Earnings Season - Central Banks and Discounts

26 July 2024 _ News

We enter both the US and European earnings season, and we enter it with a market divided into two parts. On the one hand, there are the large tech-driven companies that continue to show excellent performance, driving valuations to unsustainable levels; on the other hand, there is a slice of the market, from small caps to China, that has already experienced the recession and presents excellent opportunities. All this in a context in which the Central Banks are beginning to show signs of global convergence towards a less restrictive monetary policy, not forgetting the geopolitical risks in view of the US elections.

What to do in this complex context?

Earnings and Valuations

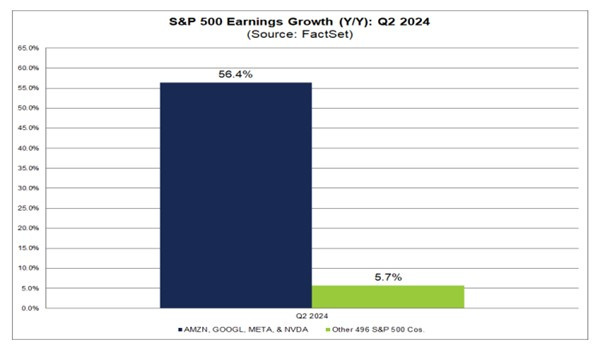

Let's start with the US, where we are entering the weeks when most companies will report. This week we will have about 30% of companies. So far only 14% of these have reported earnings, with growth of +9.7%. This growth should be led by the magnificent seven that are expected to show +56% growth, but if we exclude these seven, market growth should be +5.7%. Profit growth expectations are +11% for 2024 and +15% for 2025.

These expectations are well above historical averages. They are so high that they have inflated valuations, driving the multiples of the S&P500 about 20 per cent above the 10-year average and thus highlighting the dangerousness of some sectors, defined by the lack of a margin of safety.

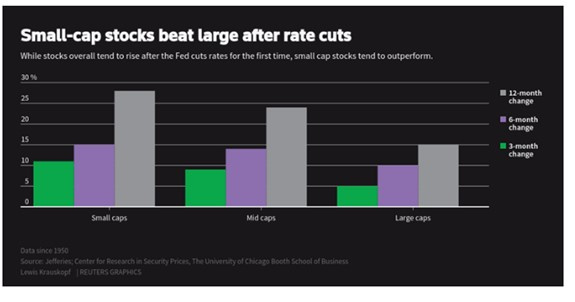

If, however, we exclude large companies and focus on sectors that have lagged behind and on American small- and medium-sized companies, we notice very interesting valuations.

For example, let us start with small- to mid-capitalisation companies where valuations are averaging a 25% earnings cut. This implies that they have a very good valuation and are currently discounting a recession.

Historical curiosity: small caps and mid caps are the best performers after an interest rate cut.

Add to this the attractive valuations of the small cap segment, and we are over-exposed to these asset classes for the coming months.

Let's turn to Europe where this week we will have several leading companies reporting results. European valuations remain at a deep discount, highlighting the excellent opportunities in the region. Among all, European real estate and now also luxury is back to excellent valuations.

Turning to China, which has just cut rates, valuations are at a deep discount. Valuations that show a considerable margin of safety for the patient investor.

What discounts

Talking about indices can often lead the investor to not really understand the discounts that the market presents on leading companies. This is why it is useful to remember that there are stocks behind an index, that these stocks represent companies, and that some of these companies have been leaders for several decades and will continue to be leaders in the future. Being lucky enough to buy at a discount can happen once every 5-10 years.

Let's take a look at three leaders, one American, one European and one Chinese:

- Brown and Forman: Leading company in the alcohol sector, a sector that has experienced a normalisation of results post pandemic; the company was born in 1870 and therefore has experienced several wars, pandemics and revolutions.

- LVMH: Leading luxury goods company, which is experiencing a strong correction related to the normalisation of post-pandemic growth and the Chinese slowdown.

- Tencent: Leading Chinese company offering various types of technology services: from payments, gaming, cloud computing, e-commerce.

As we can see, these discounts are all over the world and affect different sectors, unlike the technology sector which has valuations that are difficult to sustain.

Central Banks

Let us now turn to the commentary on global monetary policy easing. In this context where only a few companies seem to have missed the recession, the international monetary policy scenario is slowly aligning. In recent weeks there have been several statements by Central Banks, all characterised by an easing of restrictive policies:

1. After the June cut, the ECB held rates steady, pointing out that they will continue to monitor the situation in the coming months and leaving open the possibility of further cuts.

2. Powell clarified how they are happy with the slowdown in inflation and the first cut will probably come in September.

3. China cut rates, highlighting continued support for the economy.

So the 3 major Central Banks seem to be lining up rate cuts for the coming months. This highlights how they are beginning to shift focus from inflation targeting to economic slowdown targeting, evidenced by the key economic data that continues to come out.

Conclusion

In the coming months, we believe that investors should focus on the margin of safety. Underweight sectors and countries with excessively high valuations, which have now become borderline unsustainable, and build on leading companies and countries that have fallen behind. Global monetary policy convergence with more expansionary moves could be the pivot for a value-seeking rotation in the coming months.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.