Fear = opportunity? History says yes

14 April 2025 _ News

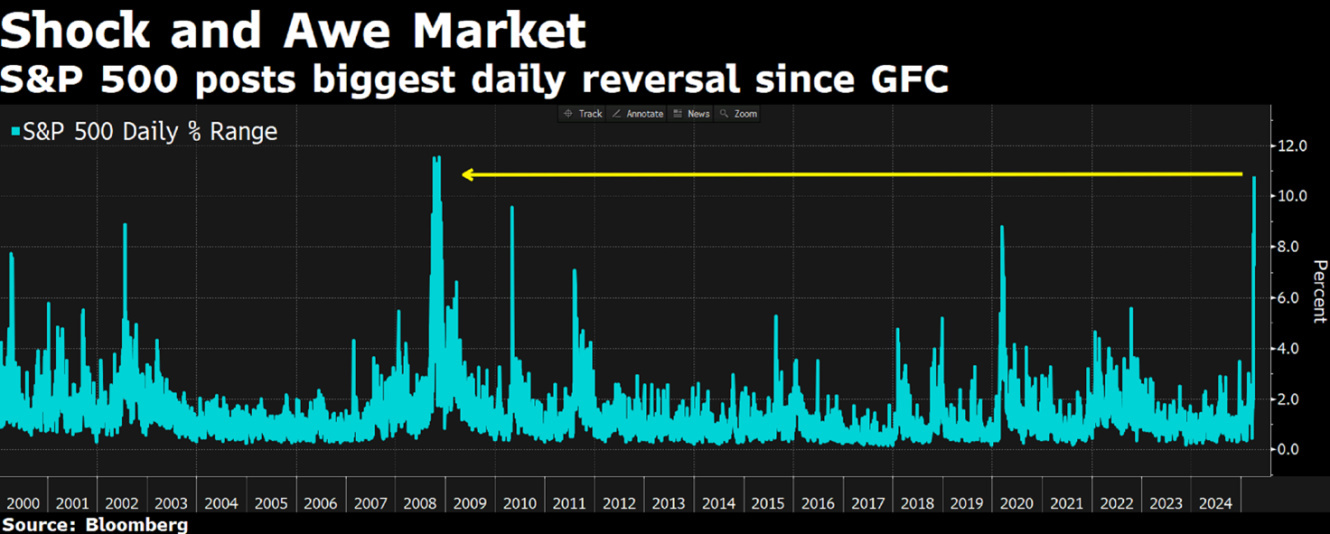

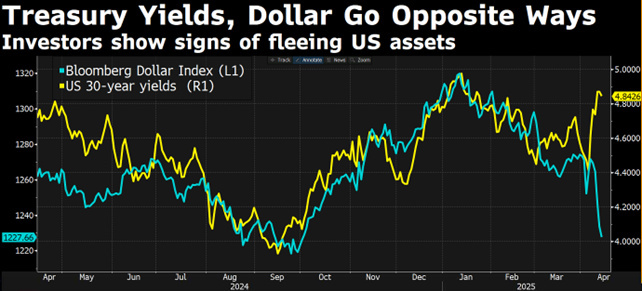

The dominant theme this week was once again the issue of tariffs implemented by the Trump administration, an issue that is causing great volatility in the markets. Volatility and disjointed price movements have been the hallmarks of the financial markets in recent weeks - just think that in the last month we have seen no less than three price movements that statisticians would define as tail movements. In fact, at the beginning of March we saw the biggest one-day move ever in German government bond yields, while this week we saw both one of the fastest movements ever in US 10-year yields, which went from 3.88% to 4.5% in just three days, and one of the biggest one-day rallies ever in equity markets.

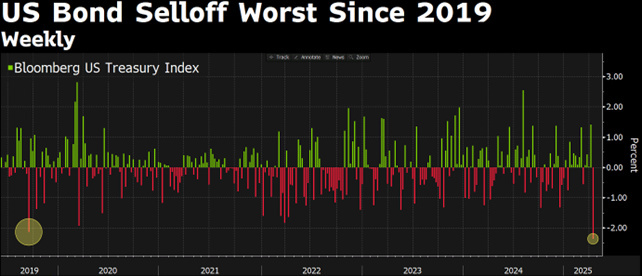

The tariff issue is not only causing volatility, it has also reignited a much deeper debate about the balance between economic policy and the reaction of financial markets, putting pressure on the Treasury where technical issues and geopolitical tensions are unleashed. And it is in this context that the so-called bond vigilantes are back in the limelight.

Coined by Ed Yardeni in the 1980s, the term bond vigilantes refers to those bond investors who, in the absence of fiscal or monetary tightening, take the reins of the market into their own hands. And this week they certainly struck again. In fact, Trump's decision to reduce reciprocal tariffs to 10% for the next 90 days seems to have been taken in response to the disjointed moves seen in Treasuries.

However, despite the announcement of more consistent and seemingly less hostile tariffs towards allies, the bond market remains at a tense level, keeping the Treasury in the 4.40% range, along with a violent depreciation of the dollar amid distrust of dollar assets. On the other hand, all of Stephen Miran's papers talk about inducing a decline in dollar holdings as a reserve currency in order to reduce the value of the greenback, so if Trump's ultimate goal was to weaken the dollar, this is gradually being achieved, but rising long-term yields were certainly not among the goals and are not welcomed by the administration.

Yet we said that just as bond yields were rising, the stock market was having a historic day. The S&P 500 rose 9.5% and the Nasdaq 12%, the biggest one-day gains since 2008 and 2001 respectively. Although high tariffs remain in place - and have even increased for China - the perception that there is a plan to negotiate has restored investor confidence.

However, the S&P 500 is still 17% below its February highs and we expect volatility to continue. It is important to remember that it will take time for the situation to normalise. A recent example is 2018: even then, Trump's introduction of tariffs led to a sharp increase in volatility, with moves of +20%, and the year ended with the S&P 500 down -6% overall. The good news for assets of all kinds is that the administration appears to be backing away from its more extreme negotiating positions, and whether this continues is likely to be the main determinant of asset prices in the short term.

Selling on a wave of emotion can lead to losses that are difficult to recover. At such sensitive times, it makes all the difference in the world to stay calm and think long term, rather than trying to seize opportunities when the market presents them.

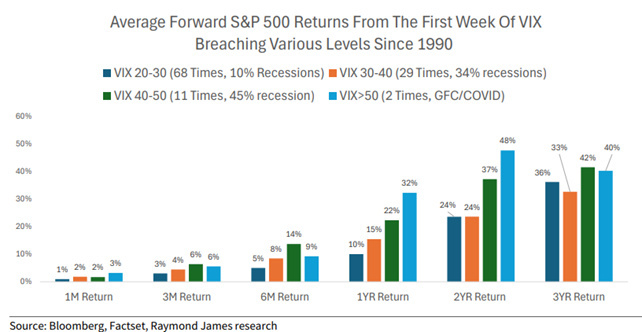

On 8 April, the VIX index - also known as the fear index - closed at 52, a level only seen in recent history during Covid-19 and the 2008 financial crisis. This indicates a high level of fear in the markets. But it is precisely at these moments that the market offers us the greatest opportunities: every time in history when the VIX has closed above 50, over any subsequent time horizon - 1, 2, 3, 4 or 5 years - the S&P 500 has always closed in positive territory, with returns above historical averages.

A common thread in all crises is that the best decisions start with a structured approach to analysis.

Firstly, many leading companies of unquestioned quality that had very high valuations at the end of 2024 now offer attractive entry opportunities. Regardless of their sector, there are solid companies that can continue to grow and deliver good results. This is precisely why investors should take advantage of these moments to build selective positions in these quality companies, with the right degree of caution.

As always, the markets are driven by expectations. We therefore believe it is time to have the courage to look at those sectors and stocks that have been affected by the tariff policy but whose valuations are now definitely discounted because expectations are now very, very low. These include the drinks, healthcare, energy and utilities sectors. They should be accumulated very patiently, on weakness and over time.

When bond markets rebel, as they are doing these days, they remind everyone - even governments - that there is a limit beyond which risk signals cannot be ignored. And that is perhaps why the bond vigilantes are still the most influential arbiters of the global economic cycle, with the FED watching and ready to intervene in the event of excessive stress. A Trump put has already been activated; we may soon see a FED put to support the markets.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.