Bessent and Trump's economic policy: A new era for investing

04 December 2024 _ News

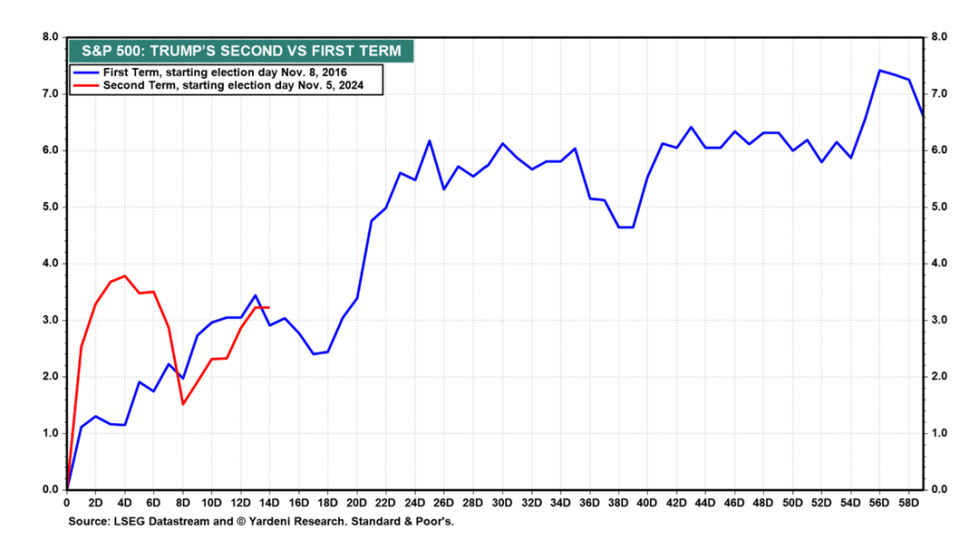

After a period of recent weakness, global equity markets rallied last week to near all-time highs, and the bond world also saw interest rates fall by around 15-20 cents in both America and Europe.

One of the major news items that was greeted with great enthusiasm by the markets was the appointment of Scott Bessent as Treasury Secretary and successor to Janet Yellen. To those who fear that Trump's tariff policy will hurt the economy, Bessent replied that the extreme tones of the campaign will give way to pragmatism. Indeed, Bessent is seen as moderate and pragmatic, and very supportive of Wall Street. To understand his thinking, we have to quote his '3-3-3' rule.

1) maintain economic growth at an average of 3% per year by cutting red tape and deregulation

2) Reduce the budget deficit to 3% of GDP

3) Increase oil production by 3 million barrels per day.

A report dated 31 January 2024, written by Bessent to his partners in the Key Square Capital Management hedge fund, quotes:

"Our base case scenario is that a re-elected Trump will want to create a period of great economic growth, and will likely call it 'the greatest four years in American history.

The report went on to say: 'In this scenario, the biggest risk factor would be a sudden rise in long-term interest rates'.

It is clear from these words why Bessent is likely to help Trump win the confidence of the bond market, which immediately responded with a vote of confidence in Bessent, with the 10-year falling from 4.45% on the day of the nomination to 4.20%, a clear reversal of the downward trend.

The week was notable for the release of some relevant US macro data such as GDP, Unemployment Benefits or PCE, all of which were fairly in line with expectations, as evidenced by the performance of the economic surprise indices.

It was also the week of Black Friday, with online sales on Thanksgiving Day in the US up around 4% according to the first available data from Salesforce, compared to a 2% increase last year. Mastercard's figures, on the other hand, put sales growth at 3.4%, with the physical store segment up 0.7% and online sales up 14.6%. However, overall growth for the festive season is expected to be the slowest in six years.

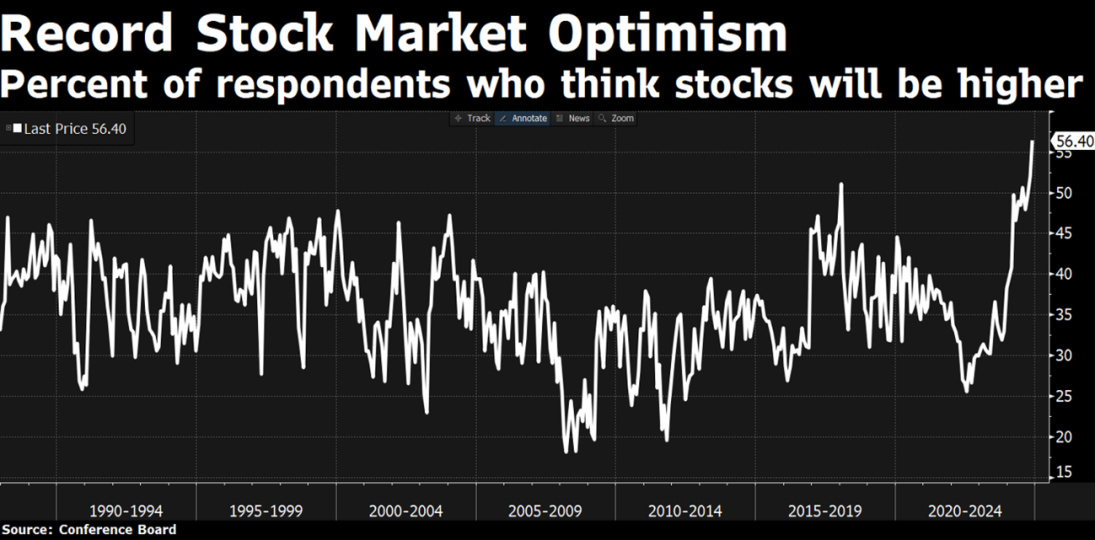

Despite this, according to several surveys, the percentage of Americans who believe that stock prices will rise in the next 12 months has reached a record 56%, a sign of great optimism about US equities and not really surprising as we know that this optimism often accompanies markets to new highs.

On the other hand, those who are not as optimistic as the stock market are the so-called insiders, i.e. those who often work in top positions within companies, with the ratio of selling to buying by these privileged observers rising steadily to an all-time high today.

Part of the increase in insider selling can be attributed to the strong US equity markets of the past two years, which have generated substantial paper gains that some may have simply decided to take. However, historically high levels of insider selling have proven to be a reliable indicator of difficult times ahead for corporate earnings, which are often associated with weaker equity markets.

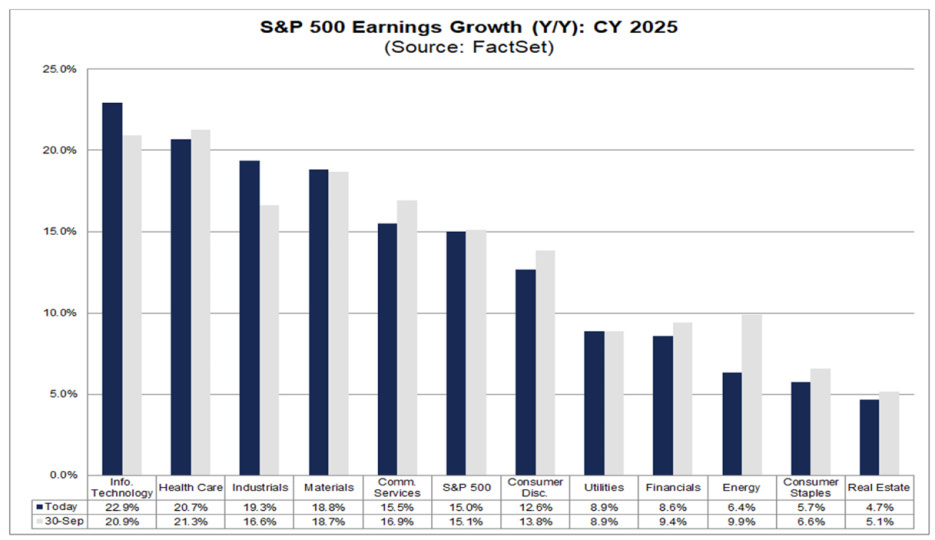

Earnings growth will continue to support equity markets, and we are probably just over halfway through the earnings cycle, but we agree with the insiders and see the 15% earnings growth expected in 2025 as very challenging, or at least already incorporating all the positive news related to the Trump presidency.

The key point for investors is to be aware of the short-term risks of an overall overvalued market, despite a stronger long-term bullish outlook driven by a still-extending earnings cycle and sectors that have yet to recover from an earnings recession that has already occurred.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.