Between Trump and the Fed: The dynamics underpinning financial markets

13 November 2024 _ News

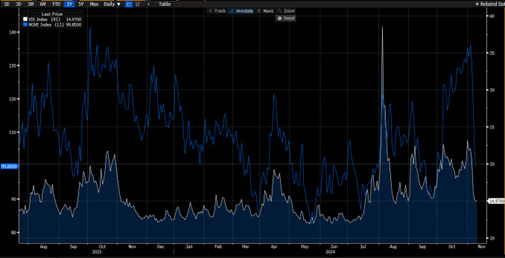

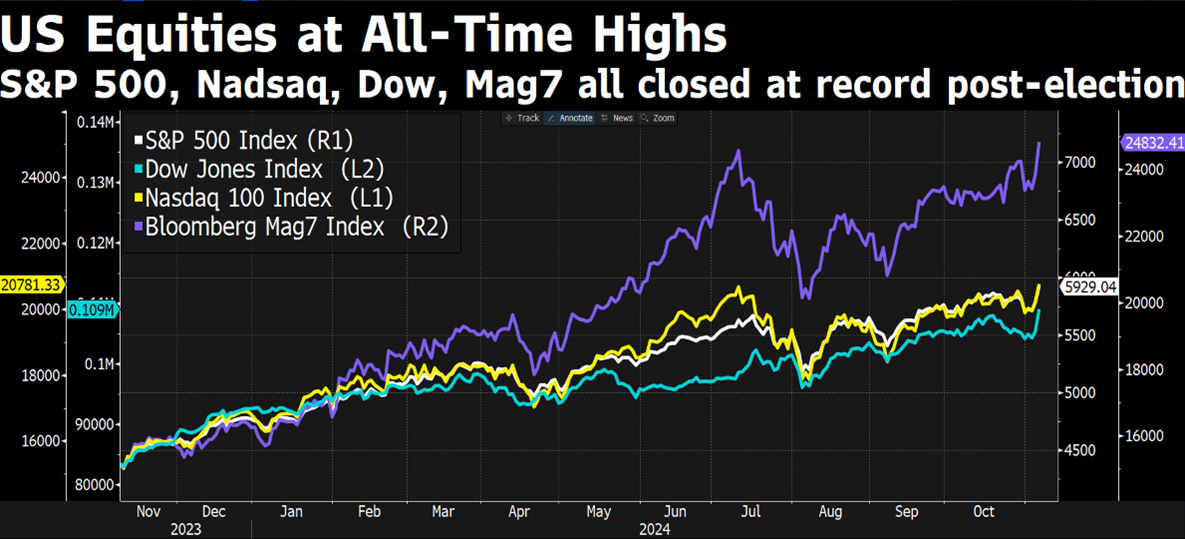

Financial markets ended a very positive week with global equity indices up around 4%, in many cases reaching new all-time highs. Of particular note was the 9% rise in US small caps, while defensive and interest-rate-related sectors underperformed, with the US 10 year initially reaching almost 4.5% before ending the week virtually unchanged. Volatility also fell sharply in both equities and bonds.

The US elections and the FED meeting were the two market themes that dominated the scene.

The Republican victory was overwhelming to say the least, with Trump becoming the first Republican president to be elected for two non-consecutive terms and gaining control of both the House and the Senate, the so-called 'Republican sweep'.

The emotional reaction of the markets was in line with what was expected and in line with the so-called 'Trump trade' that had already begun to take hold in the market in recent days. Equities have been celebrating as they discount the earnings benefits of Trump's promised tax cuts and deregulation. Europe is faring less well, with fears of a negative impact on corporate earnings, mainly due to tariffs.

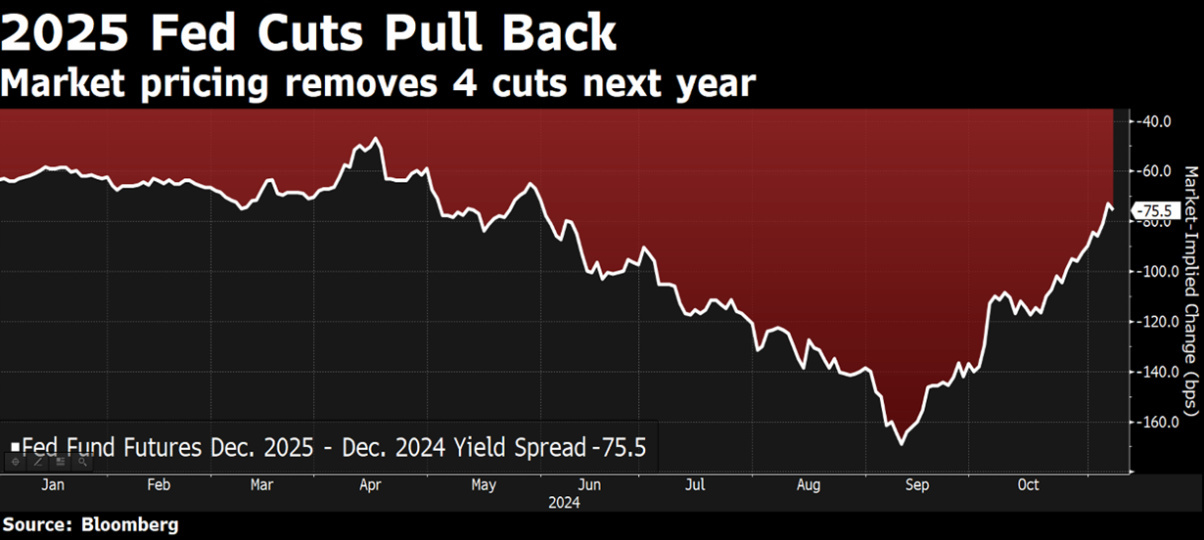

There is a common view in the markets that Trump's policies are inflationary, the tariffs are really a tax on consumption, the liberalisation, the fight against illegal immigration as well as the better tax regime for companies may also have inflationary effects and this is the concern of the bond market where we see rates tending to rise.

The so-called bond vigilantes, i.e. fixed-income investors who demand a higher risk premium in the face of a growing deficit, are also increasingly coming into play for US interest rates. The real dilemma for the bond market in the coming months is whether Trump will be able to sustain an expansionary fiscal policy with an expansionary monetary policy, and Trump could be helped in this endeavour by technology and LAI, which, as promised by Mask, increase productivity while avoiding inflation and thus deficits. For now, market narratives only, we will see if and how Trump manages to implement these policies in practice and consequently the impact on growth and monetary policy.

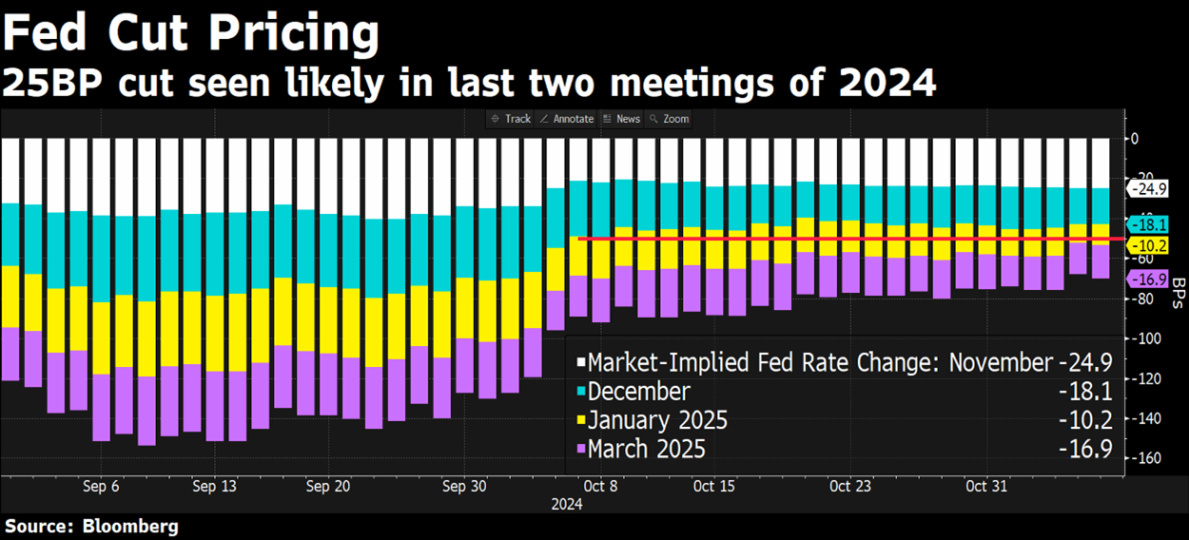

Speaking of monetary policy, as expected by the markets, the US Federal Reserve cut the cost of money by a quarter point in a unanimous FOMC vote, bringing US interest rates to a range of 4.50-4.75%. This is the second cut in a row for the central bank, following the one in September. For investors, the path forward is now more uncertain: While Powell did not rule out another cut in December, some observers believe that the language used by the FOMC was slightly less accommodative than at the previous meeting, opening the door to a possible pause. The differences from the September statement are minimal but, according to some, indicative and, in particular, there were some changes in Powell's language when speaking of inflation, stating that the decline in prices has "made progress toward the objective" instead of "continued progress" as indicated last month.

In any case, Powell did not mince his words and, while reaffirming the data-dependent approach, did not rule out another cut before Christmas, which the market is currently pricing in at a 70% chance.

Powell said that the Fed is trying to find a middle ground between the risk of cutting too fast and undermining progress on inflation, or cutting too slowly and allowing the labour market to weaken too much. In either case, rates will be cut. The question is how fast.

Finally, Powell, when asked what he would do if Trump asked him to resign, reiterated the independence of the central bank and said he would not resign.

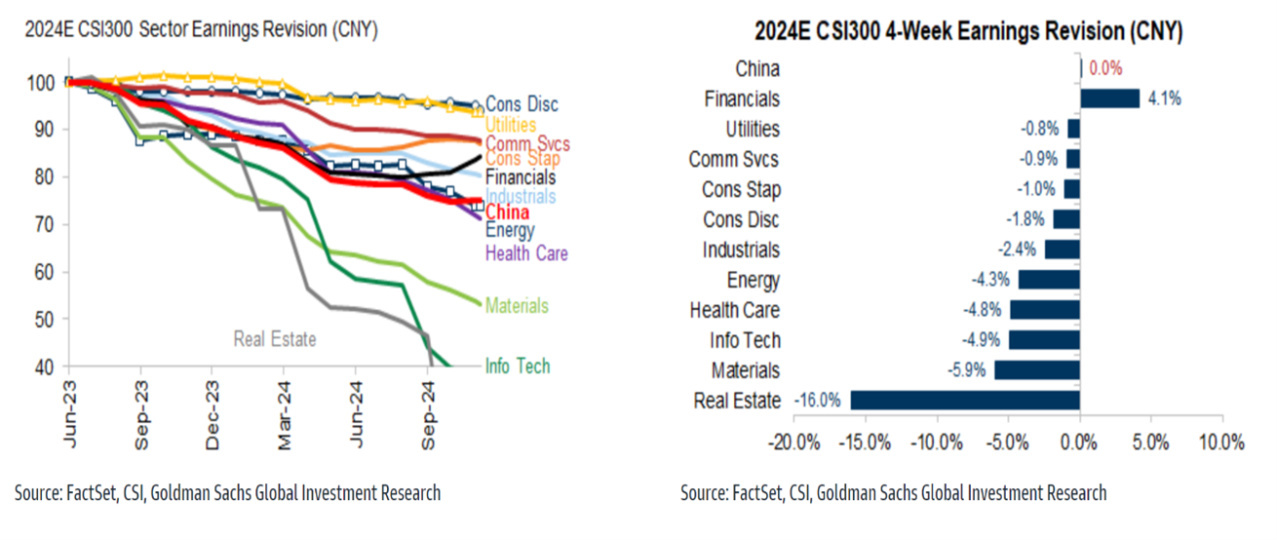

Further positive news for markets came on Friday morning when China announced a 10 trillion yuan, or around USD 1400 billion, programme to refinance local government debt and support a slowing economy. Also in China, economic surprise indices returned to positive territory for the first time since the start of the year and earnings revisions appeared to have turned a corner and rebounded after three years of declines and downward revisions.

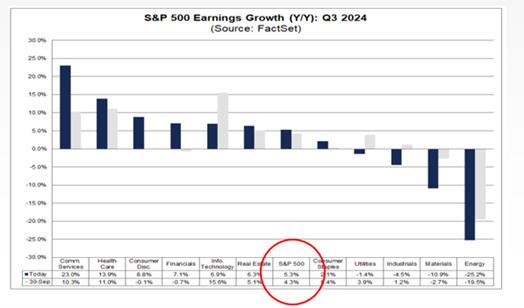

Earnings season is also in full swing in Europe, with an average of 65% of companies reporting earnings in line with expectations and earnings growth close to zero, highlighting a European economy that is struggling more than the US, where the earnings season is almost over, with 75% of companies beating estimates and earnings growth of 5.3% in the quarter, the fifth consecutive quarter of earnings growth.

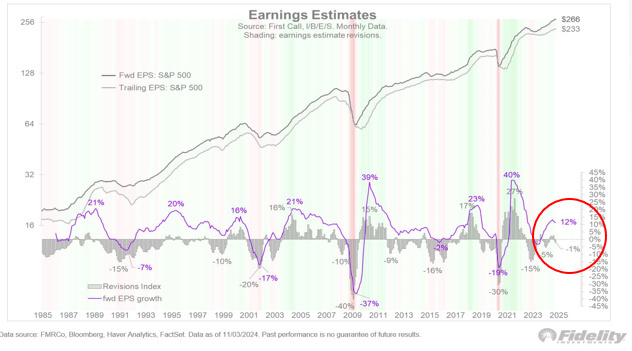

While EPS continues to grow, the second derivative, earnings growth, appears to have reached a turning point, with calendar year estimates now stable and 2025 estimates no longer rising as they did earlier in the year, suggesting a maturing cycle in earnings revisions.

The long-term impact of Trump's policies on earnings remains to be seen, but with expected earnings growth of 15% by 2025, while we would not be surprised to see many strategists revise their estimates upwards, it seems to us that there is already a lot in the expected growth.

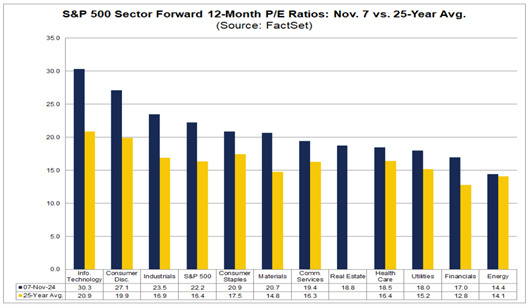

Earnings that are no longer being revised upwards are compounded by valuations that, at least for the US market, remain well above historical averages, and this is particularly true for many large-cap technology companies.

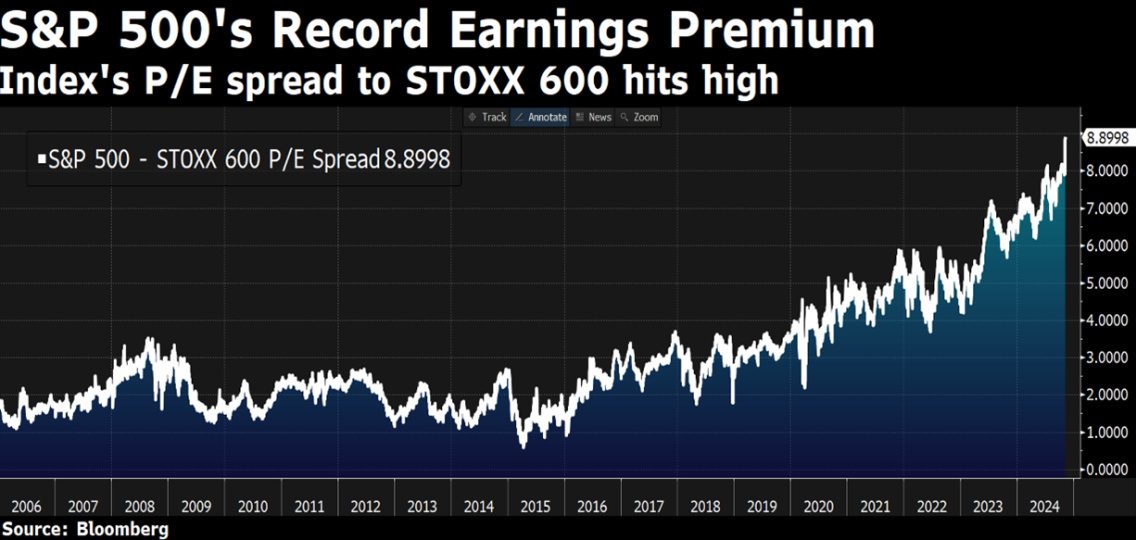

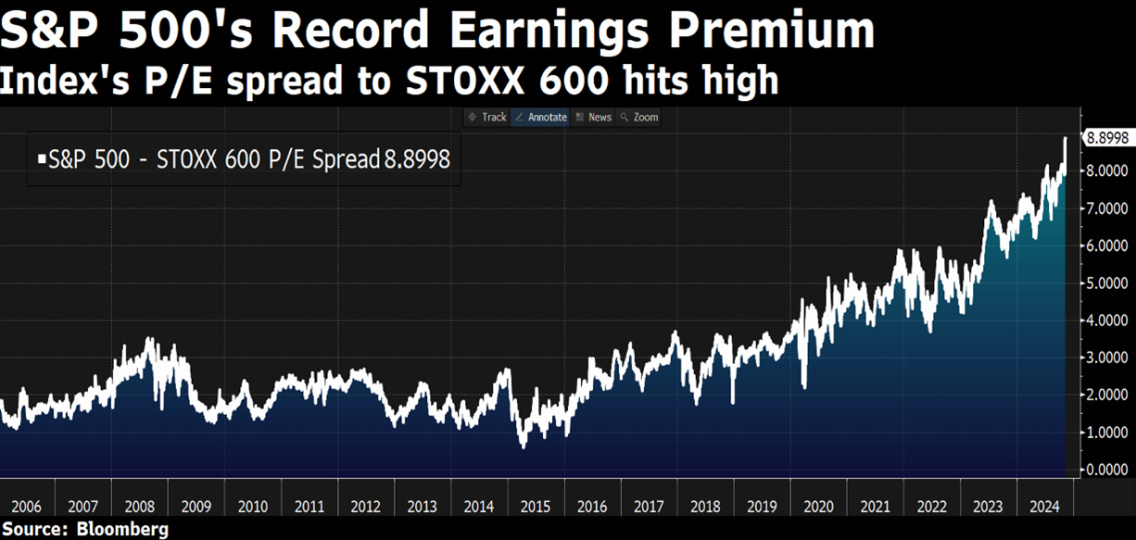

Europe is a different story and has many difficulties, from a struggling domestic economy to fears of tariffs, but the valuation gap between Europe and the US is at an all-time high, with Europe at a 40% discount to the US, and some sectors such as non-discretionary consumer stocks (made up of stocks such as Nestle, Unilever and Danone) at post-2020 lows, offering great opportunities.

A Europe that is easy to see as the big loser in this situation, but which, on the basis of deeply discounted valuations, may in some ways be forced to pull itself together and regain the strength to talk about old issues such as the common debt, which would be a welcome surprise for investors.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.