Lower rates, lower growth: will the Fed save the economy?

26 September 2024 _ News

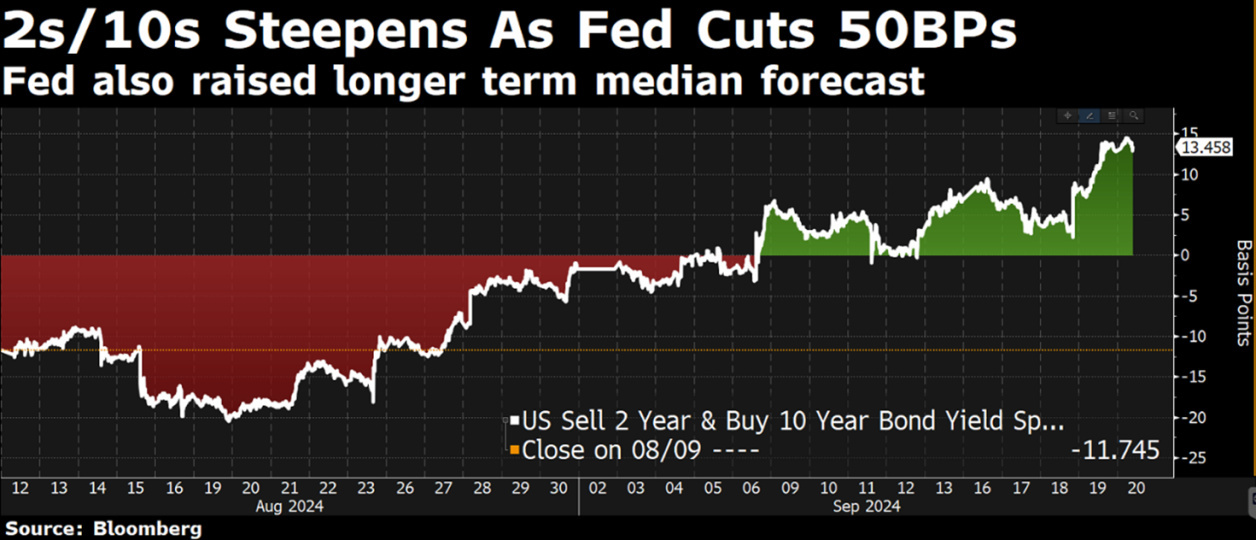

The long-awaited day of 18 September has arrived and, as expected, the Fed opens the new era of monetary easing by announcing a 50bp cut, with equity markets reaching new highs after some initial hesitation. In the bond world, we see short-term rates tending to stabilise (rather than fall) and long-term rates rising slightly, with a soft landing scenario increasingly being factored in rather than a recession. This is helping to push the US 2/10 year curve back into positive territory.

The immediate consequence of this new phase of falling rates is reflected in the "dots", i.e. the individual indications of the FOMC members on the path of interest rates, which now see rates at 4.25-4.50% for 2024 and at 3.25-3.5% for 2025. More important than the pace of rate cuts is the end point of the cycle, the so-called neutral rate. The forward curve discounts 2.8%, the Fed's dots tell us just below 3%. In essence, rates are falling and will continue to fall, both at the short end of the curve and at the long end, whose decline will be all the greater as the economy slows.

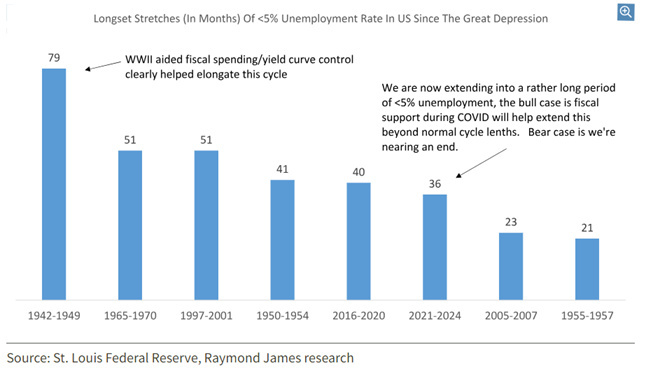

Driving the Fed's decision is first and foremost a stated change in the macro-control variable, from inflation to monitoring the tightness of the business cycle and the labour market. The main concern is that the unemployment pendulum rarely stops swinging once it is in motion. In fact, we are finishing the third year in a row with an unemployment rate below 5% in the US (what we might call "full employment"). If we exclude the post-World War II period, we have never had periods of full employment lasting more than four years, and if we think this time will be no different, then we must expect the labour market to deteriorate. A scenario that has historically seen equity markets peak about a year before the unemployment rate reaches 5%, accompanied by below-average returns.

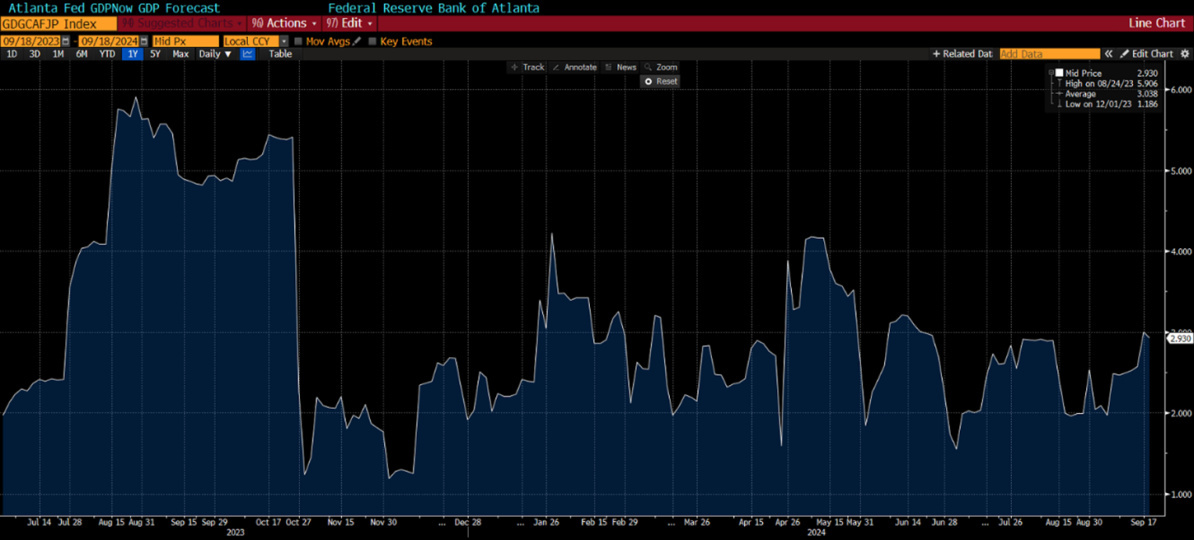

If we look at the macro picture, we are in a great situation: earnings seem to be growing, interest rates are falling, the economy is slowing but still growing at 2.9% according to the Atlanta Fed's GDPNow.

Valuations are certainly not being given away, but what's going on? If the Fed is going to make such a big cut, why not celebrate?

The problem is that the Fed's monetary policy must be measured against underlying growth conditions. Fed funds at 4.75% may be appropriate if the economy is expanding, or simply too high if the economy is weakening rapidly.

How do you define when the economy is slowing? And what macro data to watch?

We continue to believe that rather than macro data, which is always lagging, it is much more rational to listen to what companies are telling us in their comments during earnings season, and the result of this analysis is simple. There is nothing to celebrate. The Fed's policy is probably still dangerously hawkish, despite the 50 basis point cut, and indeed the slowdown already seems to be underway in many sectors of the economy.

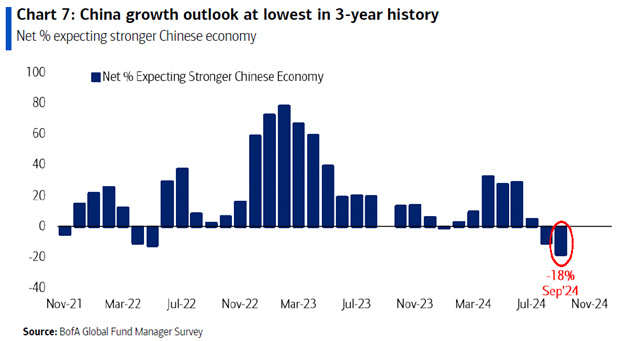

To take just a couple of examples, just on Friday there were warnings from two giants, Mercedes and Fedex. Mercedes cut its margin forecast for 2024 by 250 basis points, citing weakness in the Chinese market. Fedex also reported declining results and lowered its guidance, with results impacted by a negative change in business mix as consumers become less willing to pay for premium services for fast delivery. The economic slowdown can also be seen in other aspects of the market, such as the luxury sector, which is experiencing one of the most severe recessions in its history, driven by a slowdown in growth, particularly in the Chinese market, with the luxury sector returning to valuation levels (P/E multiple) not seen for several years.

Or if we look at the non-discretionary consumer sector, such as alcoholic beverages or soft drinks, many stocks have halved from their highs.

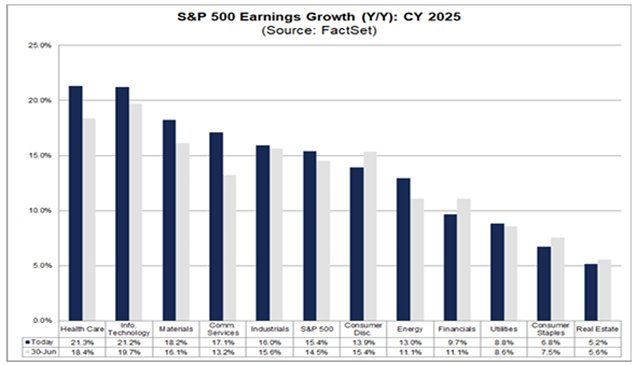

If we look at analyst estimates, earnings growth for US companies is still very strong and above historical averages at +10.2% for 2024 and even +15% for 2025.

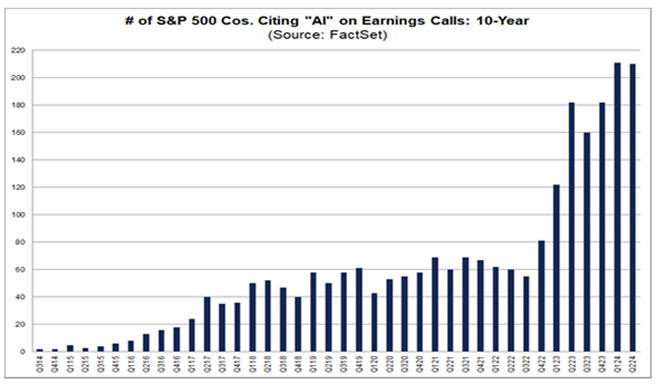

This growth is, of course, highly concentrated in the tech world, with extremely positive sentiment about developments in the AI world. Suffice it to say that in the last reporting season, more than 40% of the total number of companies mentioned the term AI when commenting on their results. This is the second highest number on record.

Indeed, history teaches us that an interest rate cut justified by a growth revision has an impact not only on earnings growth but also on valuation multiples. For these reasons, we continue to favour companies, sectors and geographical areas that have already discounted a recession.

Within these discounted areas, we have

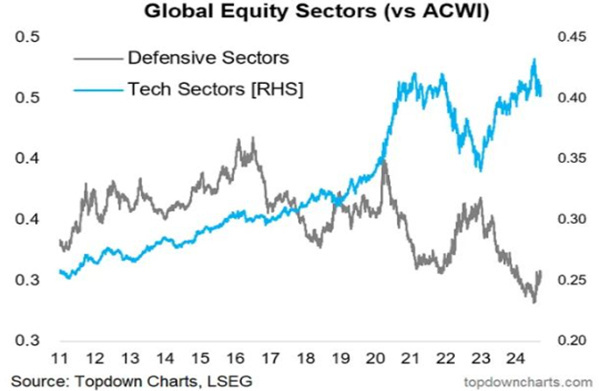

- Defensive sectors in the US, ranging from utilities to consumer staples to traditional healthcare, where there is a large gap to the technology sectors.

2. In Europe, the industrial and luxury sectors are already anticipating a recession.

3. Finally, China is experiencing one of the biggest recessions in its history, accompanied by investor negativity at an all-time high.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.