2024, and particularly in the tech sector where about 90 percent of companies mentioned artificial intelligence.

The sector that has benefited most from AI has been the semiconductor sector, since AI needs increasingly powerful and faster semiconductors to work. This has overly fueled market optimism by driving semiconductor valuations from 15x PE at the end of 2022 to 41x PE today (chart below).

This rise in valuations reminds us of the importance of Mr. Market's pendulum, which always swings from one excess to another, always driven by investors' shift from optimism (today on tech) to depression (tech in 2022). Excesses of depression among investors give rise to investment opportunities for the next few years, while excesses of optimism reduce the margin of safety and tend to disappoint the investor in the following months.

Equity

Profits

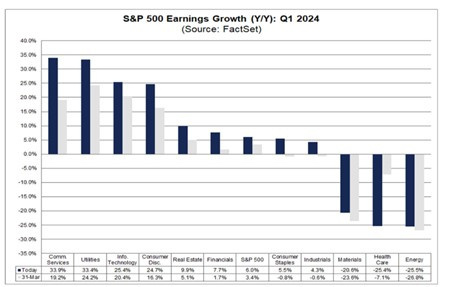

The first quarter earnings season ended with +6% growth, significantly better than expectations of 3.4%. This earnings growth was driven by the excellent performance of a few companies. First is the leading semiconductor company Nvidia; in fact, if we exclude Nvidia from the earnings season we go from a growth of 6% to a growth of about 3.3%. Second by Amazon, which if it were excluded would bring the growth of the discretionary sector from 24.7 percent to 2.7 percent. This concentration of earnings growth has also driven equity performance, which has been concentrated in only a few companies and sectors in the index, leaving a large chunk of the market behind.

Equity Valuations

The polarization of earnings growth, and the fact that market performance was driven by only a few companies, created some imbalances. First and foremost, it has brought the Price to Earnings ratio between the S&P500 and S&P500 equated from a 5 percent discount during the pandemic (i.e., large companies were at a 5 percent discount to small companies) to a 25 percent premium today (i.e., today large companies are at a 25 percent premium to small companies). Why is this? Because the pandemic recovery has been led by the technology sector, which has come to weigh about 31 percent in the S&P500 from a weight of only 20 percent in early 2020. This has led S&P500 valuations to be expensive today compared to the equated index, which instead presents excellent opportunities.

Second, if we extend the analysis not only to the equated but also to small companies we see how Small Cap in the U.S. has suffered from a sharp three-year under-performance. As we see from the graph the three-year performance gap between Small and S&P500 reached -40%, worse values were only seen in 1998.

Finally, if we analyze the one-year performance gap of an index of leading companies at a discount against the market, we see that we are experiencing underperformance seen only in 2008 and 2015. This shows us how the market is experiencing excess.

Equity sectors

In light of the above considerations, and the excess of optimism that is affecting the sectors most related to Artificial Intelligence, we believe that there are very interesting sectors left out of the market, particularly in the United States those that are most defensive: Utilities, Non-Discretionary Consumption, and Health Care. The preferred sectors in Europe, on the other hand, are: Non-Discretionary Consumption, Health Care, Real Estate and Industrials.

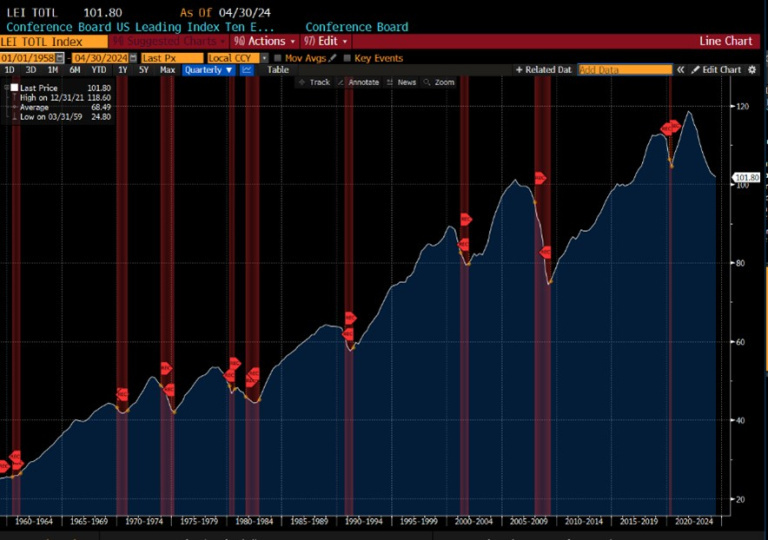

Bond

On the bond side, we believe that several macro indicators point us to a likely slowdown. From the Economic Surprise Indices to the Leading indicator (chart below) show us how interest rates are weighing on the economy. Based on these considerations we continue to prefer government bonds to corporate bonds. On corporate we note that companies are running out of excess cash and increasing leverage, and therefore we believe we need to select the right bond issues very carefully.

Government

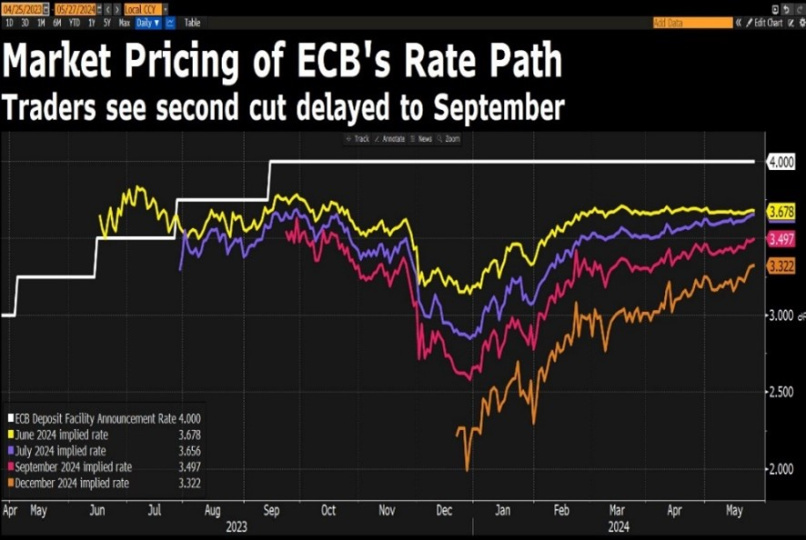

Next week we will have the ECB's pre-announced rate cut. This move is justified by all the macro indicators in Europe that point to an ongoing slowdown. As for the U.S., we expect the high level of real rates to continue to slow the economy and for the FED to continue the process of easing restrictive monetary policy that began months ago with the slowdown in balance sheet reduction.

Corporate

On the corporate bond side, we continue to believe that current spreads do not allow the investor the proper margin of safety. Analysis of the corporate balance sheets of both Investment Grade and High Yield American and European companies show us several common characteristics. First, companies are returning to increasing leverage. Second, the ability to pay interest is deteriorating. Finally, excess cash, created after the large post-pandemic capital injections, is shrinking. These considerations make us even more careful about the proper selection of companies.

Conclusion

In conclusion, the market has been driven so far by certain sectors and companies that, however, present somewhat overly optimistic expectations. Optimism justified by better-than-expected results that, however, have turned into valuations that discount an overly rosy future. On the other hand, we believe there is a large chunk of the market where investors' expectations are overly depressed. Selecting these opportunities will help the investor navigate the coming months that will be characterized by various complexities, from rate cuts - international conflicts - U.S. elections. Finally, rather than focusing on Artificial Intelligence, we believe the investor should remember human stupidity, which tends to make the same mistakes over and over again forgetting that everything has a price, and some valuations turn out to be unjustifiable and dangerous.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.