Central Banks: oil or Petrol Indicator?

19 September 2024 _ News

The machine of the economy is beginning to show some flashing warning lights. It is now up to the central bankers to decide which light to give priority to, the gasoline light (representing inflation) or the oil light (representing economic growth). The choice appears to fall rightly on the priority of the oil light.

Rates cuts

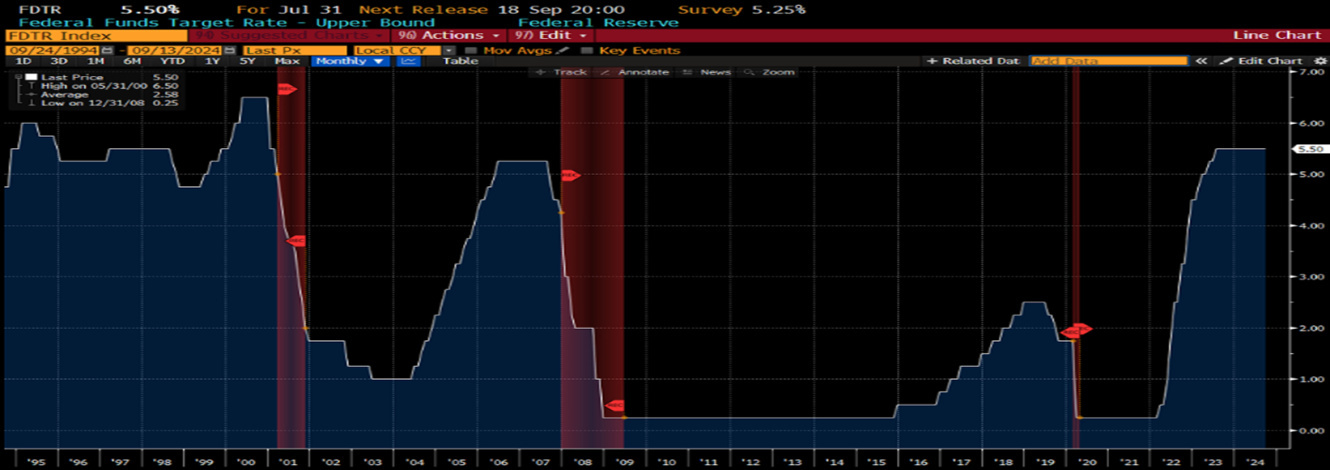

The Fed decided yesterday to cut rates by 0.5%, in line with futures market expectations. This indicates that the priority is the oil indicator, i.e. growth. In fact, rates have been around 5.5% for 13 months now, the last time they were close to this level was in 2008 with 12 months.

We arrive at the time of the FED cut with headline inflation again around target. The decision to cut is therefore driven by a shift from the FED's first objective, inflation management, to its second objective, economic growth. Macro data is holding up better in the US than in Europe, although the negative revision to the labour market a few weeks ago, which showed that some 800,000 jobs were counted that did not exist in the previous 12 months, raises questions about the reliability of this data. The Fed will therefore have to start looking at growth, because even if it were to start cutting, it would take time, given the lag in the effect of monetary policy.

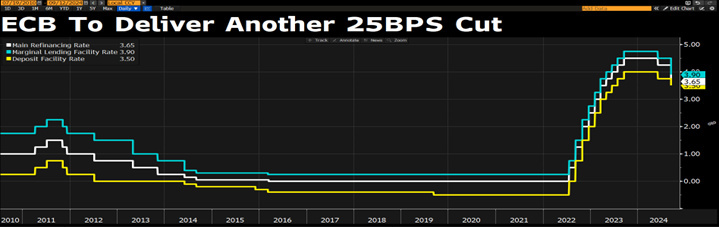

The Fed's cut comes a week after the ECB's second cut. The cut was justified by an inflation rate of 2.2%, which is close to the central bank's target. The ECB also downgraded its expectations for economic growth, highlighting how high interest rates are weighing on the economy.

This shift in central banks' focus from inflation to growth can be likened to a car driver on the motorway with two warning lights ahead. On one side is the petrol warning light, representing inflation, and on the other is the oil warning light, representing economic growth. We know which is the more dangerous warning light to act on first to save the car.

But is the market really pricing in a soft landing or is a growth revision already under way?

What we are seeing in the second half of the year is a market realisation of this possible growth revision. We see this in a number of ways:

1. First and foremost, rotation rewards those asset classes that have lagged the most. On the one hand, US small caps are the best performers, up +7%, while the Nasdaq, with its high valuations, is down -1%. The utilities and real estate sectors have also been the best performers this quarter.

2. Another example of growth revision is the luxury world. Luxury companies are experiencing one of the biggest recessions in their history, due to the decline in Chinese and European consumption.

3. Another example of growth revision is oil. There is little mention of the fact that oil has lost almost 50% since 2022, as there was a positive surplus in 2022.

That the market is not really discounting a soft landing is shown by the correction in oil.

4. For bonds, the fall in interest rates is a proxy for the revision of economic growth expectations.

How could the rate cuts impact the markets?

In our view, this will depend on valuations. Indeed, history tells us that a cut in interest rates, justified by a growth revision, leads investors to lower valuation multiples. For these reasons, we continue to favour companies, sectors and geographical areas that have already weathered a recession, rather than chasing dreams of artificial intelligence.

Within these discounted areas we have:

1. In the US, defensive sectors ranging from utilities to consumer discretionary and traditional healthcare are also rallying. In addition, oil companies are starting to show very good valuations.

2. In Europe, the industrial sector and the luxury goods sector are already in a good price recession.

3. After all, China is experiencing one of the biggest recessions in its history. This has driven investor negativity to all-time highs.

In conclusion, the economic machine is starting to have some warning lights flashing. Central banks will have to intervene, but it will take time. In the meantime, the investor should not lose sight of the fact that the market is full of opportunities at deep discounts, companies that have already discounted the recession and where investor expectations are very low.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.