Artificial intelligence knocks on the door of Utilities

20 June 2024 _ News

That Artificial Intelligence (AI) will be a major innovation and the main driver of productivity gains and economic development for the coming decades is not difficult to understand and share.

It is certainly less intuitive to see the link being made between AI development and the utility sector, a link so strong that utilities will be one of the next beneficiaries of AI development itself.

The relationship is not immediate, but it is very simple to understand: developments in AI are already leading to huge investments in data center infrastructure and cloud computing, which require immense energy absorption to operate. This will then lead to skyrocketing electrical demand and, consequently, the need for new electrical infrastructure. Electric generation and power grids represent the very core business of Utilities, and hence explained the strange link between one of the fastest growing sectors in the coming decades (that of AI) and the most defensive and "drawer" sector in the market (that of Utilities).

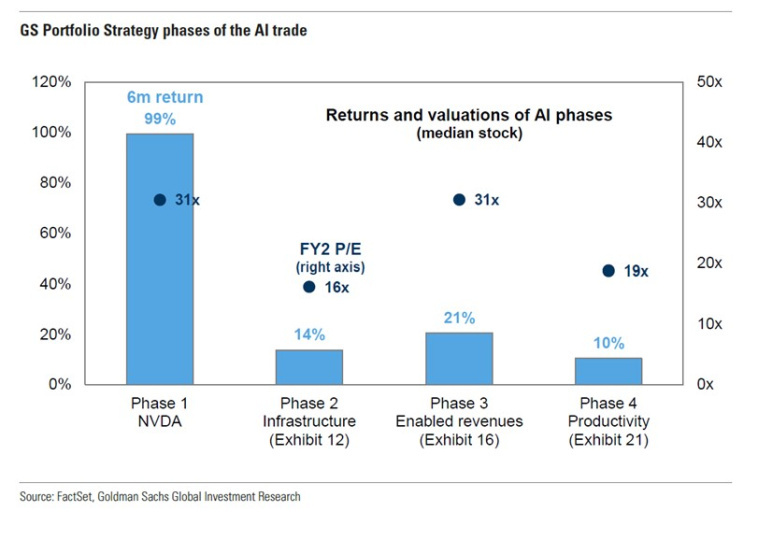

This scenario is also confirmed by research by one of the leading U.S. Investment Banks (Goldman Sachs), according to which the development of AI will gradually expand to different sectors of the market and will therefore see different phases of development. The first phase as we know has been monopolized by the company Nvidia, but the second phase is now beginning, which will be dominated by infrastructure, among which we include data centers, cloud providers, cyber securities, but also power grid infrastructure and then Utilities, so much so that in the portfolio recommended to take exposure to these issues, about ¼ of the stocks belong precisely to the Utilities sector.

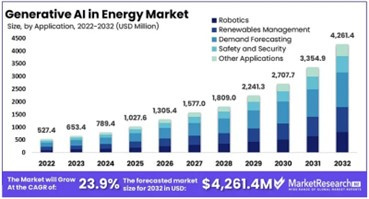

S&P Global Commodity Insights also comes to the same conclusions, stating that AI-related technology will lead to a significant net increase in U.S. energy consumption. According to some research, AI energy demand is expected to increase from about 7.4 million in 2022 to as much as ,261.4 million by 2032, with a robust compound annual growth rate (CAGR) of 23.9 percent from 2023 to 2032.

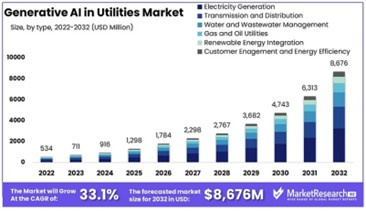

At the same time, the utility market is expected to experience even more significant expansion, rising from 4 million in 2022 to as much as ,676 million by 2032, driven by a remarkable CAGR of 33.1 percent from 2023 to 2032.

Utilities will also see increasing demand for energy from other factors, such as manufacturing reshoring and the development of electric vehicles. According to Bank of America, U.S. electric demand has grown at an annual rate of 0.4 percent over the past decade, but these growths are (as just seen above) soon to change dramatically.

The sector is transforming from a surrogate for bonds to a much more thematic business because utilities are becoming a great way to leverage data centers and AI developments.

Remember, the way the world of regulated utilities works, the more you invest in infrastructure, the more companies make money.

There are already numerous examples of companies in commenting on quarterly results that have guided for increased investment in the coming years by emphasizing these growth developments in AI.

For example, WEC said that its kilowatt-hour sales are now expected to grow from 4.5 percent to 5 percent from 2026, far above the range of 0.5 percent to 0.7 percent seen over the past decade.

Also surprising are the slides presented yesterday afternoon by Nextera (a global leader in the utilities sector) at an investor day, where it was revealed that the company predicts that energy demand in the United States will grow by 38 percent from 2020 to 2040, four times the increase over the past 20 years.

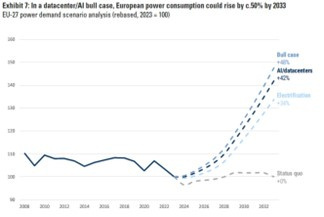

The same growth dynamics, by the way, can be seen in Europe where electricity demand is expected to grow by up to 50 percent by 2033.

Never-before-seen growths and fascinating very long-term narratives for a sector that is catching up with the general market in terms of valuation, but is still undervalued even without incorporating these very positive growth developments, from which one can therefore expect only positive surprises.

The contents of this informative message are the result of the free interpretation, evaluation and appreciation of Pharus Asset Management SA and constitute simple food for thought.

Any information and data indicated have a purely informative purpose and do not in any way represent an investment advisory service: the resulting operational decisions are to be considered taken by the user in full autonomy and at his own exclusive risk.

Pharus Asset Management SA dedicates the utmost attention and precision to the information contained in this message; nevertheless, no liability shall be accepted for errors, omissions, inaccuracies or manipulations by third parties on what is materially processed capable of affecting the correctness of the information provided and the reliability of the same, as well as for any result obtained using the said information.

It is not permitted to copy, alter, distribute, publish or use these contents on other sites for commercial use without the specific authorization of Pharus Asset Management SA.